Netflix vs YouTube: the next big streaming battle

More niche VOD services getting into the market, plus (some) data transparency comes to podcasting.

This week, I’ve covered:

The next phase of the streaming wars: forget Netflix vs networks, are we now entering the Netflix vs YouTube showdown

Podcasting edges closer to data transparency

Letterboxd announces a rental service for cinephiles

- and his upcoming book.

And as always, send feedback - especially if there are particular things you want to know more about -send me a DM or email hello@businessoftv.com.

Please do share if you think any of your colleagues will find this interesting or useful:

Netflix vs YouTube: The next phase of the streaming wars

Last week I wrote about the rebranding of Max as HBO Max, and after publishing I spotted this comment by Abram Brown of the Information:

The decision [to rebrand Max as HBO Max] was mostly interpreted through a lens of what it reflects about WBD. That’s an amusingly narrow view, because if you pull back the camera, it also represents a pretty concrete final moment in the Streaming Wars. So yes, let’s just say it explicitly: Netflix has won. No other streamer—not Peacock, not HBO Max, not even Amazon—is going to come close to matching its enormous catalog. There’s Netflix, and then there’s everyone else, who I suspect would be best served by figuring out what makes them bespoke—or letting the end credits roll.

While it is in reference to the HBO brand, I wanted to pick up about Netflix and the streaming wars. When the competitor set for Netflix is viewed as the above group, then yes, you can argue Netflix has won the subscription streaming wars, although it is more than just the catalogue that creates their moat against other competitors. After all, Amazon has a larger catalogue however a lot of it pay per view/rent/own and therefore the browsing experience has an additional psychological hurdle that is less ‘what do I fancy watching?’ and more ‘what is there to watch that I don’t need to pay extra for?’ For Netflix, despite their continued deep investment in originals, TV acquisitions are continuing to do doing some heavy lifting in terms of views.

Broadcast series such as ABC’s “Grey’s Anatomy,” NBC’s “Seinfeld,” and CBS’s “NCIS” accounted for just 1% of the TV shows available on Netflix’s US catalog, but drew 7.1% of the total demand.

When you add in 25% coming from cable and 17% international content, then 50% of the views of Netflix contents originates elsewhere. Even so, they’ve gone some way in reducing their dependence on acquisitions over the years.

Rather than this being the moment where the end credits roll, I’d suggest it is just the end of the first act where Netflix has won the initial streaming battle: wiping the blood and sweat from its face, looks around the battlefield to see groaning TV networks and their streamers lying around, turning to look into the distance only to see a much larger, more technologically advanced and perhaps most importantly - free - army coming over the hill.

There are various graphs I could share to demonstrate this next phase, for example from Chartr this week:

Obviously this is revenue and not net profits: Google doesn’t report YouTube’s full financial performance separately, so often people attempt to piece together a financial statement from various available datapoints, for example here is an evaluation.

