MrBeast's take on streamers after Beast Games (and was the show a hit or not?)

Plus new launches - Fox with a new streamer and Alan Titchmarsh with a gardening YouTube channel.

Before getting going: I’d love to know if this format works for you. Each week, I put together a newsletter of trends I think are important for people working in TV, film and digital content, all with the goal of helping you plan for the future. At the moment, I send out one long email each Friday. Would you rather I stick with this approach, or would you prefer shorter emails on one subject but more frequently - say two to three times a week?

Please click your preferred option below - thanks in advance!

Find out more about me and the purpose of this newsletter, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

Is Beast Games a hit or miss - and what makes a success anyway?

Beast Games has been going out weekly on Amazon Prime Video since before Christmas, with the finale due to drop next week. Press coverage thus far has headlined Amazon’s data that it has had 50 million viewers in its first 25 days; reached number 1 on Prime Video in 80 countries; and 50% of viewing has been outside the US.

In our globalised streaming world we have all sorts of data but not a single public oracle of consolidated figures. As a result, this has created the space for PR gloss to polish how well a show has done and as a result often different metrics are used for titles depending on which - dare to suggest - look better. The end result is it is really tricky to quickly and easily get a clear sense of how well a show has performed.

But thankfully, we don’t need to wander round in the dark as we have

(ESG), who for years has compiled multiple data sets for 1,000s of titles across all the platforms, from a whole range of sources such as measurement services like Nielsen and Samba, the streamers themselves as well as audience metrics such as IMDb and Rotten Tomatoes. This means he’s able to compare title against title, and as a result, we can rely on him to do a pretty good job in stripping out the spin to give cold hard analysis on actual performance in an uneven world of metrics and data.So ESG has now run Beast Games through his data machine, comparing it to not just all titles, or Amazon titles, but also reality TV shows as well as other super expensive shows of all genres, and his conclusion is - drum roll - “Beast Games Is … Mid”.

His full piece is really worth reading, and has lots of graphs like this below:

He says that against all these categories and any metric, Beast Games is not a miss, but it isn’t a hit either: “This isn’t a show in the top 10% of any metric I track, whether accounting for just 2024 or all-time or just reality shows or especially for big budget shows.”

Interestingly, he also noted how little noise Beast Games has generated, to the extent in his research on its performance it was notable how “almost no one is talking about it” (it being the show).

So, why is that? MrBeast (Jimmy Donaldson) is the biggest creator in the world with 350m followers on YouTube, and 114m on TikTok (although there will be a crossover between these two audiences). It is fair to assume the ambition for the show was for a significant chunk of these fans to come and watch Amazon Prime Video.

Here are the latest numbers on his YouTube channel (via ViewStats - MrBeast’s own platform to compete with other social analytics tools like SocialBlade). You can see that in the last three months, his channel did 7.3bn views, and gained 26m subscribers. These are big numbers in anyone’s language.

To do some very rudimentary back of an envelope calculations:

In the last week, MrBeast’s YouTube channel had 669m views

Amazon has said that 50% of viewers of Beast Games are outside of the US

ESG says Nielsen reports 6m people in the US watch the show each week, so perhaps that’s 12m in total globally

This equates to a 1.8% conversion rate from his YouTube views to Beast Games.

As we don’t know how many of his YouTube videos are watched on average per person per week - does a single user on average watch three videos or one video per week? Even if we are generous and say each person on average watches five videos in a week, then that is still just a 9% conversion rate. Or, as ESG has done, if we go by his subscriber numbers of 350m on YouTube, that is a conversion rate of 3.4%. And, this assumes that all the people watching the Amazon show are subscribers to his YouTube channel or have watched his videos. So when a show costs $100m and hopes to attract social fans to watch it, then purely on these numbers it is easy to understand why this might be considered a middling performance.

However, as often is the case, there is another way to look at these numbers - which is hinted at in Amazon’s announcement that 50% of Beast Games’ views were outside of the US.

It is well known that India is a huge priority for Amazon Prime Video - the country has c65m subscribers, and is the company’s second biggest subscriber base after the US. Back in March last year they said that India has driven more subscribers to Amazon than any other country bar the US over recent years. Amazon bought MX Player, which is the leading free streamer in India, and merged it in with their Amazon miniTV product to try to capture more market share in the country.

