A big deal: Google and Apple both lose important court judgements

Plus tax credits, tariffs and Trump; newspaper publishers continue their investment in video; and the shape of the global podcast economy.

Over the last couple of months, there haven’t been many big important moments that could impact TV, film and content producers in the medium to longer term. But in the last week, there has been a whole lot of action:

Two significant court cases which are likely to have an impact on the shape of the internet in the years to come:

Google losing its third antitrust trial (that’s three out of three)

Apple vs Epic Games and whether the tech company can take a share of consumer revenue paid to third parties

Trump’s announcement to slap tariffs on movies.

As well as these big issues, I’ve also covered the following this week:

Google sets up a TV and film production initiative

More on newspaper publisher getting into video

The shape and size of the global podcast economy

Tracking a UK TV production company’s YouTube growth.

And as always, send feedback - especially if there are particular things to want to know more about - to hello@businessoftv.com. And if this is your first time reading, please do subscribe, you’ll be joining over 1,600, 1,700 other TV, film and online content professionals from across the world.

Court case number 1: Google loses third antitrust case

One of my early posts when I started this Substack was about the various court cases in the US which could determine the future shape of the internet and have a significant impact on multiple industries, including TV and film.

In the long list of cases faced by various tech companies, Google had three antitrust cases. We knew they had already lost two out of three, and this week, the judgement was announced that it had also lost the third. By way of reminder, these are the three cases:

Google case 1: Epic Games argued that Google was operating a monopoly by forcing developers to publish and monetise their games via Google’s Play Store on Android (where Google takes transaction fees of up to 30%)

Google case 2: Google’s practice of paying other companies such as Apple to ensure their search engine is given prime placement on their devices and web browsers.

Google case 3: Google’s ad tech business, which generates $200bn a year, and makes up 75% of the company’s revenues. The Justice Department argued Google has a “trifecta of monopolies” across the publisher ad server market, the ad exchange market and the advertiser ad network market.

This decision is a big deal for everyone including the TV, film and content production sectors. This for a broad range of reasons, and not just because Google owns YouTube and controls 27% of the UK’s online advertising market (but that too).

As

wrote this week:Over the last two decades, Google has made its $3 trillion business off a very simple framework: own the way people seek and receive their information, and own every dollar spent along the way. In August, the Department of Justice declared that Google violated antitrust laws to achieve the former. A few weeks ago, the organization ruled that Google violated antitrust laws to achieve the latter.

Last year, I wrote a long explainer about how Google has slowly absorbed the content from third party publishers and websites into its own search ecosystem. They argue this improves the user experience, however it also can potentially cut off the traffic to websites and along with it those websites’ revenue.

And now with AI driven search results, a common worry is even fewer users will end up visiting the websites which the AI models are being trained on.

So this decision really matters, because Google is such an enormous giant and is hugely influential in both how content, products and services are discovered online, and then how that content is monetised.

These antitrust cases all now move to remedies. For the most recent case, the US Department of Justice is seeking for Google to hive off its Ad Manager and Chrome browser, as well as other remedies such as making its search index available to rivals and allowing publishers to block their data from being used to train AI models.

Google has suggested its own list of remedies, saying:

DOJ is seeking remedies that go significantly beyond the Court’s narrow ruling by forcing a divestiture of Google Ad Manager.

So we will have to wait and see how this remedy process shakes out, and in these uncertain times, making predictions can be a fool’s errand. The one to watch for is what - if anything - happens to YouTube.

This Vox piece (Google’s big problems, briefly explained) makes two important points. Firstly, clipping the wings of big tech has both bi-partisan support and is popular with voters in the US. And secondly, carving up big corporations is hard:

Microsoft avoided a breakup after losing a landmark antitrust case in 1998 over its bundling of Internet Explorer in Windows. The remedies from that ruling nevertheless increased competition in the browser space and eventually helped pave the way for Google Chrome, which is now a main character in Google’s antitrust drama.

And often it is markets and not politicians who decide how things shake out. To that end, this

post (Wall Street Tells Google to Break Itself Up) is fascinating reading, where a senior Apple executive testified in the Google remedy antitrust case (which is the case number 2 listed above). During his evidence, he made two observations of what he believes will be the consequences of the case for Google - and in real time, this appeared to have spooked Wall Street, causing Google/Alphabet’s stock price to drop by 7.5% in value. Matt calls this moment a ‘sea change’ in how Wall Street understands antitrust, and goes on to say:… Google’s search monopoly may be starting to crack, which will put significant pressure on the company and force its cash cow ad business to be disciplined by competition. There are parts of Google that do compete, like its cloud business and office suite, but it has a money printing machine that might get taken away.