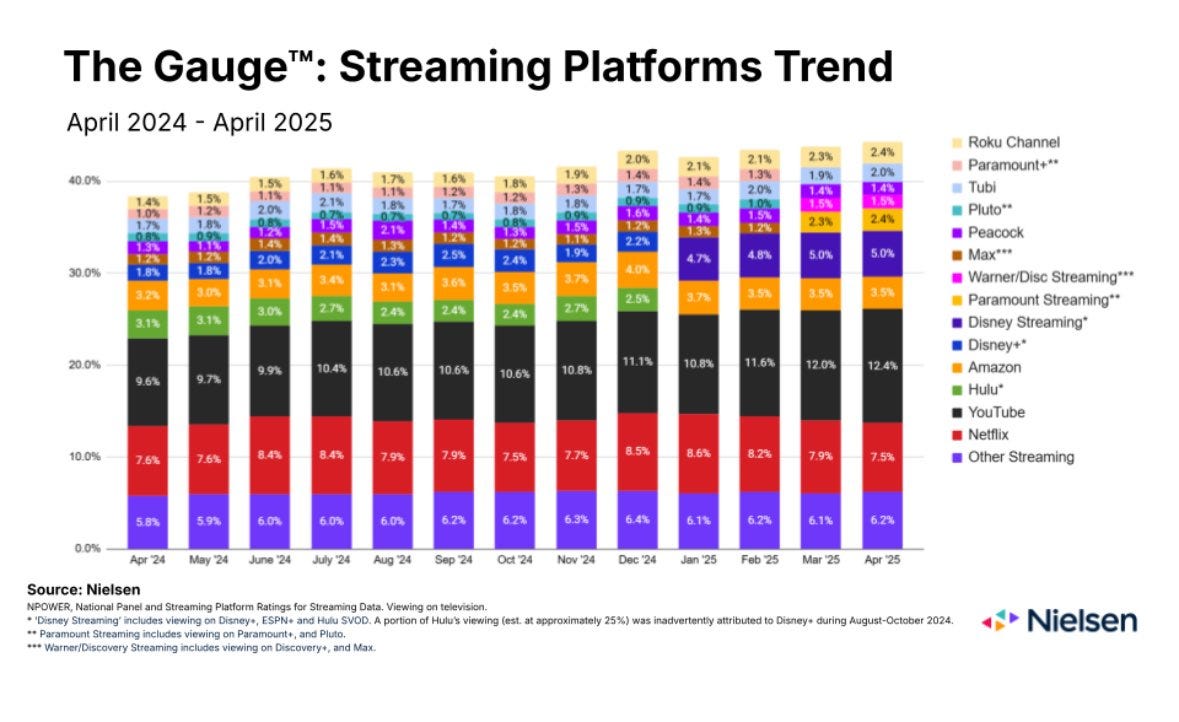

Or here is another graph, this time Nielsen’s The Gauge, showing that Netflix’s share of TV viewing in the US remains flat year on year (well, actually down from 7.6% to 7.5% share), while YouTube’s share grew 3% which is more than all the other platforms combined. Obviously a reminder that the US isn’t the world, however these numbers could be a further illustration of the inflection point we’ve reached.

In Netflix’s announcements and strategic moves, you can perhaps see their preparations, readying themselves to take on YouTube. Many (but not all) of Netflix’s competitive advantages in the first phase of the streaming wars melt away when facing the Google-owned platform. Superior tech infrastructure, size of their catalogue, global position, relationship with producers and IP holders, churn, financial reputation and stability, subscriptions and advertising proposition - can either disappear or are significantly less of an advantage against YouTube.

