What TV can learn from local news

Local news across the world is facing structural decline, and there is plenty in the experiences of that sector to give food for thought to the TV industry.

As we all know, the internet has upended many industries, so this week I thought I’d look at local news and see what important lessons the TV industry could take from that market’s experiences.

Before jumping in, a quick little promotion: Jason Mitchell of The Connected Set is running a series of ‘AI for the screen industries’ online sessions, all UK time:

Tue 10th Dec, 1-2pm: Generative Video, Imagery and Decks Sign up here.

Wed 11th Dec, 1-2pm: Post Production and Audio Sign up here.

Thu 12th Dec, 1-2pm: Project Management and Chatbots Sign up here.

These will include some live demos of AI tools, and these sessions are completely free to take part, just register via the LinkedIn links above.

Local news, what happened and what can telly learn?

To understand how we got here, we need to go back to the early days of the internet, and how the online advertising market developed - and yes, it is a highly simplified version I’m outlining here.

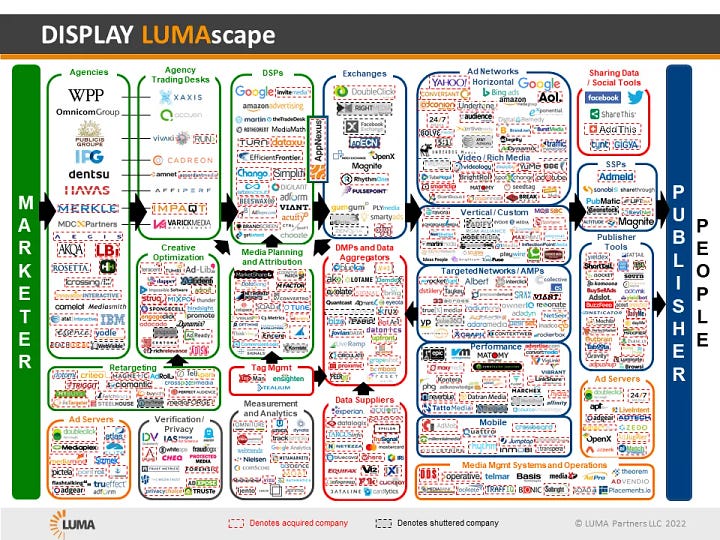

From the late-90s to the late noughties, publishers of all shapes and sizes created content websites and focussed on generating as many page impressions as possible. The more pages people visited, the more adverts on these pages were shown, the more revenue you made. All sorts of formats were developed, many of which still exist today and will be familiar to all users - banners, MPUs, skyscrapers, leaderboards, sponsorships and more. Plus an increasingly complicated ad tech ecosystem emerged:

Simultaneously, newspaper classified businesses, which had provided a key source of revenue to fund editorial operations, were being eaten up by the likes of eBay, Facebook Marketplace, Rightmove, Autotrader, LinkedIn, WhatsApp groups and more. The buyers of local print newspapers were getting older and declining in number.

And against this background was the mantra that ‘information wants to be free’ which was interpreted to mean paywalls were a bad thing. Plus there was a belief that users wouldn’t pay for news or editorial content anyway, thus limiting publishers’ horizons to focus even more on display advertising.

Meanwhile, from the mid-noughties, more online advertising options beyond display adverts were emerging: social platforms, YouTube video advertising, ad-supported premium VOD services that launched in the UK from 2006 onwards. Consequently, the market became flooded with inventory, and so a pricing hierarchy emerged. Simply put, a video pre-roll before a premium TV show on 4oD was worth a lot more than a low quality display ad at the end of an article.

This Semrush article illustrates this point showing the various CPMs by industry and ad format - bottom of the list are all the display ads units common on news publisher websites:

For online publishing businesses who already had a pipeline of quality content to monetise - TV broadcasters most obviously - this meant focusing attention on growing their more lucrative services. As a result, many got out of the game of chasing page views for lower value display ad money.

For those that stayed with the page views model, what emerged were several key developments:

More and more advertising, sponsorship, advertorial and affiliate links were loaded onto websites and editorial pages

Appearing in search results and on social became increasingly important to generate more traffic, however local news usually doesn’t do well in these spaces

So higher volumes were needed of non-local news content such as celebrities, general cultural moments and product reviews to try to catch any passing users.

