How TV producers can build direct relationships with audiences

Plus a little on Netflix removing its interactive TV shows and Samsung TV’s growth as a FAST provider.

The importance of building direct relationships with the people who watch your shows has come up quite a few times recently, so this week I’ve explored what this can mean for production companies in practice - where your opportunities might be, some examples from other companies, and what your next steps could look like.

How to build a relationship with the people who watch your shows

In the battle for survival we are all now in, there will be many factors that will see TV and film production companies survive and thrive. Most importantly, the quality of storytelling and programme making, the resonance this has with specific audiences, and the ability to deliver on time and on budget. So far, so familiar for those in the production sector.

However there are two additional - and related - elements that have been more alien to the bulk of TV producers, and yet will increasingly influence longer term competitiveness: 1) the ability to grow and manage direct audience relationships and 2) success on YouTube.

In terms of YouTube, well, the platform is coming to eat TV’s lunch. It is a video platform. TV is the ultimate audio visual storytelling machine. Ergo, it is the most obvious and natural platform for TV producers to be making hay. As Evan Shapiro says in the TVREV piece mentioned later on in this post:

YouTube is the biggest TV channel in America. Despite all the data in front of everyone’s faces, it doesn’t seem to have sunken in or changed the strategies of any of traditional media. Dumbfounding.

I’ll write more about how producers can think about YouTube both tactically and strategically next week.

Instead, this week, I’m going to focus on how and why building direct relationships with audiences is part of both a defensive and offensive strategy. Defensive, because it will increasingly become routine for all your competitors, so you are going to have to do it anyway. And offensive, as the potential upside of building direct relationships with the people who actually watch and love your shows is enormous. It can bolster your TV and film business, as well as potentially enable opportunities to diversify your revenue streams. I’ll do a future post exploring these upsides and how you can use audience insights and data to your advantage.

Having spent decades working with TV production companies in the UK, there is a common approach of allowing the programmes to speak for the company. For most production companies, as the marketing and distribution of TV shows and films to audiences has historically been handled further down the pipeline (by broadcasters, networks, streamers, cinema chains and so on), then the purpose of online activity has been to act as a showcase to potential buyers as well as talent, freelancers and contributors. In other words, it is all mainly about B2B activity. When you are focussed on commissioners and buyers, then this can work, and work well.

This usually looks something like this:

A website with credits, clips, about us, key personnel, awards and latest news

Social accounts on platforms like Facebook, X and Instagram

A LinkedIn company page.

However when you are looking to build direct relationships with audiences, this can be tricky if you shows aren’t individually famous enough or are a little more transient than big global mega-hits like Masterchef. This is why increasingly brands with longevity are important - whether it is your company, a genre or theme you specialise in, or talent.

Companies are all distinctive, and therefore each organisation will have a different USP that has the potential to resonant with audiences. However, I’ve suggested some groupings below with the ambition of sparking further thought. And yes, I’ve largely ignored rights positions at this stage.

Your company has name recognition and people love watching your shows

There are some companies out there who have a name and a reputation, and this is worth its weight in gold. For these companies, building a direct to consumer brand is possibly more straightforward, as you have a name and a reputation that appeals to audiences.

The obvious example here is A24 - as well as film and their TV division they also have a membership club, newsletters, merch, a physical publication, podcasting, music and more. While the revenues and profitability for all these individual activities is worth pondering, overall this is a company who is the market leader for identifying an underserved but significant (enough) global niche - people who are ‘terminally online…[and] culturally-adventurous’. Or ‘literate and artistically adventurous people in their twenties and thirties’. A24 is what the Generalist calls the beginning of a ‘prestige media conglomerate’.

Another company chasing a similar demographic is Mubi, although where they differ to A24 is their streaming subscription service. To pick on one other distinctive strand in their operation is ‘Notebook’ - an online daily international film publication, which has the following description: “our mission is to guide film lovers searching, lost or adrift in an overwhelming sea of content”.