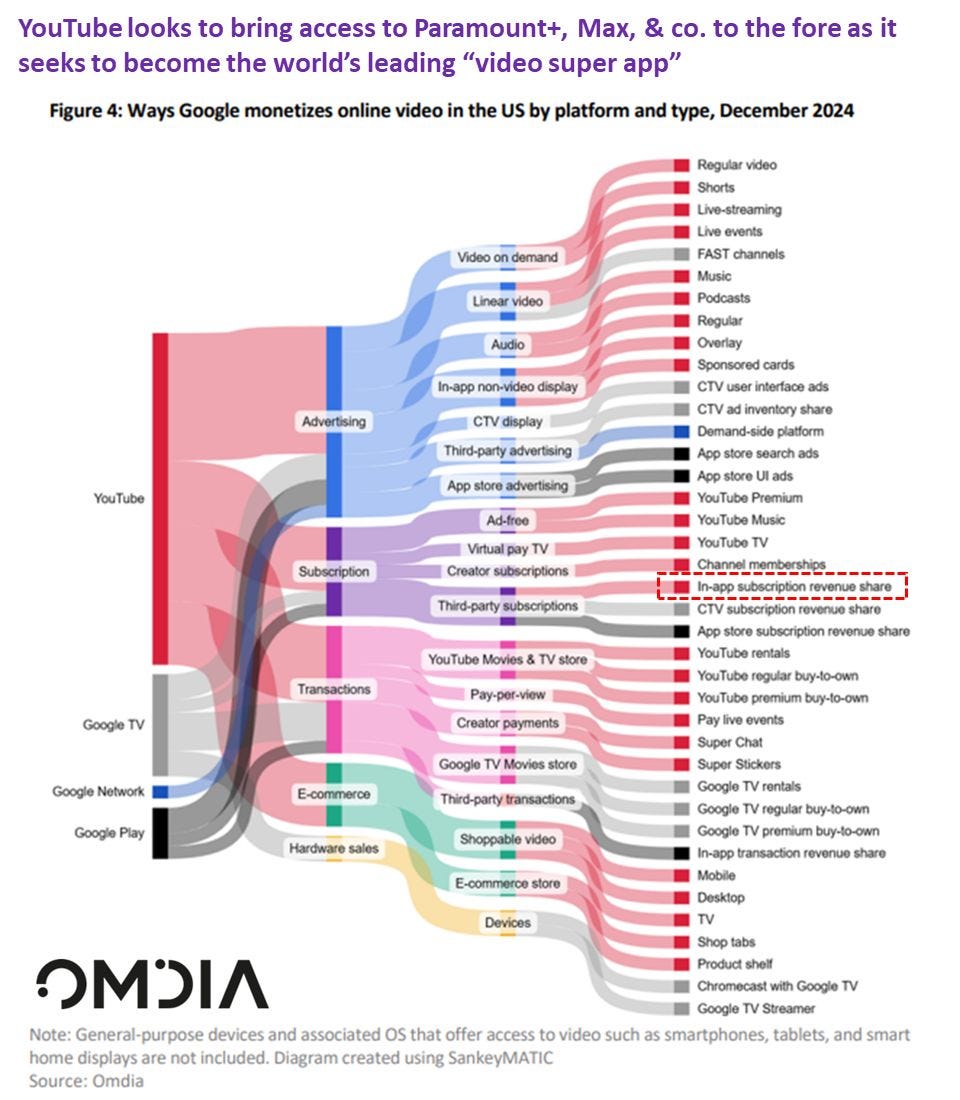

Remembering this headache-inducing graphic from a few months ago which shows how Google monetises video by platform and type:

As I wrote at the time to explain how to read it:

The red is YouTube, so on the right every red line is how YouTube makes money. The grey is Google TV, the black is Google Play and the dark blue is Google Network. If you aren’t an android user, you might not even be aware of some of these brands or platforms. Google TV is a streaming devices and smart TV operating system, while Google Play is the old android app store as well as a digital media store where you can download apps as well as buy books, music, video and TV shows. And Google Network is everywhere that ads can appear across Google’s platforms as well as other websites partnered with them for search or display advertising.

This chart is why Netflix could be nervous, especially if YouTube is aiming to become *the* video super app as reported. Google has a myriad of well established video revenue streams from advertising, subscriptions, eCommerce and digital transactions. Multiple different platforms including consumer devices. Deep technical capabilities and infrastructure especially in areas which are difficult to land well at scale - live streaming for example (remembering Netflix’s Tyson vs Paul technical challenges). A free content platform that expands in all directions from professionally produced to home videos, and quite literally everything in between. A revenue sharing model that incentivises content creators without having to take the risk of paying for the production costs. The courting of broadcasters and streamers to run their own channels on the platform. Plus a clear strategy to ‘Netflixify’ the user experience in an attempt to tackle Netflix’s design and user experience advantage. And the same battle for the living room which saw Netflix eat into broadcasters and networks domination of the connected TV - well that includes YouTube as a competitor too.

This is why Netflix is looking to podcasting, kids, creators and gaming: it may look like an expansionist strategy when compared with some of the other streamers, but when compared to YouTube it could be viewed as a defensive move as well: after all, YouTube has around 33% of all podcast listens, dominates the creator market, is the number 1 platform for kids, and also launched games last year with Playables.

Just this week Netflix announced the World of Peppa Pig game will be available with no ads or in-app purchases to Netflix subscribers. Similarly, the deal with Sesame Street also includes being able to develop games for both this title and Sesame Street Mecha Builders.

