Google's strategy for search and how it can make or break IP owners & publishers

Plus an analysis of recent decisions by Warner Bros. Discovery and some data on the impact of Tubi's UK launch.

This week, I’ve focussed on search engines (and Google in particular), as it is an area that doesn’t often feel central to TV and film producers, however it is hugely influential in getting audiences to shows, and will become even more so as producers continue to build direct-to-consumer relationships.

I’ve also included an insightful piece on the strategic decision making by David Zaslav at Warner Bros. Discovery, plus a nugget of data on Tubi in the UK.

Google’s strategy for search and how it impacts IP owners & publishers

Despite being around for over 30 years, the world of search and search advertising - and the huge beast that is Google - may be a little opaque to those working in TV and film production, as marketing is usually handled by those further down the pipeline: broadcasters, platforms, distributors and cinema chains.

However Google (and search) really matters to the TV and entertainment world. Not just because the corporation owns YouTube, it also has around 90% of the search market, so when UK producers are wanting to make their shows famous, or wanting to create a direct to consumer offering, then discoverability via search and YouTube becomes really important. The company also has the largest share of the global digital advertising market (39%); second place is Meta with 18%.

The latest frustration with Google and search is currently the subject of much noise online. It covers three broad areas: 1) new product features that are seen as a threat to smaller IP creators and publishers 2) a general concern about the degradation of the search experience in favour of advertising 3) the use of AI. These concerns aren’t specific to Google - there are similar worries about other search engines like Bing (owned by Microsoft), however I’ve focused on Google as it has the vast majority of the search market.

I’ve touched on the issues with AI, copyright and publishers previously, helpfully summarised in an interview with Justine Roberts CEO of Mumsnet. Instead, it is the first two criticisms above I thought I’d cover in more detail in this post.

The frustration with Google’s approach to search, advertising and product features is not new. Since the company was created 25 years ago, acres have been written about whether and how far it has drifted from its ‘do no evil’ motto (which became ‘do the right thing’ in its corporate restructure in 2015), as their dominance of search and their approaching to running a functioning algorithm gave them enormous power in where traffic is and isn’t directed. In a nutshell, Google is the gateway by which the bulk of users find - or don’t find - your content online.

Simultaneously, Google faces a lot of challenges from people and organisations trying to game their algorithm - bots, spammers, scammers, various regimes and the like. So trying to maintain a functioning algorithm is very difficult.

If you want a summary about the issues some people have with Google search, then this video below is worth your time - it is 17 minutes. Or you can read this post from earlier this year called ‘The men who killed Google’.

In terms of search and advertising, the view from critics is that Google’s founders kept the management of these two activities separate for a good reason (because commercial drivers could risk the independence of search). However in the last five years, Google has merged the two and this closeness risks the veracity of the search results.

These criticisms aren’t new - for example, here is an article from 2013 outlining changes to how search results were displayed - the issue being that people see the trajectory as being one that makes the adverts look like native search results.

Google has been added product features to its search pages for years that in their view are helpful to users: providing information in a standardised layout that users come to expect and rely on. Sort of similar to how portals use to behave in the early days of the internet. However to owners of websites, publishers and the like, it is viewed as being detrimental in getting users to their own websites and instead are keeping people within the Google environment for as long as possible.

As an example, here is a result for ‘Slow Horses’. Aside from the ‘where to watch’ Apple TV logo on the right, there is no natural search result from Apple (or the producers of the show, or the writer of the books) until more than half way down the page, well after the fold.