In other words, this isn’t marketing for Mubi films and services (although it does that too), rather it is an editorial proposition for film lovers, just like the people who work at Mubi. A tribe of like-minded souls, so if you travel to Sydney, New York or Brasília, and you’ll find cool young things with their Mubi tote bags.

Shondaland is a long established destination for lovers of Shonda Rhimes and her shows. This is a mix shows, podcasts, newsletters, editorial, news and merch - everything from US election information through to buying Bridgerton tea.

A UK example is Wall of Entertainment, who have produced over 100 youth-focussed shows amassing 12bn views across TV, film, social and branded content. Their portfolio of social accounts have some serious numbers - 1.5m on TikTok, 1.4m on Instagram and 600k on YouTube. Not that follower numbers are an end in itself, however this is a company with a brand that has direct and real resonance with its target audience, while working with buyers such as Netflix, Channel 4.0 and Amazon, plus brands like Spotify, JBL and Foot Asylum (more on that below).

If your company has any sort of name recognition with an audience, then this is a great place to be as you’ve got something already in place that can be build on.

You make shows for a certain demographic

It may be that audiences haven’t really heard of your company, but you might make a returnable show (or better yet, shows) that are watched by a particular demographic, or feature a particular theme which your company now has a real expertise in.

This is more granular than just ‘young people’ or ‘women’, so a much narrower niche that has at its heart a sense of belonging or something you opt in to. It might be a hobby - knitting, reading, gardening, outdoor sports, welding. Subject matter - food science, an area of history. Or perhaps it is more ethos or vibe based - interests or values that together create an outlook on life where enough people have this shared sensibility (‘these are my type of people’). The dream scenario is your niche is a) currently poorly served b) not completely tiny c) something that people care about and d) global.

This is where traditional regional or national print publications like the New York Times and the Spectator have excelled in making this transition to an online globalised market. They know their people, and they super-serve them what they know they will like (in the case of the NYT, understanding their audience enabled them to launch enormous properties built around puzzles and cooking).

Or in the last 20 years, where media brands like Vice and SBTV grew from. And where Foot Asylum has been knocking it out the park for the last few years: the shoe retailer has 2.8m subscribers on You Tube, and is on series 5 of their ‘Locked In’ show (influencers locked in a house) - the latest episode had over 1m views in the first 24 hours. Wall of Entertainment mentioned above has produced numerous shows for Foot Asylum, including the hit ‘Does the Shoe Fit’ which has had 161m views on YouTube.

As an aside, identifying youth subcultures is where Channel 4’s Tribes initiative has been hugely helpful. A long-running youth research project, it is focussed on identifying trends as they emerge. It hasn’t been updated in a while, but hopefully will return.

Going back to Mubi, Wall of Entertainment and A24 - these companies identified ‘people like us’ who weren’t being serviced by the mainstream; an identifiable niche that wasn’t minuscule in numbers and also was in enough countries around the world that together created volume.

So if you make shows that hit a particular tribe, then this is where you can create a direct to consumer offering, that isn’t focussed on marketing and support for the shows (although that too) but is about creating something sustainable for your audiences longer term. And then this online offering ends up reinforcing your core TV and film business as you’ve amassed a whole bunch of subscribers and users who you can directly communicate with and tell them about your shows as you already know they are highly likely to be interested in watching them.

I wrote last week about a great case study to illustrate this in practice - Cineverse and how their online horror website, streamer, social channels and podcast network gives them direct access to millions of horror fans across the world. In turn, these superfans have gone to the cinema to watch Cineverse’s film, Terrifier 3, which has now grossed over $50m at the box office. Or another great example is Glitch Productions from a few weeks ago, where there 11m subscribers on YouTube means they have a direct relationship with their fans.

You have a show (or shows) that has strong name recognition

I’ve already mentioned Masterchef - and their website has cooking products such as knives and pans, plus there is a membership offering as well).