And India is also huge for MrBeast. In the video below Jimmy Donaldson says that India is the second biggest territory for him after the US. He’s long experimented with ways to attract international audiences such as launching channels targeting specific countries (again, India, most importantly) and then ensuring his most popular videos are dub or transcribed into multiple languages. He even at one point seemed to be considering launching a dubbing company - although perhaps advances in AI made that challenging. If you drew up a Venn diagram of creators that are hugely popular in both the US and India, MrBeast would be one of a very small number fitting into this category.

So to hypothesise, it is a possible scenario that the ROI of Beast Games is less about the overall global numbers (although of course they’d be happier if the figures were a bit more punchy), but more in how it performed in India against very specific metrics. Such as: did the show help increase subscriptions, did it bring MrBeast’s Indian fans to Prime Video, did those people churn or keep their subs; did these people go on to buy other Amazon products? After all, as a company Amazon Prime Video is well known for prudently choosing rights for specific territories that align with their wider Amazon strategy, rather than the more costly blanket worldwide option. So through this lens, the relationship with MrBeast makes a whole lot more sense - reach the core US demo, but also do the same job in Amazon’s big target growth market.

Separately, last year I mentioned a LinkedIn post where Night, the talent agency which previously represented MrBeast, shut down their TV studio that was intended to produce a slate of TV & streamer shows with other creator talent. Those involved outlined why they didn’t think the studio had worked, saying:

“Besides the MrBeast x Amazon project (which we are very excited about), streamers are still getting their heads around the power of creators to tell stories and move audiences. We hope to see more progress in this area soon.”

The argument that it up to TV to get its head around the creator/influencer sector has been made for years, however this has usually been too one-sided. So yes while TV and streamers need to understand the world of creators, in turn creators need to understand the power and artistry in producing, scheduling and marketing TV. Especially if they are hoping for TV and streamers to offer them enormous budgets similar to the deal MrBeast landed with Amazon.

To that end, below is a fascinating and illuminating conversation between Jimmy Donaldson and Colin & Samir, recorded before Beast Games was released, and they discuss the experience of making the show, Hollywood and streamers, as well as other facets of the MrBeast empire.

I’d recommend watching the whole thing, especially if you are a factual or formats producer or work in TV scheduling or marketing. Or indeed if you just want to understand more about the creator economy. A few key standout points from their discussion:

The upside of TV and streamer scheduling over the limitations of YouTube in creating water cooler moments

How YouTube isn’t a great place to tell a story or narrative over a series (as users might be served the episodes out of sequence by the algorithm)

Streamer and TV executives have a lack of understanding about creators both individually and also collectively

The need for creators to understand deals, production budgets and the like, so they should hire experts because creators have no idea how TV works

However that doesn’t seem to extend to creative storytelling, to the extent that Jimmy suggests hiring people who make reality TV can lead to a show that isn’t in line with the ethos of a creator’s channel and community.

One other observation. One of the main characteristics of the creator community that is so distinct from the rest of the media industry is the level to which they externalise their thought processes, creative and editorial decisions, performance, business models, successes and failures. While of course there are TV & film trade publications, newsletters (hi!), podcasts and more, there simply isn’t the same desire for transparency and shared learning as there is within the creator economy - indeed, to the extent that opaqueness could be considered a feature not a bug.

To return to the overall performance against the size of MrBeast’s followers. It is interesting that Entertainment Strategy Guy suggests a reason for the show’s performance is not the content itself, the marketing or indeed the appeal of streamer shows to a creator’s audience.

Rather, he raises his long-running question over the reliability of social metrics in general and suggests they shouldn’t be taken at face value. He asks about all online metrics: how many followers are real, how many lapsed, how many are bots, what counts as a view anyway and so on…?

This issue of transparency and reliability of data from online platforms - as well as the general capability of TV and streaming people to analyse and understand these numbers - is going to become a bigger deal in the future. Not just for advertisers, but also companies who are (in part) relying on these numbers to help make a decision to spend tens if not hundreds of millions on shows.