As a result, many local news websites ended up trying to serve two different audiences: 1) passing users that end up on a local news website because they’ve searched for something unrelated to the geographical area, such as looking for a product review for a new vacuum cleaner, or clicking on a link about a celebrity. And 2) those that are actively seeking out what is happening in their area, and have to wade through all the generic content that is not local.

On top of that, but quite importantly, the advertising volume and formats renders many (but not all!) local news websites challenging to use. This is not a new or unique insight but a common criticism of newspaper websites going back more than 15 years: for example this Bloomberg article from 2018 ‘Why Are Newspaper Websites So Horrible?’ is fairly typical.

To illustrate this point, I started counting ad formats on local newspaper website pages. As an example, on one 380 word article, there were 74 different adverts or sponsorship placements, 29 of which were above the comments section at the bottom of the article, the rest below. Nineteen of these placements were obviously adverts - display adverts in various formats, video pre-rolls. The remainder were sponsored content or advertorials, the vast majority of which are generic and have no local relevance: installing a lift in your home, replacing windows, drafting wills, or treating toenail fungus.

Another example that was recently shared on social shows how generic non-local content such as product reviews is syndicated across newspaper networks:

This approach creates a catch 22: chasing page views doesn’t really attract new audiences that might be interested in local news or other local digital services, nor is it likely to generate enough profit to fund the development of sustainable longer term models.

Enough of the background, what is the current situation?

What prompted this piece was various discussions in the last year about the future of local news. Reach PLC, (formerly the Mirror Group) - owner of 100+ local newspapers, multiple national papers including the Daily Express, Daily Record and the Mirror, plus a network of over 20 local news websites - recently was reported to be encouraging its journalists to increase the amount of stories they publish when on shift. This isn’t a new strategy, there has long been trade press coverage of page view targets and issues with ‘page view slowdown’ due to social platform changes.

As reported by Hold the Front Page, journalists (when not out on stories) are being asked to increase the volume of articles they produce, with one editor saying eight stories per shift is an optimal number. The piece goes on to report an internal email from the editorial director of Reach’s Live network:

“And at the risk of reducing journalism to pure maths, the page views we generate are a compound of the number of articles we produce, and the number of times that each one is read.

“To increase page views, we need to increase either the number of articles we produce, or the number of people who read each one (or both).”

The response to this story included this article from the Press Gazette, where former deputy digital director of OK!, Rachel McGrath, outlines her experience of focussing on volume over quality - it included the image below of articles featuring Martin Lewis published to Reach’s network in a 24 hour window:

On social, the response to the Reach story reflected the opinion that local news websites have usability issues. A flavour of the discussion is below:

Or as Kirsty McIntosh, court reporter for The Dundee Courier said: “My humble suggestion for increasing page views - get your reporters back in court. We have shown time and time again there is a real appetite for good old-fashioned court reporting over high volume click bait. (Ditto shoe-leather live news reporting).”

As other people also observed, the next step for this strategy could be the replacement of journalists with AI generated material.

The challenge is clear for local newspaper companies. They, like other online publishers, have been clobbered by Google search and Meta changing their algorithms which has reduced their traffic, although Google Discover has become Reach’s ‘biggest referrer of traffic’. However, the type of content that performs on Google Discover is not local news content, thus leading them ever more into churning out high volumes of SEO-friendly non-local content.

The backdrop is demonstrated in the chart below. With the decline in print circulation and classified income, and online display advertising not being enough of a replacement, Reach, Newsquest and National World lost more than 60 - 70% of their revenues and journalists since 2007 to 2022.

The Regional ABCs tell a similar story. The first half of 2024 saw regional daily print circulation down by 17% on average, and more than half of the regional daily newspapers have circulations below 5,000.

There are some interesting growth areas. Numerous publishers are having success with building direct relationships with specific audiences via WhatsApp and newsletters - as an example, Reach has 32,000 newsletter subscribers and 25,000 WhatsApp members for Daily Express readers interested in Formula 1; in total around 1m users receiving content via WhatsApp across Reach’s portfolio.

And other providers have introduced paywalls on their websites (for example, one local news website says: “Subscribers get the Ad-Lite version of our website which features up to 70% few ads and faster load times for a better user experience”).