Another example is Great British Bake Off. In days of old, this type of production company website and social activity caused jitters inside broadcasters, as programme support was a central part of each broadcaster's rights and responsibilities - so cast information, episode guides, behind the scenes, photo galleries and the like. However as broadcasters’ slim down and focus on driving TV and streaming viewing as well as building social channels, then this perhaps leaves a gap for producers to step into for the shows that have a level of longevity.

Also, as audiences fragment, then it appears that broadcasters and streamers are perhaps less inclined to block talent and production companies’ marketing and online efforts, and instead could be taking a more relaxed approach that any effort to get audiences to watch shows is to be welcomed.

You have talent attached

This is probably the most obvious example where a direct to consumer offering can be created, especially when talent like Jamie Oliver have set such an example of how to build a digital presence via jamieoliver.com, plus all his other activities.

Another interesting example is Reese Witherspoon and her company Hello Sunshine. In 2017, she launched ‘Reese’s Book Club’, which is a global online reading group, where people read a book together each month. This isn’t the first time a celebrity has launched a book club (Oprah obviously set the trend, but more recently Emma Watson had a book club on GoodReads). However, Reese’s approach from the start was closely tied to her production company Hello Sunshine, where the rights of these books were secured for TV and film. In addition, the book club created a live online audience research lab for the company to understand what titles resonate and in which territories. An example is ‘Where the Crawdads Sing’, which went from being a small print run of 28,000 to becoming a best-selling novel and multi-award nominated feature film (and made $144m at box off a $25m budget).

Originally, the book club had a forum on the website, but this has now all moved to Instagram and Facebook (owned and operated forums can be costly for moderation).

While I’m sure many are thinking ‘well I’m not Reese Witherspoon’. However even she targeting a specific demographic that she believed her book club and production company would appeal to.

So, what to do now?

Put (very) simply, there are two common ways to approach launching new online products and services. One way is to do a proper strategic process before doing anything - identifying your audience and their needs, mapping your competitor set, working out gaps in the market, coming up with a proposition, write a business plan and so on. An alternative is to start small, start somewhere, test things out to inform your strategy as it evolves - often called ‘test and learn’.

The former can be more tricky than the latter for TV production companies, as usually everyone is so focussed on development, pitching and production, that there is little time or capacity for this less urgent activity that will reap benefits further down the line. The dream scenario is to have a TV project that you can get off the ground that has a direct to audience element within it - e.g. needing users to sign-up to take part, or some of project happens on YouTube.

However, if that isn’t possible, you instead could use a JFDI approach - initially anyway - to grab your low-hanging fruit. This could involve:

Create a YouTube account

Put a newsletter email sign-up form onto your website

Ensure your website and social accounts all cross promote and link to each other with coherent branding and labelling

Semi-regularly encourage your existing followers to sign up to the newsletter

Ask everyone in the company and wider network to promote these accounts and your newsletter.

Just to give a bit of context why a newsletter sign-up form: email is the most valuable piece of personal data we own, and as a result we don’t hand over our addresses lightly (indeed, I’m very conscious that you’ve entrusted me with your email and so I try each week to publish something I hope will be of interest to you!). People who are signing up to give you their email address are your superfans - those that are already invested in your company and what you are doing. Not only that, they are much more likely to engage with whatever newsletter content you send out in comparison to your social followers. For example, on social, the average click through rate (CTR) - where people see a post and click a link - is less than 1%. For email, it is over 10%.

Not sure on how to do this? If your website is with a company like Squarespace they have a form and data storage available in the content management system, or alternatively there are many other options such as Mailchimp or Jotform. Obviously ensure you check your approach for GDPR compliance.

Once this is in place, you’ll start seeing some email registrations come in, and then can start to think about what you’d like to send them. And to end on a cliffhanger, this will have to wait for a later post.

In the meantime, if you’d like to discuss building direct relationships with your audiences or have a quick query, write in the comments below or do get in touch hello@businessoftv.com. I’m conscious this post is slightly different to the more trend-based content I’ve been writing about, so please tell me if you’d like more or less of it in future.