Alan Titchmarsh and Middlechild Productions to launch YouTube channel

TV gardening royalty Alan Titchmarsh is going to launch a new YouTube and social brand ‘Gardening with Alan Titchmarsh’ in April:

The videos will be published simultaneously on newly created YouTube, Instagram, Facebook, and TikTok accounts. The ambition is to reach a “broad spectrum of gardeners from first time novices to experienced gardeners from around the UK and globally.” The series will also have the potential for brand tie-ins and product placements.

Gardening is one of those activities that has become big business on YouTube and other social platforms.

Here is one example - six years ago Kevin Espiritu started blogging and created a YouTube channel about gardening called Epic Gardening. Now - acknowledging the large pinch of salt required on social metrics as outlined above - he has 1.7m followers on Instagram, 3.5m on YouTube, and 1.2m on TikTok, as well as two podcasts.

After these successes he launched an online store selling all sorts of gardening products and now his business turns over tens of millions of dollars a year.

Below is a really interesting video interview with Kevin about how he grew his blog and YouTube channel into multi-million dollar operation. The key takeaway being to what extent he diversified his operation so he wasn’t over-dependent on one revenue stream, but also how he maintained the central coherence around gardening.

Fox to launch a new subscription streaming service

Fox is planning to launch a subscription based streaming service that will feature live feeds of its Fox TV channels like Fox News, Fox Business, Fox Weather and FS1 (Fox Sports 1).

As often is the case with streaming services built around linear TV channels, the challenge will be to attract a new audience rather than cannibalising the existing linear audience. CEO Lachlan Murdoch said that this new platform will target cord-cutters or cord-nevers - in other words, aiming for an additional audience, rather than converting Fox’s existing cable audience into streaming subscribers. Indiewire reported Murdoch as saying:

“We don’t want, and we have no intention of churning a traditional distribution customer into our DTC customer, and so our subscriber expectations will be modest and we’re going to price the service accordingly.”