All this together is why Google losing those three antitrust cases really matters. While various commentators believe it is unlikely that remedies in these cases will look to hive off YouTube from Google, you can see how their domination of advertising, video distribution, search and devices is what has led us to this point.

And moving into the realm of speculation. If this is right, and Netflix and YouTube are the next big showdown, what does this mean for producers? Remembering that for some producers, Netflix is a life raft in terms of increased commissioning while broadcasters and networks flatline or contract. However if Netflix comes under pressure from YouTube, what happens to its content strategy? Without wishing to sound like a broken record, producers increasingly need to look to diversify their activities to hedge against these risks - so not just new commissioning relationships but also direct to consumer and/or branded.

And what does Netflix do? Try to compete with YouTube on its own turf of creator channels, community and monetisation tools? Focus on premium and volume? Does this increase the likelihood of being acquired at some point? And if so, by who?

Data transparency slowly starts to come to podcasting

Remember that period in the streaming wars where there was next to no viewing data being shared by most of the platforms, so all we had to go on whether something was watched or not was trending lists, as well as PR and vibes? Thankfully, that period has largely ended with data increasingly being shared directly as well as with companies like Nielsen.

For podcasting however, this lack of clarity has run on, where there is no transparent definitive set of listening/viewing figures available. This is where various companies like Podchaser or Rephonic (prices starting at $99 a month for a lite account) have developed paid for services, where they pull together what data they can combined with a little bit of their own insights to create a performance table. Helpful, but no where near the level of transparency we are all used to for TV via BARB or Nielsen’s ratings.

And so, in the last couple of weeks, it has been announced that Spotify and YouTube have made different movements towards being more transparent about performance.

Spotify announced a new feature called ‘Plays’ which they said would show the number of times people have listened or watched an episode of audio and video content. Spotify also has this charts page by territory as well as podcast genre. However, following a backlash by podcasters, Spotify said these play counts will only appear on shows with at least 50,000 plays each. Plus, instead of showing an exact number of plays, it will only be in specific milestones such as 100k plays or 1m plays.

YouTube has unveiled their new weekly top podcast shows in the US (assume other territories will follow at some point). The company said when making the announcement:

Every Wednesday, the Weekly Top Podcast Shows chart is updated with podcast shows ranked by watchtime. Generally, charts will include playlists that are designated as “podcasts” by the creator in the upload process, and will not include playlists that contain only clips or Shorts.

Charts are a useful datapoint, however there are limitations to be aware of. This is a similar challenge to putting a lot of weight in the trending charts on Netflix’s landing page compared to the full viewing figures that are released later as part of their data dump. Simply put, completely different charts can be reached depending on the length of the snapshot window, when the content was published relative to the window, what time of day (is your target audience awake and do they listen/watch at this time of day?), plus how many other popular podcasts or shows are published at the same time. So a 15 minute window with a podcast updated within that period and few other popular podcasts updating at the same time might result it being number 1 at that particular moment, however over an hour, day or week it might not even appear in the list. All this is before you get to the duration that people listen which is what YouTube is tracking.

In the spirit of looking for examples of direct to consumer businesses with multiple revenue streams, I wanted to draw your attention to Fern from the screenshot of the Spotify UK chart. I’ve mentioned them a few times, they are one of the wave of faceless YouTube channels grabbing attention of late - including MrBeast name checking it as a channel to watch.

They’ve published 21 podcast episodes to Spotify, which appear to be just the audio from their YouTube videos. Without the Spotify Play data I can’t have a guess at the incremental revenue this is generating - remembering they’ve had 255m views on YouTube, generating something in the realm of £1.1m in total. If you are a producer with an archive, then reversioning your assets into content for distribution either as video or audio to multiple platforms should be a priority especially considering how low cost this can be in practice. This is why Channel 4 has announced a deal with Spotify to publish their video content to the platform, which is about increasing reach and revenues by distribution.

