Netflix and returnables; Private Equity investing in film; using WhatsApp channels to reach audiences

Plus YouTubeTV and Paramount, and the latest about gen AI and copyright.

Hello! Thank you to all of you who voted in the poll last week on whether you’d rather one long email weekly or shorter ones more frequently. Overwhelmingly you said the former, so I’ll be sticking with that.

This week is quite a broad range of bits and pieces that I think you should know about. And one longer section on something I’ve been meaning to cover for a while, which is how WhatsApp channels have the potential to help stretched TV producers build relationships with fans of their shows.

As always, if you think this newsletter is helpful, please do share it with your colleagues.

US Court rules on AI fair use and copyright

A significant moment as the US Federal District Court rules on AI tech companies relying on fair use in training their models on copyrighted material.

The case was brought by Thomson Reuters against a legal research company Ross Intelligence which has since shut down claiming it was due to the cost of litigation. The company had hoped to use the concept of fair use so they could train their AI models on copyrighted works without consent or compensation. And the court has ruled that this is unacceptable.

The judgement will have significant ramifications, and it can be expected that more legal cases and an appeal may follow. Indeed, there also is likely to be flurry of activity in terms of commercial deals around licensing.

Not only did the judge find in Thomson Reuters’ favour, he went on to say that he reconsidered his previous decision that determining fair use should be left to a jury at a trial on Thomson Reuters’ copyright infringement claims against Ross:

“I studied the case materials more closely and realized that my prior summary-judgment ruling had not gone far enough.”

Here are some interest takes on the case:

Reversal in Thomson Reuters Case May Bode Well For Copyright Owners Against AI

Wired: Thomson Reuters Wins First Major AI Copyright Case in the US

Fair Use Fails! First Court Ruling is a game changer for media and GenAI tech

And just yesterday a fresh AI copyright lawsuit has been filed, this time 14 news publishers including Condé Nast, Business Insider, the Guardian, the Atlantic and Forbes suing the generative AI company Cohere, alleging ‘massive, systematic copyright infringement.’ Expect more of these to come.

Speaking of AI and copyright. Baroness Kidron if you remember did a great speech in the House of Lords a few weeks ago outlining the issues around permitting AI companies to train their models on copyrighted content without permission or payment. She has done an interview in the Guardian which is worth reading, and includes the following quote:

The government is suggesting a wholesale transfer of wealth from a hugely successful sector that invests hundreds of millions in the UK to a tech industry that extracts profit that is not assured and will accrue largely to the US and indeed China.

Writer Ewan Morrison made this comment this week:

The non-artists who are pushing for tech acceleration without copyright protections for creatives do not care if the arts sectors they prey on die. Foolish - as ever parasite needs a host. And AI has only grown fat from preying on the arts.

As a demonstration of the tricky dance the UK government is engaged in as they try to protect UK interests while also ride the AI wave, it is worth watching the speech by US Vice President JD Vance at an AI summit in Paris this week. It is 15 minutes long, but clearly demonstrates the divisions in approach between the EU and the US to this new technology.

This is a high stakes game, and if you want to know more about how generative AI is developing especially around copyright and the creative industries, then do subscribe to Charting Gen AI. I have several free subscriptions to give away, so email me at hello@businessoftv.com if you’d like one.

AI as a creative endeavour

An article in Forbes this week - ‘The Best Star Wars Movie In Years Is Made With AI’ - showcases Kavan the Kid’s short film ‘The Ghost’s Apprentice’ which he made using AI tools.

The article is worth a read, if only for this paragraph that succinctly sums up the binary opinions on the creative use of AI:

“This is the end of Hollywood,” one of my students remarked during our call. “No,” I said. “This is the dawn of a new Hollywood.” What a spectacular opportunity for talented and ambitious young people.

Finally, this sentence in Kavan’s description under the film on YouTube stood out for reasons that hopefully are obvious: “I've spent the last two weeks working non-stop, everyday to make this film.”