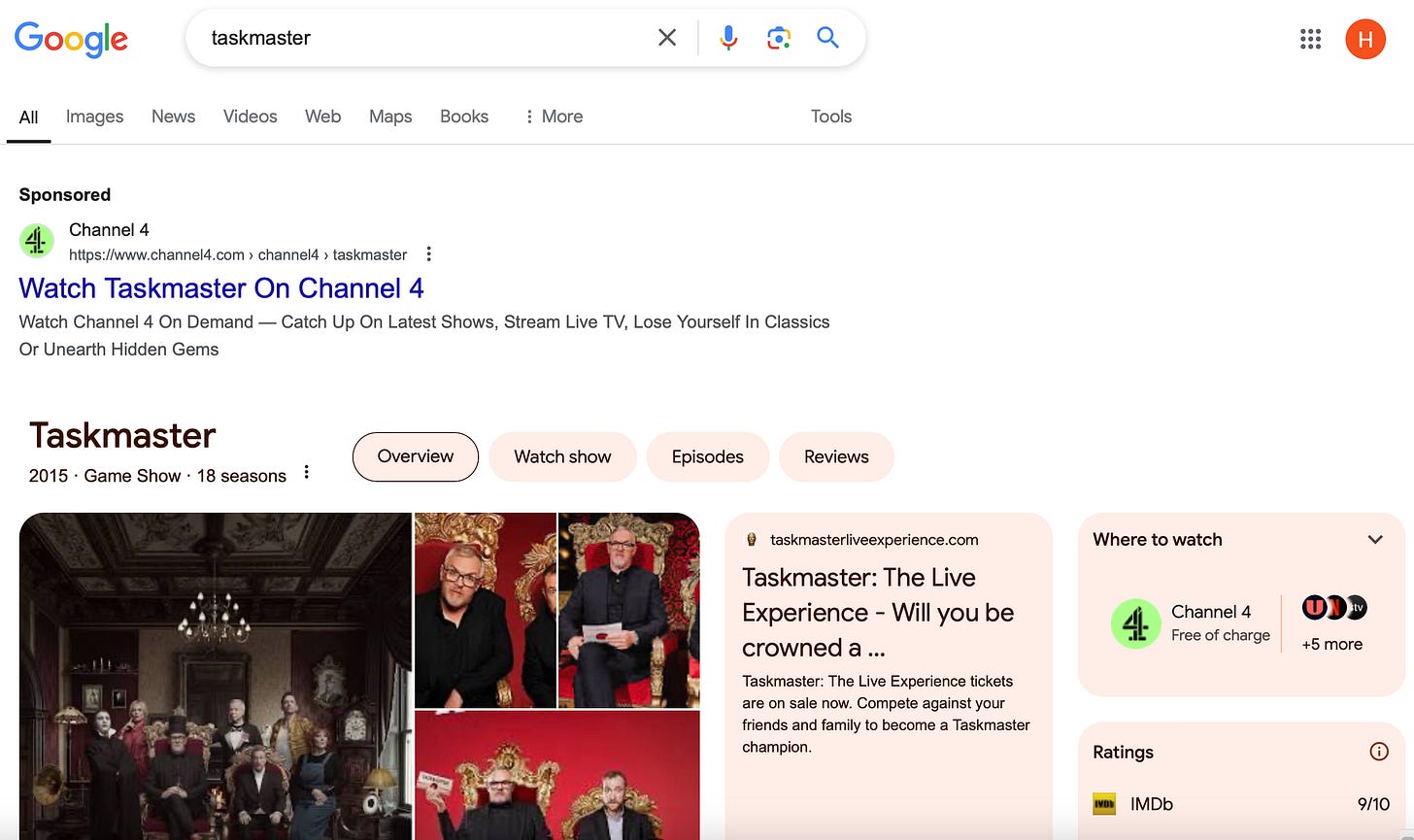

The way round this is to pay for Google ads so your website appears higher in search results. Many choose to take the approach of buying search adverts, as it is viewed as just a marketing cost of doing business. However for others it feels too much like ‘pay to play’, which is especially frustrating if you are the owner of the IP and are struggling to appear in results while third party content or Google’s own information is being prioritised. An example of this is below, where Channel 4 has bought Google Ads for the show Taskmaster, so that it appears above Google’s own knowledge graph information (the block below with images, where to watch links and more).

Recently, a new product feature became public which has caused yet more concern from publishers across the world. Called ‘quick view’, where recipes and their associated comments are shown within the Google search results, meaning users don’t have to visit the publishers’ pages at all - thus significantly effecting the revenues and viability of these websites.

The video above is from Search Engine Roundtable and you can get a flavour of the concerns from bloggers and publishers here.

This is an extension of the Slow Horses example above, where content that used to be housed on a brand’s website - cast, images, series and episode information - now sits within Google.

The added challenge for recipe websites is that users often don’t stay for long on the site, instead they search for a specific recipe, click on the link, cook the recipe then leave. It is tricky to monetise this type of traffic beyond relatively low value display advertising on each recipe page, compared to users who deliberately come to a home page, read multiple articles, watch videos, register their details, post comments and so on. If Google keeps users seeking recipes within the search results rather than directing them to the website of the recipe publisher, then the revenues of these individual websites will dry up.

Google have said: “This is an early-stage experiment that we’re testing with a select number of creators. We have test agreements in place for this initial phase, but don’t have more to share right now.”