Netflix is removing most of its interactive TV shows

For many, the promise and thrill of the internet and TV has been less about streaming TV shows on demand to any device (‘TV anywhere’), and more about turning the TV programme itself into an interactive experience.

Going back to the late 1990s, there have always been ‘imagine if’ pitches that cover everything from choose your own adventure narratives to play along games or purchasing items on screen at the click of a button. Early attempts included 1998’s X-Files game (and if you feel inclined here is a three-hour video of someone playing the entire thing), or from 2013 The Walking Dead by TellTale Games which made $40m.

All the while, people wondered how these types of titles could work as a branching narrative experience within a TV set when the technology was further developed. And the technical barriers for this type of interactivity have always been significant as broadcast audiences were fragmented across a myriad of providers - terrestrial then digital aerial, set top boxes, smart TVs, free or paid satellite or cable - as well as a whole range of devices all with different operating systems and standards.

So for a company like Netflix, having a more streamlined and standardised internet-driven technical set up for its audience must have made it simpler to be able to offer interactive TV shows via its apps and browser. Since 2017, they’ve created numerous titles like Black Mirror: Bandersnatch and Boss Baby.

However the Verge has reported that as of December 1st, all but four of the above titles will be removed, and that the company has said it doesn’t intend to build any more interactive titles.

Is this because the technology isn’t there yet to deliver on the promise of interactive storytelling? Or that the cost to develop it stretches beyond what can be justified - it is notable Netflix are investing in cheaper to produce and perhaps more appealing mobile games as well as shutting their AAA games studio. And when in that mindset, is the sit-back passive experience of watching TV and films (even when streamed) simply more appealing to audiences?

TV manufacturers growing their FAST audiences

I’ve previously outlined why tech companies - including consumer appliance manufacturers - are seeing their investment in content as a way to become the operating system of choice for all our lives.

Last week, Variety’s VIP+ (£) reported on the latest FAST (free ad supported TV) subscriber numbers for Samsung, and what this means for the future of streaming.