YouTubeTV and Paramount standoff

YouTubeTV and Paramount have been in game of brinksmanship over the terms of their carriage deal. Overnight they’ve agreed a stay of execution for a few months to keep the channels on the service, however up until that point all of Paramount’s channels include CBS and Comedy Central were due to go dark yesterday.

As a quick reminder, YouTubeTV has 8m subscribers who pay a monthly fee to stream 100+ live channels, access to a catalogue of video on demand shows as well the NFL Sunday night ticket exclusively. This is distinct from YouTube proper, and instead is what is called an vMVPD or ‘virtual multichannel video programming distributor’. In a nutshell, traditional linear cable TV or satellite packages are MVPDs, where you pay a fee for a bundle of channels distributed to you. vMVPDs do the same but are delivered to the customer over the internet rather than via cable or satellite. Other examples of vMVPDs are Sling TV, Fubo TV and Hulu + Live TV.

Back to the Paramount situation. These types of negotiation stalemates often happen in carriage deal negotiations, however this one has greater significance than others.

Firstly, it is another clear demonstration of how Google is seeking to scoop up even more share of TV viewing not just via its main YouTube platform but also via subscription linear TV/VOD services.

Secondly, it also is a great demonstration of what happens when a product or service doesn’t have a competitive advantage. If you look at YouTube proper, Google clearly is miles ahead of any competitor - what in business lingo is called a moat. All aspects of YouTube are now hard if not impossible to replicate, so while market domination isn’t guaranteed, at this stage it is tricky to see how any competitor could launch something that would seriously compete across technical video delivery, advertising, audiences and so on.

In comparison, YouTubeTV is going to toe to toe with all the existing MVPD and vMVPD players. When they first launched back in 2017 for $35 a month, they were competing on price, and also offered unlimited DVR storage and other technical features that gave a level of differentiation.

However since then, YouTubeTV has increased its price by 137% to $82.99 a month, and the last $10 price increase was poorly timed considering the Paramount situation, coming in only four weeks ago. As a result, YouTubeTV is now the most expensive vMVPD in the US:

The service, which launched in 2017 for $35 per month, is now the most expensive virtual MVPD in the U.S., surpassing Hulu Live+, which goes for $75.99 per month; DirecTV, whose streaming platform starts at $74.99 per month; and Sling TV, at $40 monthly.

On top of that, its competitors have also introduced features like unlimited DVR storage, so that is no longer giving YouTubeTV an edge.

While YouTubeTV signed an exclusive seven year $14bn deal for NFL Sunday Ticket games in 2023, there is also an ongoing 10 year long completely separate antitrust lawsuit around how the NFL packages up these rights. Depending on how this case finally plays out, it could have a knock-on to YouTubeTV in the future.

And one last point on sports rights - streaming is upending this too, which is affecting the whole sports market. And as 10 - 15% of pay TV subscribers regularly watch RSNs (regional sports networks), then for them having access to their local team or sport is a core expectation of whatever TV package they sign up to.

And here YouTubeTV has limitations on the sports it offers:

… YouTube TV's RSN coverage is spotty. It includes all NBC Sports RSNs, but it lacks AT&T-owned RSN (except SportsNet NY) and every Bally Sports RSN (previously, these were FOX Sports RSNs). The limited RSN coverage has significant implications for your ability to watch regular-season MLB, NBA, and NHL games.

And if the comments on social are anything to go by, the price hike combined with the loss of channels has gone down badly with users.

Here is one to give a flavour:

YouTube TV is going to end up being a case study of how a beloved brand launched a great streaming service and then slowly ran it into the ground (while also negatively affecting the brand perception of broader YT) with stupid decisions and price increases.

All of this comes just as it is announced that the viewing of YouTube (proper, not YouTubeTV) on television sets now surpasses mobile and desktops in the US.

Hollywood Reporter: Paramount CEOs Say They’re in Standoff With YouTube TV Over Carriage Deal

Variety: YouTube Viewing on TV Now Surpasses Mobile, Desktop in U.S.