And it is worth remembering that this doesn’t end here. Last week, Meta CEO Mark Zuckerberg spent three days on the stand in a case that will decide if Meta’s acquisitions of apps like Instagram and WhatsApp violated antitrust laws. The Federal Trade Commission (FTC) and 17 US states are suing Amazon over its online marketplace which goes to trial next year.

All of these companies are as much part of our lives as the air we breathe, and we can almost forget how much they influence all aspects of the media, entertainment, tech, TV and film industries. So in terms of tectonic plates shifting, these court cases - depending on the remedies dished out - may have implications for all of us and the internet as we know it in the longer term.

Court case number 2: Creators to benefit after Epic Games successfully took on Apple’s policies

Remember Google’s case number 1 outlined above where Epic Games successfully argued that the tech giant was forcing developers to publish their games via Google’s Play Store (and having to pay Google 30% on all transactions)?

Well, Epic also made a similar claim against Apple, which Apple lost in 2021. Last week the judge in the case found the tech giant had violated the order she had previously made for Apple to allow outside payment options in the App Store. As The Verge reported:

Epic v. Apple judge Yvonne Gonzalez Rogers just ruled that, effective immediately, Apple is no longer allowed to collect fees on purchases made outside apps and blocks the company from restricting how developers can point users to where they can make purchases outside of apps. Apple says it will appeal the order.

While Apple has said it will adhere to the order while they appeal, this BBC article is worth reading as it outlines how the case has reached this point, as well as Apple’s view this the court order is unlawful because it prevents the company from controlling “core aspects of its business operations.”

Why is this case important for TV production companies and producers? You might be thinking “I don’t have any apps or plans for any apps in the Google or Apple App Stores”. Well, the reason this matters is the court decision doesn’t just benefit large companies with subscription models like Epic or Spotify, it also impacts creators large and small.

To explain: For many direct to consumer businesses, one of the revenue streams open to them is some sort of subscription model, often run on platforms like Patreon. As examples, in this week’s post about the history niche, I highlighted how some creators are generating serious revenues via their Patreons: Time Team makes around £88k a month, and Tasting History around £19k a month.

So this decision says the platforms (such as Patreon) where they run their subscription services are now able to generate revenues without having to give 30% to Apple in the process. We will have to wait for the appeal process to see whether this continues in the longer term.

The Verge: A judge just blew up Apple’s control of the App Store

The Verge: Patreon will update its iPhone app to sidestep Apple’s payment system

Tariffs, tax incentives and Trump

I have taken to heart

’s approach to this US presidency where she recommended waiting to see what actually happens, rather than responding to what is said, otherwise there is a danger of permanently running around like a headless chicken about something that never turns into reality.And so in that spirit, we all need to wait and see how the proposed international movie tariffs shake out in terms of actual impact on global production, distribution and the whole content market overall.

Even so, after the initial furore, some interesting details (or should I say, potential details) are emerging. Similar to the UK’s 2003 terms of trade which returned rights to producers and was largely responsible for the boom in UK independent production over the next twenty years, Jon Voight’s ‘Make Hollywood Great Again’ plan includes the following on rights retention in relationship to the various global streamers. As Ampere Analysis noted:

The plan describes demands from streamers for 100% ownership of content they fund as ‘Draconian’, arguing that the pre-1990s network system that forbade networks from owning the shows they aired is a better model to follow. Voight calls for a return of the so-called FINSYN rule with streamers paying a minimum guaranteed premium based on a percentage of the total production cost that would be set at 25% for a five-year exclusive license; 35% for a seven year and 40% for a ten year. Where global rights were not taken, a producer would be able to co-finance and co-own the rights for exploitation in international markets.

In terms of the wider context, I’ve written previously and in more detail about the various tax credits and tax breaks models around the world and within the US.

It is important to recognise that the reason these incentives exist is to try to attract productions to various territories: away from Hollywood to other US states, and of course to individual countries which by definition includes trying to lure projects away from the US.

So Georgia has done a great job attracting productions and creating a TV and film industry to rival Hollywood. Similarly, the UK has done likewise, which is why so many feature films and HETV shows are filmed here including this year’s Mission: Impossible.

In March 2024, BFI research showed that 78% of the £4.2bn spent on UK film & TV production in 2023 was from inward investment. Other countries have built up their own production sectors: Australia, Canada and so on.

Are we in the territory of unintended consequences - after all, this concept of US-imposed tariffs isn’t happening in a vacuum and instead is a response to the global tax break battle that has been going on for numerous years. As I hinted at last year:

There is a potential race to the bottom here, where all TV (and film, and scripted, and unscripted, and kids, and animation) has so many global tax breaks the advantage is cancelled out.