Maybe together a mix of paid online products and services will provide a revenue engine to replace local newspapers’ print and classified businesses. However, for some commentators, it does feel the elephant in the room should be addressed: the poor user experience of many local news websites due to the volume of adverts, irrelevant syndicated content and affiliate links.

wrote a post called ‘Local journalism is killing itself – but here's how to fix it’. He suggested that if local news is going to function as a business and a market “there needs to be a conceptual shift in how it [local news] is approached”. Calling some online local news operations ‘zombie outlets’, he argued:Simply put, scale and advertising is not working. Most people simply do not care about news that is actually important, like what is happening at their local council. Those same people are never going to pay for news. However, there is a smaller, proven cohort of people who will pay for journalism….I think if local news were to shift to a paywall model, with distribution similar in style to Substack, with a product optimised for quality and not reach, it could find a viable audience all across the country.

When James talks about using a platform like Substack, this is a reference to removing the significant technical and operational costs associated with owned and operated websites and instead use the monetising tools and platforms out there so the journalists can focus on journalism. To give an illustration, the average price for a Substack subscription ranges from £3 - 8 per month for hobby or interest based publications, and higher for niche or business related subjects. After Substack’s cut as well as payment fees (together around 15%), a publication could net say £4 per subscriber per month. Substack suggest that usually 10% of all free subscribers are will to pay, so to generate £100k per year, a publication would need 2,000 paid subscribers from approximately 20,000 free subscribers. That would certainly pay for a couple of journalists with a small expense account.

Obviously, Substack doesn’t replace the huge content management systems and sprawling website destinations of news publishers. In addition, building an audience solely on someone else’s platform is risky, as you are then beholden to their whims. You only need to look at publications like Buzzfeed, where to their cost they lost vast amounts of traffic after Facebook changed its algorithms:

However the Substack subscription model does drawn attention to the operational and technical costs involved in running owned and operated websites, and that’s before you get to the point of paying any journalists.

For smaller players or individual local journalists with a decent patch, a hunger to pound the pavement, as well as the ability to use social to drive an audience, Substack could provide a fruitful option to build a direct to audience business. And it isn’t just independent journalists arguing for the subscription newsletter model. One of Substack’s competitors, beehiv, is investing millions on a hunch that newsletters are the next newsrooms.

James O’Malley mentioned three local news publications as evidence that his paid subscription local news Substack theory can work: Manchester Mill, Birmingham Dispatch and Local Authority covering the Medway in Kent. James wrote about them in January, and now it is nearly December, so below I’ve listed their January and then December subscriber numbers, and made a guesstimate at revenue based on 10% of their December subscribers being paid:

Manchester Mill - 40,000 to 53,000 = £424k a year

Birmingham Dispatch - 8,000 to 21,000 = £152k a year

Local Authority - 2,000 = £8,100 a year.

Along with these examples,

, formerly of Buzzfeed and the Guardian, recently launched his own paid news publication, LondonCentric. He’s published a series of noisy pieces that have got a lot of attention - one about the daily chaos at Euston Station, and this week another about scammers on Westminster Bridge. It launched six weeks ago, and thus far has 12,000 subscribers. If 10% are paid, then at the moment that could generate around £70k a year. Yes, London has a big population to draw from, but equally, there are quite a lot of competitors in the capital.Another example of a revenue generation model is in the Outer Hebrides. The main weekly newspaper there is the Stornoway Gazette (disclaimer, my first journalism job was at the Gazette under previous ownership), which had a print circulation of c15,000 in the 1990s but is now down to around 2,400. In 2005, a former editor of the paper set up his own monthly free print classified publication that significantly undercut the Gazette’s classified ad prices - rumoured in the 1990s to have been roughly the same as those of the Daily Telegraph. Widely available locally, this monthly freebie is full of buy and sell listings, jobs, local advertising, births and funerals, latest events and the like - so it is hugely useful to people living in this area and as a result has a circulation of 13,500. The classified income funds journalists who in turn run a digital first news operation on their website as well as a lively Facebook page. So while they haven’t (yet) done a subscription offering, their free classified print publication is the revenue machine a local news operation needs. And while the fairly simple website carries some display advertising, what is noticeable compared with other local news websites is that the content is 100% focussed on that patch - there isn’t any syndicated material, celebrity stories, generic product reviews or SEO friendly non-local fodder.