Private Equity film deals

Speaking of Paramount, they’ve agreed a co-financing deal with Domain Capital, a private equity investor which in 2022 announced a $700m fund for entertainment and media. This is part of a longer term trend of PE funds exploring opportunities to invest in films and media - if you are interested in some of the players this PDF of a Business Insider piece from 2023 is worth a read (I can’t find the original article on the BI website):

As mentioned in Ampere Analysis’ newsletter, this Domain deal is important because:

With the production market slowdown and the pull back in film order volumes by both streamers and Hollywood majors, the days of the one-stop-shop financing are over, meaning more opportunities are emerging for co-financing with private equity investors.

Domain Capital has already financed Sonic the Hedgehog 3 with Paramount, and they also signed a deal with WB Motion Picture Group in 2023 which resulted in Barbie.

The rise of PE money in TV, film and digital content will be a big theme over the coming years, so is area to keep a close eye on and look for opportunities.

Variety: Paramount Pictures Enters Major Slate Financing Deal With Domain Capital Group

Private equity investment in movies, entertainment plunges to 6-year low in 2023

Screen Daily: How a European fund is investing Nordic private equity in the indie film sector.

Netflix and building audiences for returning shows

An interesting point this week from Kasey Moore who runs What’s On Netflix:

Netflix is really struggling to grow its audiences on returning shows. Bridgerton was the only one up season over season (13%) ... The Umbrella Academy - down 36% The Diplomat - down 37% That 90s Show - down 79%.

Various people responded to Kasey’s post making roughly the same observation - that the delay between series combined with an audience reticence to invest the time in case a show gets cancelled. As this user summarised:

There's way too long a gap between seasons imo. Shows like Diplomat require continuity given its genre & if you're going to take forever, the barrier to the next season is higher. And of course, the chicken egg situation. Not wanting to invest in case it gets cancelled too soon.

And this quote from a Forbes article about why season 2 of The Diplomat was cut from eight to six episodes stood out, and reflects this ongoing audience desire for longer run and more regular shows:

This also represents just how weird TV has gotten, where turning around eight episodes of a show in over a year that does not need some kind of elaborate VFX work still barely seems possible for these showrunners. Bridgerton’s creator has also said at minimum, they can really only do every two years. Times have certainly changed from 22 episode seasons ever year in the broadcast era, and it does not seem like we’re ever going back.

What’s on Netflix: Only One Returning Netflix Show in 2024 Grew It Audience.

So if online chatter is anything to go by, audiences do continue to appear dissatisfied with the significant gaps between series and how short series are compared to the 22 episode runs of old. There certainly seems to be a lot of nostalgia for the old ways, and also for solidly reliable series as well as sitcoms and procedurals. When you add in the trend for eyewatering budgets for certain titles across both and scripted and unscripted compared with even just a few years ago, and the rumours around the number of scripted titles greenlit by broadcasters but unable to stack up the remaining finance and get into production…. well, perhaps a shift could be coming in this area?