And even more prescient was

when he wrote in April:Most foreign countries (like Canada and England especially) would like to keep their tax credits for film and TV show production; removing them would mean jobs going away from those countries and back to Los Angeles, New York and Georgia probably.

In this case, Hollywood should be worried that Trump learns about other countries’ tax incentives and just takes them away. It’s costing American jobs after all. And he’s a pretty zero-sum thinker. All it takes is one Georgian Senator to tell Trump that foreign countries are illegally/unfairly subsidizing their industries to steal American jobs for Trump to slap tariffs on foreign productions.

Now we wait to see what shape any of this becomes. Axios has this rather arresting graphic of how much of US film studios’ revenue is generated from outside the US - showing the international nature of revenues, never mind production.

As has been widely reported, it may not even be legally possible for Trump to make an executive order anyway as according to the 1988 Berman Amendment, films are exempt from Presidential tariff orders. And I must admit, this was the first time I’d ever heard of the Berman Amendment…

We are in uncharted territory, which leads me back to Helen Lewis’ recommendation to maintain a cool head we wait to see what actually happens rather than what is talked about.

If you fancy further rumination on the question of tariffs, here are some suggestions:

- : How film nationality is determined around the world

- : Trump's Tariffs: Bad for the Industry...Or Are They?

- : A Trade War Could Be A Disaster…For Hollywood

Convergence continues: Tracking news publishers and video

The process of convergence means that what previously were distinct markets - say newspapers and TV - are now merging into one amorphous blob.

As previously outlined, The Sun has ramped up its video operation, including hiring from the TV sector. The director of video for The Sun Jon Lloyd shared on LinkedIn this week how The Sun Originals first documentary ‘Madeleine McCann: The Unseen Evidence’ was picked up by Channel 4 and broadcast at 9pm on the main channel.

Jon outlined how after a year long investigation by The Sun (which was documented throughout by film director Max Molyneux), they went to Channel 4 and ended up partnering with ITN to deliver what must have been an incredibly complex legal and editorial programme.

While investigative partnerships between broadcasters, news producers like ITN and newspapers are hardly new, the way this came about, and the shift of the TV production process into the newspaper operation is noteworthy.

Another point to note. The UK’s oldest newspaper, The Observer is now owned by Tortoise Media, and has recently hired Tom Larkin, producer working with Sam Coates at Sky News as Head of ObserverTV. Another one to watch over the coming months.

The Global Podcast Economy

As mentioned above, I wrote a little this week about the economics of podcasting in relationship to the history niche:

Then straight after I hit publish, into my inbox came the latest report into the global podcast economy from Owl&Co and Hernan Lopez. It is well worth a read - the link is here, and you’ll need to put in your email address to get access.