Letterboxd announces curated online film rental store

Letterboxd - the cinephiles social platform - has announced they are planning on launching a VOD service for their 20m registered users. They said it would feature rental ‘shelves’ of titles from film festivals, global cinema and emerging film makers, with limited festival-style windows.

This is interesting for several reasons. Firstly, again, it is all about super-serving a niche - in this case, dedicated film fans all over the world. Secondly, at its heart, is the concept of community, especially a community of like-minded souls. So while in general people are weary of many of the aspects of social media, there are areas all over the internet where people can find an oasis of other people who share their passion.

Thirdly, it shows the opportunity outside of the mainstream especially by providing a VOD offering you can’t get elsewhere.

There are other companies in this cinema loving space, although all are coming at it in slightly different ways: Criterion Collection, Mubi, Curzon Home Cinema, Jolt.film. Will more enter this market, and indeed, will each of them be able to carve out a USP in what is becoming a crowded arena?

As an aside, Letterboxd was sold to Tiny, a very interesting Canadian company a few years ago that buys or invests in businesses in quite an unusual way. The first link below is worth a read if you are interested in distinctive investment strategies for internet-native companies.

From $4 Million to $1 Billion and Back – A Financial Teardown of Tiny Capital

The Hollywood Reporter: Letterboxd to Launch TVOD “Video Store”

The Verge: Letterboxd announces curated online film rental store

Doug Shapiro’s new book

Rather excitingly,

this week announced he’s writing a new book: ‘Infinite Content: AI, The Next Great Disruption of Media, and How to Navigate What’s Coming’. For anyone interested in the future of TV, content, media, storytelling and tech, it will be a must read (indeed, anyone fancy a virtual book club when it comes out in March next year?).He’s released his draft introductory chapter here if you’d like a flavour.

Some of the reasons I value everything Doug writes is he a) has many years under his belt trying to steer media businesses in the face of great upheaval, b) deals in all the shades of grey rather than absolutes that this world throws up, c) focusses on strategy rather than tactics, and c) admits when he has got things wrong.

Find out more about me and the purpose of this newsletter, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

I'm in for the book club, Jen. I loved the first chapter, and amen to Doug dealing in the shades of gray rather than retreating into determinism... 🙌🏼

I have to say this about netflix. As we would do in hip hop, lots of sales-doesn’t mean the MC is nice. He’s just popular. Is he a better at rapping? No.

Once I gave the guy the fact his favorite rapper has sold more than mine he had nothing else. Now my guy sold massive units but not like his. But his guy only outsold my guys cause he’s popular. Once we went line for line. Lyric for lyric, verse for verse, the picture changed dramatically.

He got that way doing things my guy doesn’t do and doesn’t have to do.

HBO is Nas, Kendrick Lamar. Netflix is Drake or Future. As for as popularity is concerned the latter of this group are gods.

Break their songs and verses down…they are slightly above mediocrity. (One huge knock with Drake is take away the hits and just listen to the other songs and it’s a snooze fest).

Lil Wayne worst rhyme is 1000x better than Drakes best. That’s HBO and Netflix. But Drake is much more popular than Lil Wayne (and he’s very popular nevertheless).

I don’t watch the service due to its Tsunami of programming much of which when scrutinized is underwhelming. (Line for line, bar for bar).

Netflix doesn’t lean on its legacy it just pumps out new things and moves on. But I know people under 30 discovering The Wire and The Sopranos along with the Last of Us which is why they subscribed to the service.

Fans don’t care about who won the war.

Just like I don’t care who sells the most records.

Netflix still wants to be HBO no one talks about anything with them.

Sure it’s Adolescence-for a weekend and then nothing.

And with that show, it’s more of the production tactics and subject matter that is more of the talk not the actual show itself.

People want to talk about the show, plots and characters. It seems netflix wants us to talk about “itself” and not what is on the shelves.

Industry people might care to do that, my sister and her husband couldn’t care less.

They have netflix but love what’s on Tubi and YouTube. And aren’t favoring Netflix over Tubi due to its catalog.