Whatsapp channels to reach your audiences

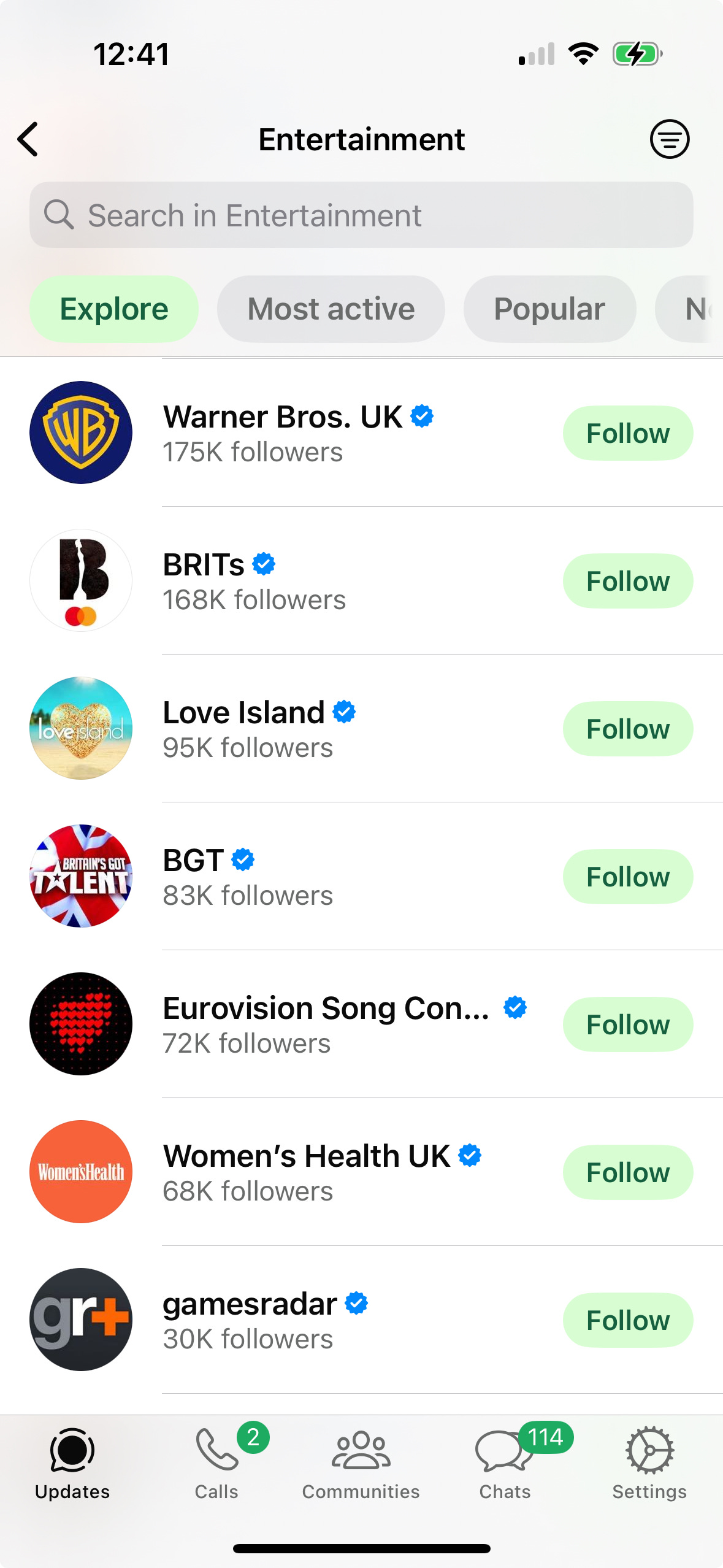

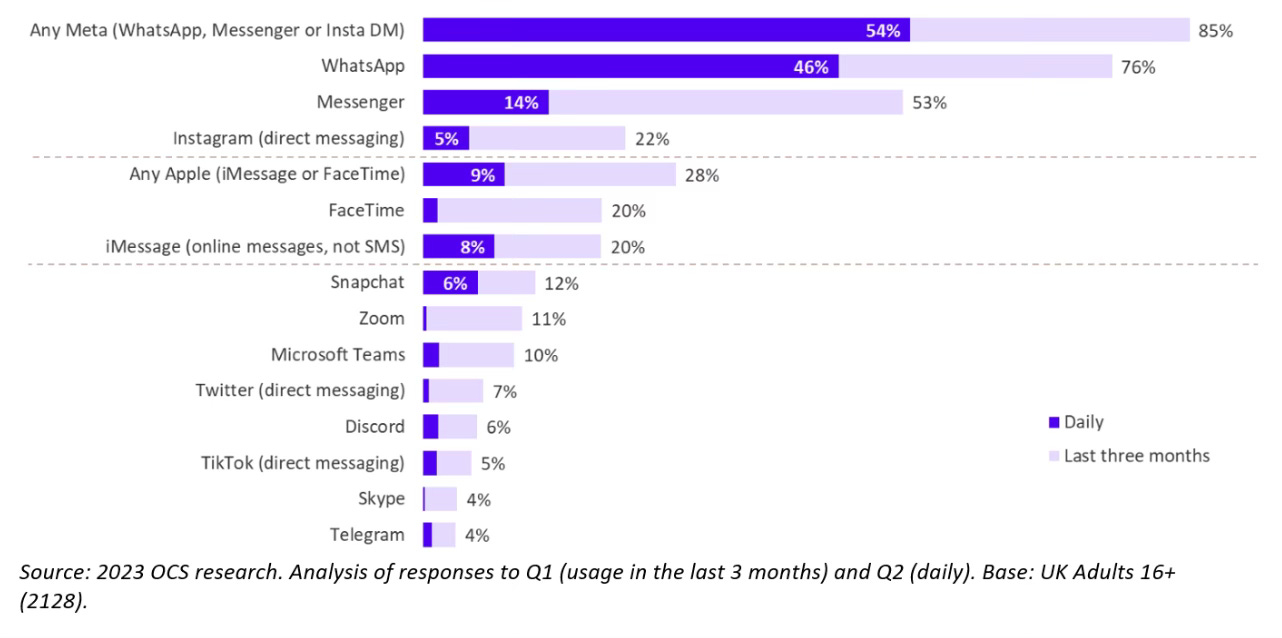

Quietly, a new marketing channel has been emerging inside your phone - the enormous growth in WhatsApp channels run by brands. These channels are a way of the owners sharing text, images and other interactive content (such as polls, video or gifs) with their followers.

If you click on the ‘updates’ tab within the app, and then hit the word ‘explore’ you can see the hundreds of brands running channels direct to their audiences around the world. Top is WhatsApp itself with 221m followers, second is Real Madrid with 60m. Sports clubs dominate, however Netflix is fourth with 33m. Shakira is the first individual talent with 15m. The biggest news brands are the New York Times with 12m and BBC News with 10m. Sony Pictures is the largest of the legacy media companies with 3.4m. It isn’t just big established brands - online internet culture brand ‘Know Your Meme’ has 1.1m followers.

The breadth and volume of channels is quite something. From local councils to the World Economic Forum, online publishers like LADBible (778k followers) to the Met Police, creators to podcasters, TV (Britain’s Got Talent with 83k) to studios (Warner Bros UK - 176k followers), UNICEF (8m) to the Met Office (146k).

WhatsApp channels have been a real boon for newspapers - not only have the masthead brands got channels, many of the publishers have multiple sub brands specifically for people interested in quite narrow subjects, often which are bigger than the parent newspaper brands. For example, the fourth biggest News channel is the Daily Mail - Kardashians channel with 1.6m followers. Similarly, The Sun’s Cristiano Ronaldo channel has 814k followers, while The Sun’s main channel has 80k.