However this might prove challenging. As

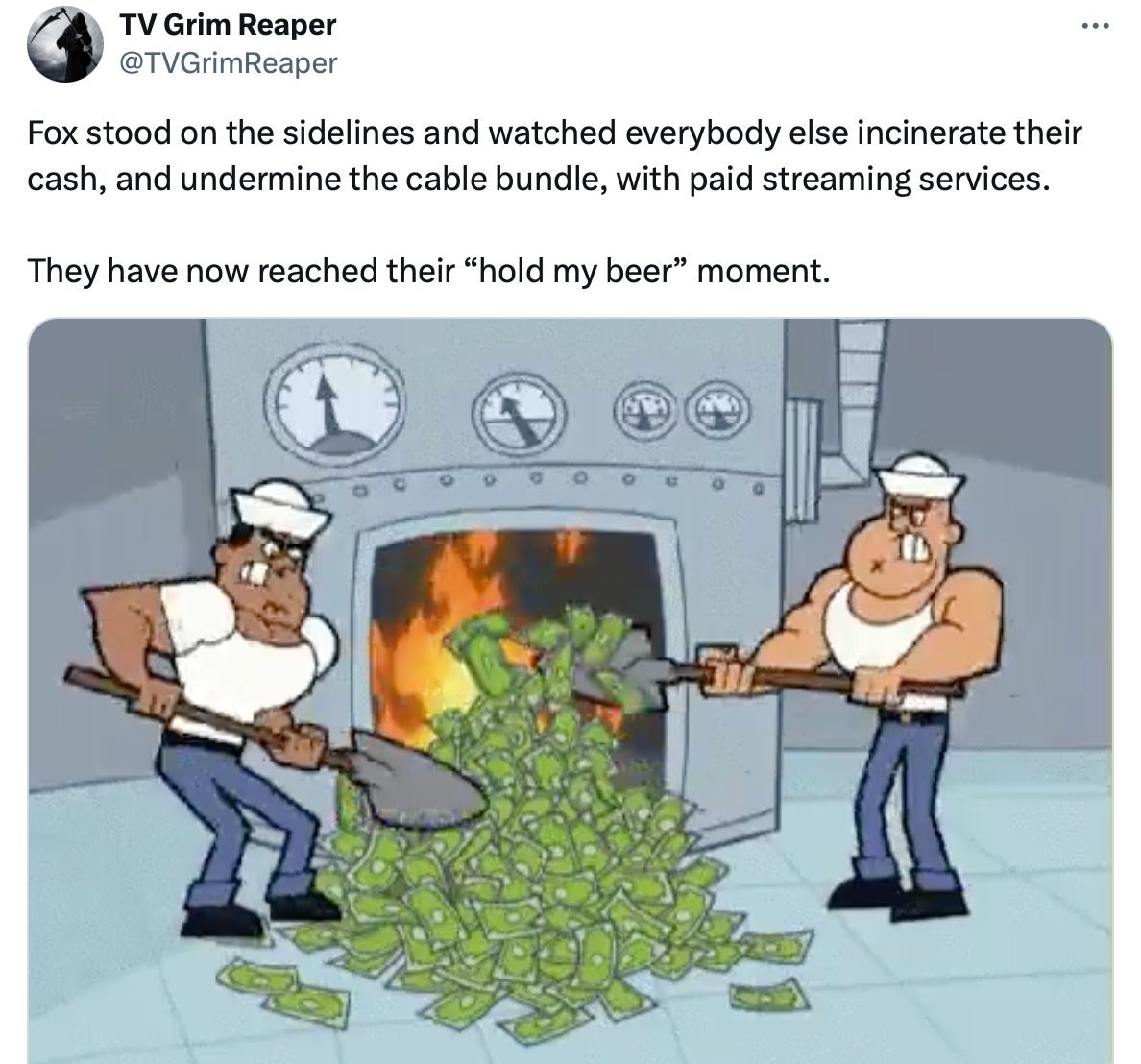

observed, when Venu Sports was a thing they commissioned a study to identify a potential audience, and supposedly it showed that those interested in the sports centric app were those looking to get rid of their current pay cable subscription. (who ran TV by the Numbers) posted the following response to the announcement:While MasaCapital noted that so far, Fox is best positioned out of all of the cable nets:

As the proposition will be built around the live streaming of Fox’s TV channels, it therefore is likely to generate ad income as well as subscriptions. In addition, by not having originals or buying up exclusive rights, the operational costs will be lower than other streamers in the market.

The above graph shows how Fox has been clever to avoid the buckets of cash needed to finance a subscription streamer service - remembering it isn’t just the originals and acquisitions costs that are significant, but also the technical and operational costs of an owned and operated platform of this nature. Instead, Fox has focussed on Tubi, which is the largest of the free ad-funded streamers (after YouTube of course), however still isn’t profitable (although Fox and Tubi seems to suggest that is by choice as they’ve opted to continue investing in the platform).

So why launch a subscription offering, and why build it around live streaming its linear TV channels? Well here,

’s theory that this is about enhancing the value of the linear offering for some sort of deal in the future does hold some water:…my thinking is that by creating the digital product that the linear channels plug into, when it comes time to sell off those linear channels (likely within the next 2-3 years) they will have greater financial value to them.

And if you’d like to see the linear/streaming profit margin conundrum in one tweet, here it is:

Potential M&As in streamer-land

The quarterly earnings report from Peacock-owner Comcast saw their stock fall 11 percent last week, after a reported loss of 139k broadcast subscribers, as well as stagnant subscriber numbers for its streaming service.

Matt Belloni of Puck News says Peacock is ‘a subscale, money-losing, U.S.-only streamer,” and the growing chasm with Netflix is putting new pressure on Comcast CEO Brian Roberts to merge or bundle. As for who the deal could be with, Belloni goes on to outline how some agree with the logic of merging the streamers of Warner/Max with NBCU/Peacock:

We all know that Warner Bros. Discovery CEO David Zaslav wants a transformational deal. Do Roberts and [Comcast President] Cavanagh? That’s been the open question, and the triple-whammy of broadband weakness, the cable TV spinoff, and the issues at Peacock suggest the right time may be approaching.