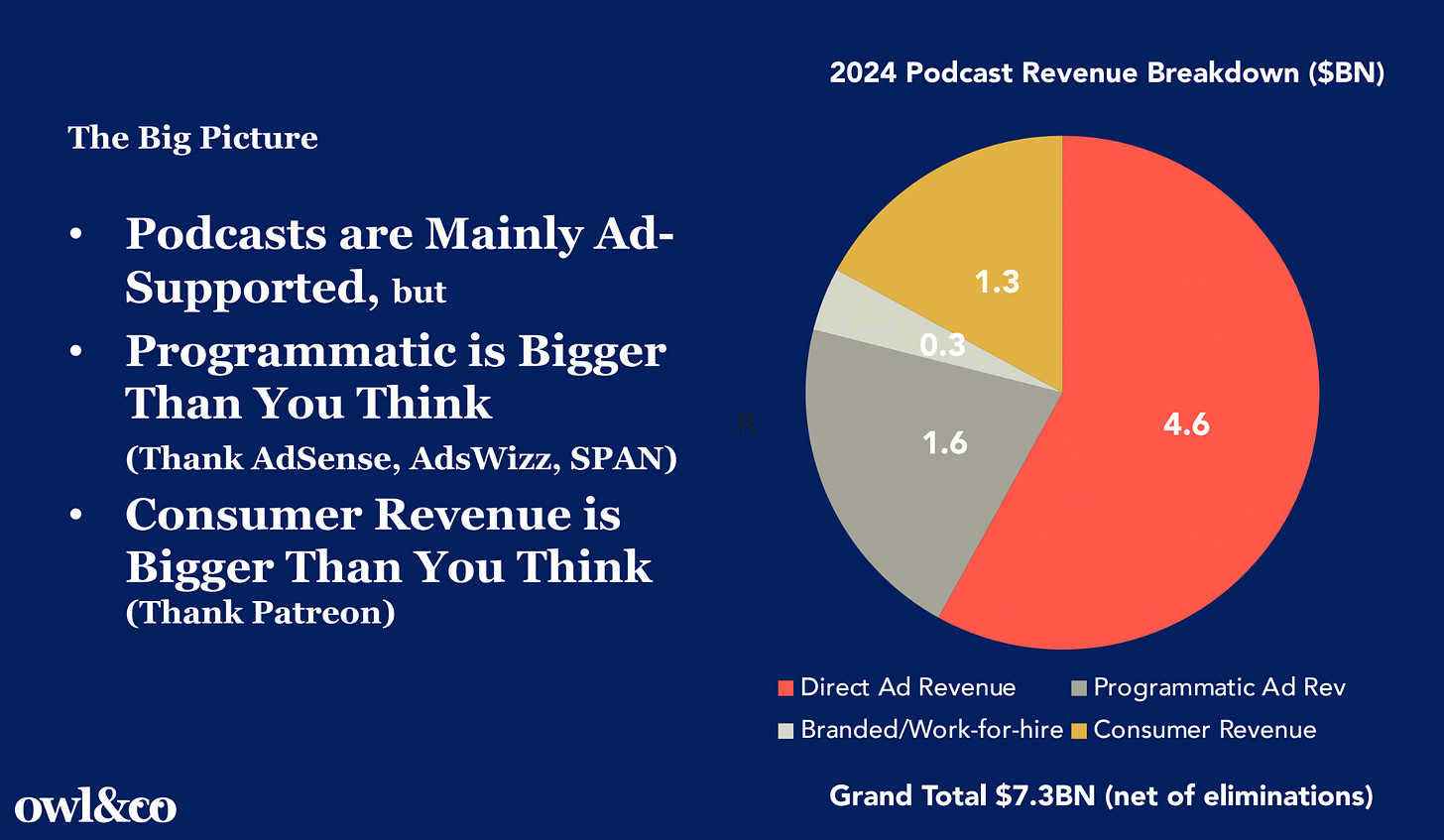

One of the key points to draw your attention to is the size of the consumer revenue stream as part of the overall podcast revenue market - making up $1.3bn or 18% of the total.

This type of revenue includes various types of subscriptions such as Apple Podcasts, Wondery+, YouTube Premium and Spotify Premium, but also crucially Patreon, which is the biggest consumer-paying platform podcasts (paying out $473m last year - or 36% of the total value of the consumer revenue stream). Thus hopefully further explaining the significance of the Epic vs Apple decision as outlined above.

The reason for flagging this is because a) the podcast market is a natural place for TV producers and production companies to open up direct to consumer businesses and b) there are many people out there who are open to paying money to creators and producers.

On this point, Owl&Co’s report has an important observation: that is, for many of these people, they view themselves as supporters rather than subscribers. This is a useful concept when understanding how your fans view themselves in relation to you and the content you produce. So rather than trying to grab their head, instead aim for the heart, and it might make it an awful lot easier to keep hold of them in the longer term.

Google sets up a TV and film production initiative

It was reported this week by Business Insider that Google has set up a TV and film production initiative, rumoured to be targeting TV and film studios for projects rather than making their own content for their own platforms - YouTube most obviously. As the Information reported:

The Alphabet-owned company is partnering with Range Media Partners, a talent and production company behind films like Bob Dylan biopic “A Complete Unknown,” which will identify projects that Google can help fund or produce.

While Google haven’t commented on this initiative (called 100 Zeros - which is how many zeroes are in a Googol), Business Insider’s report suggests it is in part a marketing, product placement or brand enhancement activity rather than about generating IP:

The company sees it as a way to get the creative community to adopt its newer tech products and services, like its Immersive View feature that lets you see things in 3D, spatial tools that blend the physical and virtual worlds, and AI.

Google also wants to promote a positive view of its products — and tech generally — through entertainment to young audiences by helping shape pop culture.

So while this doesn’t look like a step into the hugely crowded content and IP market similar to Amazon Studios, it is worth keeping an eye on as it evolves.

Tracking direct to consumer by production companies: CandourDocs

You might remember last week, I shared CandourDocs’ new YouTube channel which they created while the fourth of their documentaries on the UK’s grooming gangs scandal was broadcast on Channel 4. And here is what a week of data looks like:

So in one week, Candour has now more than likely met YouTube’s requirements to monetise this channel (although because of the subject matter they may choose not to turn adverts on). It will be interesting to keep watching this channel and see how Candour decide to invest in it in the future.

Find out more about me and the purpose of this newsletter, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.