The upsides of WhatsApp channels as a way of building a direct relationship with audiences includes:

It is the world’s most popular messenger tool, and a significant number of which use it every day. So by using it to communicate with your audience, you aren’t in a ‘if we build it they will come’ scenario - you are joining the place where your audience already is likely to be present and active.

Secondly, it is easy to use - it is as simple as sending a message to a friend. Yes of course you have to work out what that message is, however if it is just ‘watch this show’ with a link, well, that is not exactly rocket science.

It is a one way broadcast tool, not a conversation. Anyone can set up a channel - indeed, I just did to test the process - sign up here. While I can send messages out, you can’t respond beyond an emoji. And even then, I can either turn emojis off entirely, or limit what emojis you can choose to a default safe set - so no aubergines or water pistols.

This last point makes WhatsApp channels hugely compelling for a range of companies and brands. For many organisations, the overhead and risk around running online communities is a very real headache. Not only the costs and operational effort involved in moderation, but also how online communities can be prone to becoming unmanageable due to disagreements or battles within the members or between the membership and the admin of the community. In 2020 BBC Radio 4 had an interesting series on this phenomena called ‘Purity Spirals’. Having managed online communities since the late 90s, I believe it is wise and reasonable for brands to tread carefully in this area.

So the upside of WhatsApp channels is they create a mechanism to directly reach your audience, but doesn’t come with the significant responsibility of managing a full, live, online community.