And to give a sense of how much cable TV has lost through people cancelling their subscriptions in the US,

has run the following numbers:NBCU has lost broadly about $550M in 2 years in its cable TV business from #cordcutting alone.

This doesn’t even account for the additional advertising revenue losses 💰 from smaller audiences and smaller reach.

Also, a few weeks ago, Comcast announced key hires for the publicly traded SpinCo for their cable networks and some digital assets including USA Network, CNBC, MSNBC, Oxygen, E!, SYFY and Golf Channel along with complementary digital assets Fandango, Rotten Tomatoes, GolfNow and SportsEngine.

Why does the new Fox streamer and the goings on with SpinCo, Peacock and potential streaming mergers matter to TV producers? Well, these movements are a reminder of the continued jostling for market share and the future shape of the TV industry overall, especially if the trend for spinning off declining cable businesses continues.

How this shakes out will impact the wider industry - although in ways it is hard to predict.

Tubi and the Super Bowl simulcast

Tubi in the US is live streaming the Super Bowl this Sunday, and it will be interesting to see how it handles such a huge event and tailoring it to their younger audience. The platform has 97m monthly active users, and according to Fox CEO Lachlan Murdoch, 65% of them are cord cutters or never corders - meaning they have never had a cable package to cut from.

Last year, when Paramount+ streamed the Super Bowl there were 123m viewers and 3.4m additional sign-ups. The challenge for Tubi will be to offer a premium (and stable - hello Netflix and Tyson vs Fury) streaming experience.

If Tubi’s audience is 65% cord cutters/cord nevers, and Fox is saying they want these types of people to take out a low cost subscription to its new paid for Fox streamer later in the year…. then capturing email registrations during the Super Bowl to attempt to convert these people to the new service will be the name of the game.

Interestingly, as Super Bowl ad spots are the most expensive and iconic in the world, those watching the game on Tubi will be getting the same as spots as those watching on Fox.

Graphs similar to the one below have been doing the rounds this week - this one is from Sherwood’s piece ‘Super Bowl ads are selling for record prices — again’, It argues that one of the drivers of the high cost of these ad slots is brands are scrambling for one of the last chances to reach a mass live audience.

And this is a reminder for why sport and sports-adjacent programming is big business, and increasingly so for the streamers.

Podcast of the week: Why Broadcast Television Won’t Die

Matt Belloni is joined by Amy Reisenbach, the president of CBS Entertainment, to talk about how broadcast networks continue to succeed despite living in a world of streaming and social media.

Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

I read ESG and I have bought his argument day one. I have a YouTube channel. I don’t create I just watch. I was going down that creator road way back in 2011 but that never came to fruition. But the 274 subscribers I have are still there. Are they active? No. Because I’m not. However it raises this question, of the followers you have how many are active?

Hard to advertise to someone who forgets they are subscribed to you. And only remember they are when your content comes in their feed they and then they ignore it. People paid for gym memberships for years -somehow they forgot they were SPENDING money on something they didn’t use.

Another reason MeBeast show isn’t banging like that is YouTube is free, Amazon is not.

And it also has real actors doing real acting things in real shows like Alex Cross. And isn’t much if not ALL of YouTube is what netflix calls “laundry content”?

It’s perfect for not following along with every word.

I just tap my screen and go back a few seconds or scrub the timeline bar. So as much as I hear how netflix should fear YouTube, I don’t buy it. It’s a blind man yelling at a deaf man he’s going the wrong way.

Both companies lie and hide data to suit their needs. And don’t get me started with the amount of scandals so many of these creators seem to all have.

Go on YouTube there’s all these expose videos detailing the very funny business and unethical tactics they do to create content.

Who wants to PAY for that?

Especially if you already get some version of it free. Usually in the same feed is the creator trying to PR his way out of the latest scandal.

Hollywood is used to scandals but from those with equity in the industry. Been around for a while. MrBeast fame is recent.

He wasn’t this known a decade ago. And unlike Hollywood hopefuls he didn’t get to a point where he had to consider how he moved and what he does and how it will be perceived by the public.

There’s still too many unanswered questions (by design) that I don’t buy from this content creator world. Show us the books and shut us up. Otherwise I call BS.