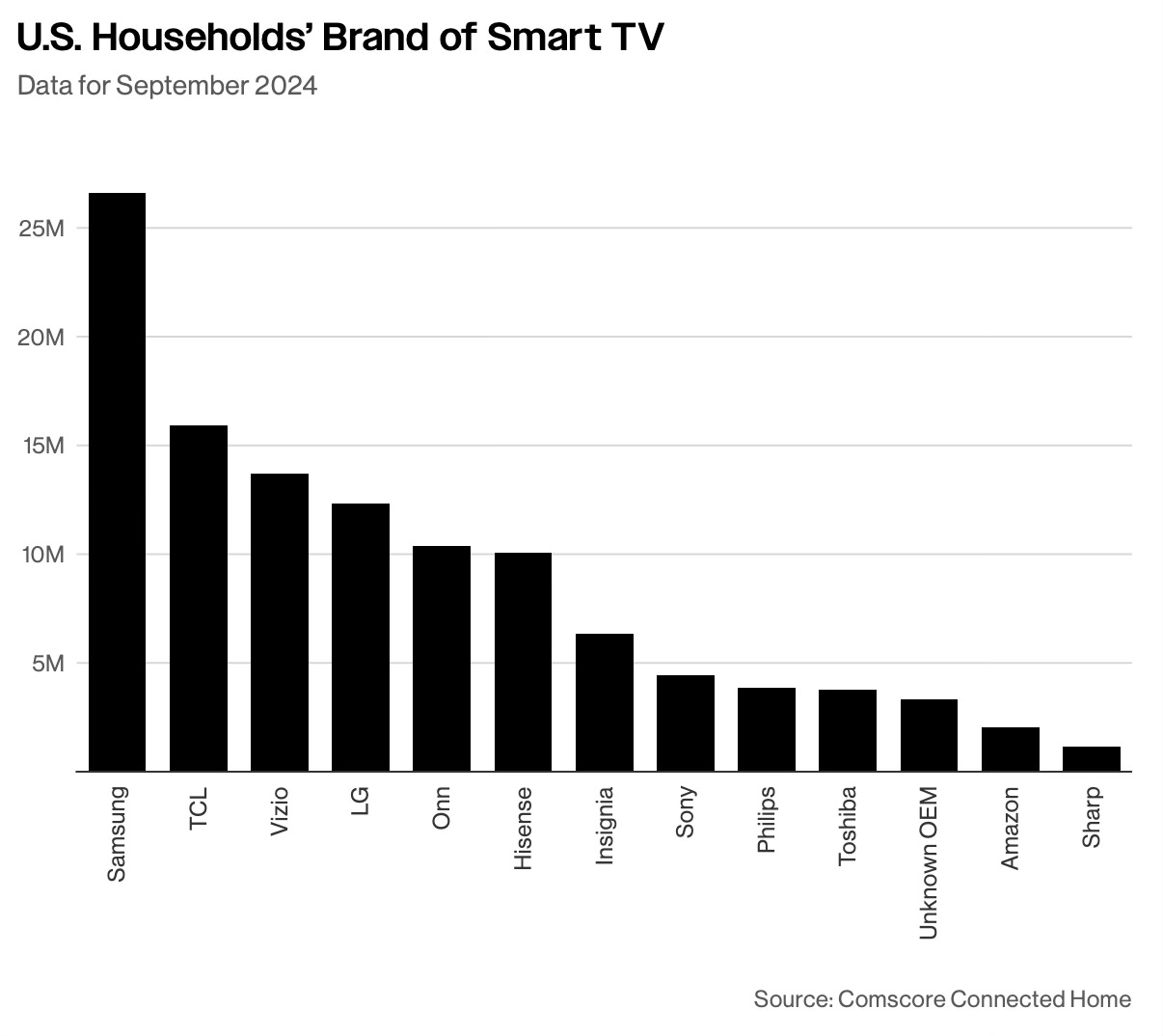

The company has 88m global monthly active users, which puts them within spitting distance of the darling of FAST services, Tubi (88m MAUs). However, as the Variety piece shows via the following graphs, what really counts is the viewing time rather than subscriber numbers (as viewing times equals watching more ads), and here Samsung TV is quite far behind - although nibbling at the heels of Paramount-owned Pluto TV.

In a separate graph, however the potential for Samsung to grow streaming share is clear, as they are the market leader in terms of smart TV ownership. It also demonstrates why LG is investing so heaving in content to grow the streaming content business side of their operation.

The article then goes on to explain the reasoning why we will continue to see a lot of competition in this free streaming ad-funded market over the next few years:

Meanwhile, the factors behind the rise of FAST, including consumers’ subscription fatigue and content discovery frustrations, seem likely to continue fueling the format’s popularity. It may therefore only be a matter of time before Samsung TV Plus is within spitting distance of some of the major SVOD shares of viewing time.

What trends are being missed?

In the most recent TVREV’s hot take article, they asked a bunch of industry experts what one emerging industry trend you’re seeing right now that more people should be paying attention to, and why? Many of the responses are from those in the advertising part of the market, so the needs and opportunities for advertising dominated the answers. However at the end, TVREV’s own take said that “…we think more people should be paying attention to the need to manage the massive amount of fragmentation that will be with us for at least five years.”

They go on to say that because of the volume of services and choice, consumers and advertisers feel overwhelmed, although AI and other tools will help, in their words, “bring order to the chaos.” They end with this recommendation:

Now all we’ve got to do is get everyone [TV networks, studios and producers] rowing in the same direction and realizing that the real enemy is not other media companies but tech giants like Google and Meta for whom TV is still largely a hobby business.

A very profitable hobby business, but a hobby business nonetheless.

Or in other words, up until now TV and streamers have been seeing ourselves in competition with each other, but actually there are bigger beasts coming over the hill.

And finally…

The following was shared on X recently, and was originally posted on a forum 5 years ago - so not exactly new. However, it is worth read if you want some insights into how Netflix approaches A/B testing (where you launch two different versions of something and see which one users prefer):

Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.