Also, worth being aware the app that we experience here in the UK is much more lightweight than people have in other countries. In India, Brazil and Singapore, they have ‘WhatsApp payments’ where you can transfer money between friends and family as well as pay businesses registered with WhatsApp. In these countries, WhatsApp acts more like an ‘everything app’ - the concept of a single app that fulfils many of a user’s daily needs. In these countries it is a full online marketplace and eCommerce offering including payments, customer support and marketing, as well as the messaging functionality we have. This LinkedIn post here explains the difference: ‘The WhatsApp India Story: Revolutionizing Communication, Society, and Economy’.

Why is this important to producers and production companies?

Well, as written about previously, having a relationship with people who love your shows is crucial way to build value in your company. Broadcasters and streamers see companies with a direct relationship with their superfans on whatever platform - social, YouTube, email, and yes, WhatsApp - as an additional marketing channel. It also can act as validation for an idea going to green light (‘see, these people like it’). And separately, it creates an opportunity for producers to test their ideas, marketing their shows, and also potentially generate revenues via advertising, subscriptions or products in the future, especially when the functionality available in India, Brazil and Singapore is rolled out to other territories.

Indeed, some producers have already cottoned on to the benefits of WhatsApp channels - I’ve been at two TV screenings recently where a QR code was shown at the end linking to a WhatsApp channel as the call to action.

Press Gazette: Whatsapp Channels one year on: Top news publishers ranked

Strategies news publishers use on WhatsApp Channels for audience engagement

Tubi and the Super Bowl

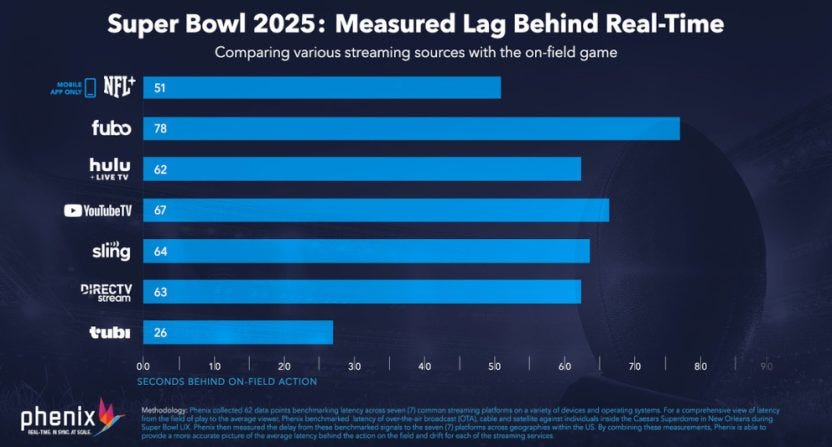

Fox appear pleased with how things went across their portfolio for the Super Bowl last weekend, and specifically around the performance of Tubi. It was the most streamed Super Bowl ever, reached 24m unique views with a peak of 15.5m concurrent users - which is much higher than the projected numbers of 8.5m.

It also performed well technically. There was some low level social chatter about the streaming stuttering, however nothing like the technical issues of the Paul vs Tyson fight on Netflix which had a peak of 65m concurrent streams at its peak.

The service also did well in terms of lag-time - the gap between the actual live event and when the viewer by platform is delivered the content. This is one area where broadcast TV has always been superior to online streaming.