For publishers of all sizes, this has prompted many questions. If this test feature is rolled out to all users, will publishers have an option to opt out, if they agree to take part will they be paid by Google, and will this extend to all publishers beyond recipes, so news, sports, entertainment and more. Perhaps a wider question is what does this particular product feature indicate about Google’s vision for the future of search and the internet?

Another bone of contention has been Google’s ‘Helpful Content Update’ - HCU - which was a huge upgrade to their search engine in 2022 which the company said “… aims to better reward content where visitors feel they've had a satisfying experience, while content that doesn't meet a visitor's expectations won't perform as well”. However some website owners complained that in reality this downgraded smaller, independent bloggers and publishers while also promoting forum answers from Reddit, Quora and the like, irrespective of the veracity of the user comments on those platforms. Search Engine Roundtable has this article explaining Google’s rationale and people’s concerns about this approach, and there is also this summary of the HCU update and its impact.

These worries about search, advertising and product features all contribute to the concerns about AI. In simple terms, publishers and IP owners fear that AI produced answers appear within Google’s search results, however the raw information for these answers is data scraped from their websites that are no longer getting traffic.

All this is against the backdrop of the corporation having lost two anti-trust trials and currently waiting on the results of a third trial (with the US government looking at a range of remedies including breaking the company up).

Last thing. Interestingly, Google last week replaced their head of search and ads, Prabhakar Raghavan. You can read more about him in this Wired piece: Prabhakar Raghavan Isn’t CEO of Google—He Just Runs the Place.

More tea leaf sifting on Warner Bros. Discovery

Tracking the goings on at WBD - and trying to predict the next moves - is a popular spectator sport, and last week

wrote a tempered defence of the coporation’s strategy, called ‘David Zaslav: A Cautious Defense’ (£).It is cool-headed analysis of the strategic wisdom of quite a few of the decisions that have been taken by the corporation, especially when the options are so limited considering the state of the market, the turmoil caused by the streaming age, plus how boxed in the company is by the level of debt it is carrying.

In a nutshell, ESG makes the case that with sports, the cable bundle and films (the hiring of James Gunn most notably), WBD have made a series of sensible strategic decisions that aren’t as daft or foot-blowing off as online chatter would have you believe.

On cable TV in the US, as previously noted, it was an established truism for a few years that the floor was around 50m subscribers, however analysts now say there is no floor to the US subscriber numbers. There were 100m subs in 2014 and a forecast of around 30m in 2029. As ESG says: “I love this forecast, because both sides of the “death of TV” argument can make their case.” For streamers, they can say this is a business in terminal decline, for cable nets, 30m subscribers equates to a lot of money still sloshing around. As ESG explains: “Managing an asset declining in value for the cash it still generates is a proven strategy.”

The final area ESG observes that WBD is making smart decisions is in ancillary activities such as live experiences and consumer products, He singles out games as a key area where the corporation has got a strong track record - ‘Hogwarts Legacy’ generated $1bn in revenues in 2023 and there is a follow-up in the pipeline. The importance of diversified incomes streams is increasingly a common theme, and is especially notable when Netflix is succeeding in the streaming business, and is distinctive for being so singular in its focus in comparison to the heavily diversified businesses of its competitors.

Tubi in the UK

A little nugget of data on how Tubi is doing in the UK was released last week, when Kantar published its quarterly Entertainment on Demand (EoD) data on the UK’s streaming market.

Tubi continues to be an important streamer to watch considering it has 81m monthly active users and is the most watched free TV and film streaming service in the US and Canada after YouTube. It launched in the UK in July, and it will be interesting to see what impact it can have considering that unlike the US, the UK has long established free ad supported streaming services from the BBC, Channel 4, ITV and so on. I wrote a longer piece on Tubi here.

The Kantar EoD report showed while the UK launch of Tubi has had limited impact on subscription VOD services, it has stirred up competition for fellow FAST providers (free ad supported TV) like Pluto TV and Freevee.

Plus this week it was announced that Ross Appleton, ITVX’s launch director who oversaw ITV’s streaming business, has been appointed Tubi UK’s general manager.

Odds and ends

Variety: Meta Teams With Blumhouse and Filmmakers Like Casey Affleck to Test Movie Gen AI Tool

Listen to this podcast with Helenor Gilmour, director of strategy at Beano Brain, the agency focussing on generational trends. Helena is a first class expert on kids, their attitudes, hobbies and opinions, and this is about generation Alpha (kids born after 2010) and how they differ from Gen Z.

Scriptwriter Chris Lang has published 50 shooting scripts on his website to help aspiring screenwriters get an idea what a filmed script looks like.

Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.