Meanwhile in the US, philanthropists have been investing in local news operations due to concerns about the collapsing industry, with the goal of creating a future for local journalism. In 2023, it was reported that Philanthropies pledge $500 million to address 'crisis in local news'. Another example is the San Francisco Standard, which has a website, podcast, a portfolio of newsletters and video content plus a big following on TikTok.

While relying on wealthy benefactors might not be a long term solution for local news provision, it could give the (enviable) space to try out new ways of working and models, free from the daily downward revenue pressures of a traditional online news business.

What relevance does this have for the TV industry?

I think there are five key lessons to be taken from what has happened with local news and the internet, all of which have direct (or indirect) relevance to TV producers and production companies.

Firstly, it may be obvious, however the nature of TV offers no protection from the forces of the internet and connectivity. While of course there are many differences between TV and local newspapers, these don’t by default offer an inoculating protection, so being aware of what happened in these adjacent media industries, and what lessons we can all learn is important.

Secondly, the next big lesson is about identifying your tribe. I’ve written previously about how TV production companies can form direct relationships with the people who watch and like their shows by identifying who are ‘their’ people. For local news obviously, it is likely to be geographically based, or a wider diaspora who want to keep tabs on what’s going on in their home town. For TV production companies, it might be specific subcultures, hobbies, demographics or interests, cutting across geographical borders and territories to find a global niche audience. Whatever it is, there is a potential bunch of people to grab hold of.

The third lesson (following on from the second) is about being hyper-focussed on this audience - what do they like, what are they interested in, what do they need (even if they aren’t aware of it!). For those working in online, the mantra has long been ‘user centric’ or ‘audience centred’ - so keeping your audiences front and centre in decision making is crucial. Arguably one of the biggest issues for local newspapers is that chasing passing users searching for non-local news content has meant the focus on a specific local audience can get diluted. In practice, for TV production companies, this means being constantly curious to the point of obsession about what audiences are interested in, what they are missing, as well as regularly reviewing data and insights to see what is working and what isn’t.

The fourth lesson is being aware there are tools and services out there that means anyone - TV production companies included - can create and monetise ‘stuff’ for these audiences without necessarily needing huge amounts of technical and engineering resources to do so. It could be anything - Substack newsletters, podcasts, YouTube channels, membership programmes, WhatsApp groups, live events, merchandising, online services to name but a few. The creator economy is a huge and expansive beast, with remarkably low barriers to entry, but also no guarantee of success. Knowing what might work for your audience, and how to go about building and launching something successful… well, that will have to wait for another post!

And finally, the fifth and last lesson is perhaps recognising when the game is a bogey. Numerous UK commercial TV broadcasters in the late noughties worked out the page views game was one that involved higher and higher volumes of content just to sustain declining display ad revenues - running harder and harder to at best stand still. Hindsight is a wonderful thing, and reducing the dependence on display advertising 10 - 15 years ago was a much easier decision to make for TV companies. Indeed, below is a (very beautifully designed and highly nuanced) slide from a presentation I did on this subject back in 2011. Obviously display advertising does generate revenues for certain businesses, but within the context of a TV broadcaster or TV rights content owner, far more can be made via video advertising on VOD services:

As a final postscript. I can’t mention

without including his plea below for anyone who knows what to do with old recordings of live TV. As so many TV people subscribe to this Substack, I thought someone out there might have a clue how to help him!Other odds and sods

Doug Shapiro has written an insightful response to the Ben Affleck clip I shared last week where he talks about the impact AI might have on production and Hollywood. It is worth reading, but as a summary, Doug argues that Hollywood is not competing in a closed system, and therefore as AI will mean lower barriers to entry from the creator economy which will further disrupt the existing TV and film production sector.

TV brand spin-offs and live experiences have long been a source of income for production companies: The Traitors Live Experience will launch in spring in London.

TV Beats Forum Panelists: The TV Bubble Has Burst, Remakes, New Technologies and Impact Investment Offer Other Opportunities.

TV Rev: Why Broadcast, Not Cable Is The Peacock's Golden Feather.

Podcast of the week

Last week I included a link to a story in The Atlantic about how hundreds of thousands of Hollywood TV and film scripts are in an AI dataset being used to train numerous AI tools owned by big tech companies.

has done a podcast episode on this, and it is very much worth a listen:Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.