Variety article on Cable TV

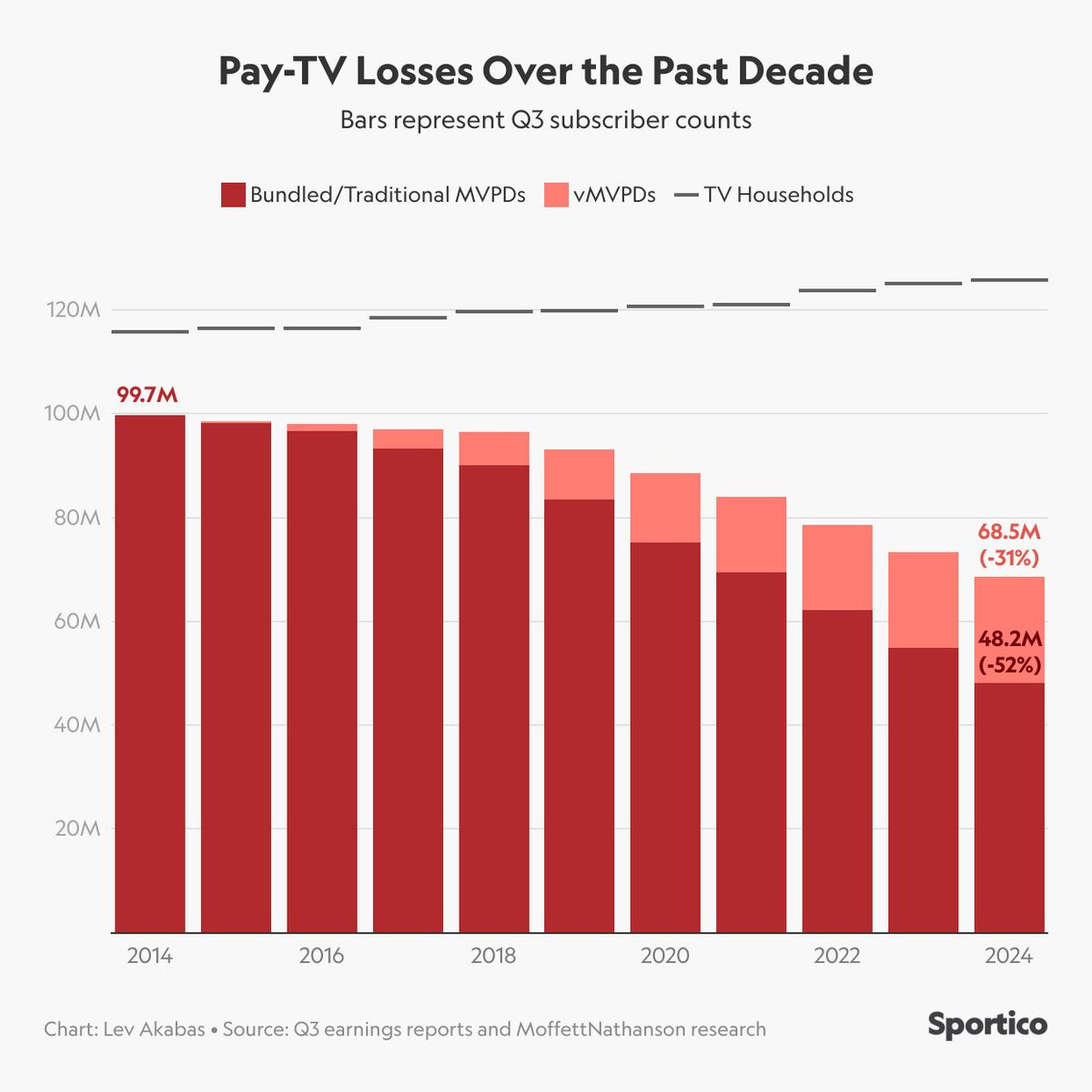

You might have noticed a Variety piece this week called Inside the Cable TV Hospice: Can NBCUniversal’s Divorce From MSNBC, Syfy, E! and More Prolong the Life of Once-Popular Channels?

It is an interesting trawl around the various cable companies in the US and their strategies for managing the declining audiences of these still profitable operations. However, there is one paragraph in the Variety piece that triggered some attention online:

In the U.S., cable and satellite service subscriptions peaked at roughly 100 million households in 2010. That amounted to a penetration rate of 90% of all TV homes in the country. Today that number stands at 85 million, which accounts for about 65% of available households.

It was noted that the numbers are actually much more pronounced than that. According to MoffettNathanson (the main source on pay TV subscriber numbers in the US), they are around 68.5m, which is around 52% of households.

And yet, as demonstrated last week by Disney’s financials, the linear channels despite declining still provide a healthy profit, while streaming generates more revenue with slim pickings on the profit front (thus far).

Listen of the week

Inside Content features Dean Possenniskie, MD of Hearst Networks EMEA, where they discuss how Hearst has evolved its pay TV business.

Find out more about me and the purpose of this newsletter, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.