OpenAI’s video generation tool went live this week to much fanfare, however here in the UK (and the European Economic Area), we are geoblocked from using it. As well as Sora, I’ve also included details on a great new report on Netflix and the kids streaming market, plus some food for thought about membership and subscriptions for audiences.

Follow @businessoftv on Twitter/X or on BlueSky, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

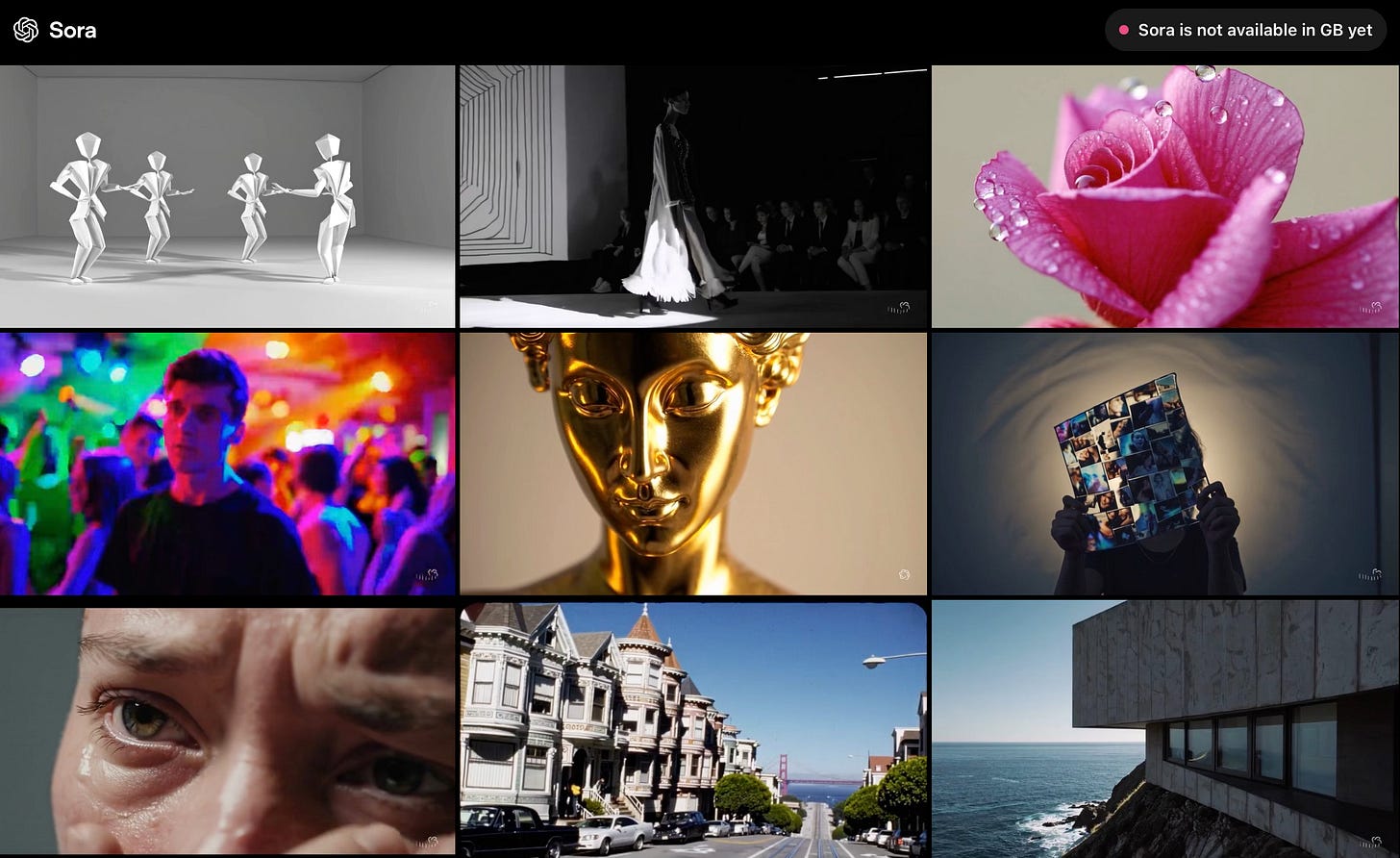

Sora launches, although not in the UK or the EEA

After last week’s demo at Content London, Sora snuck out the door this week to much excitement as well as mixed reviews on its readiness and capabilities. The insightful review below (thanks to

for the recommendation) shows the limitations as well as the capabilities for it as a tool. As has been repeatedly said, this is the worst it will ever be - future releases will be constantly improving.However, for those of us in the UK and the EEA, we’ll have had to wait for it to become available here. The geoblocking of the tool has triggered numerous questions about why it has not been made available in these territories (here is a list of the countries which can access it).

There has been speculation that the hold up could be down to data privacy or GDPR issues, or potentially due to copyright questions about the material that Sora has been trained on. So while there has been some focus on the issue of who owns the material that is produced out of platforms like Sora, the other big concern is the ownership of the materials that the tools have been trained on. In other words, who owns the inputs as well as the outputs.

The above YouTube review shows that Sora won’t produce videos with brands, logos, recognisable individuals or other restricted parameters, and OpenAI has said that Sora is based on the following source materials:

Select publicly available data, mostly collected from industry-standard machine learning datasets and web crawls.

Proprietary data from data partnerships. We form partnerships to access non-publicly available data. For example, we partnered with Shutterstock Pond5 on building and delivering AI-generated images. We also partner to commission and create datasets fit for our needs.

Human data: Feedback from AI trainers, red teamers, and employees.

A very human example for why this matters. This Slate article Ghost in the Machine explains how the author stumbled over an AI generated photo of ‘veterans’ that featured her father, who had been dead for 14 years, wasn’t a veteran, and also was an abuser. As the author wrote when wondering what to do about her father’s image being used by AI to create memes:

… I’m pretty sure that’s not enough evidence to sue anyone, if there even is anyone to sue. Is there anyone to sue? To whom should I address the cease and desist?

There is a view that all these AI tools should have an opt in for IP owners, rather than an opt out - which is what some tech companies would prefer. In other words, all copyright holders would have to give specific permission for each tool to use their IP to train their model, rather than these tools scraping content from the internet by default without seeking permission first. While for larger IP owners it might be somewhat easier to manage an opt out with each AI company, for smaller creators especially independent TV producers, it would be exceptionally difficult. As reported in this article from October: ‘An existential threat’: anger over UK government plans to allow AI firms to scrape content:

Apart from issues around ownership, some publishers fear an opt-out system would be impractical as they may not know when their material is being scraped – and by which company. Smaller publishers say they face an “existential threat” should their work be used in training AI models. They argue that an “opt-in” system would give them more leverage to at least agree licensing terms, similar to those already signed by bigger players for AI access to their material.

As the article reports, the BBC has already joined other organisations including Mumsnet, News Media Association and Independent Publishers Alliance, in arguing for an opt in model.

For producers, broadcasters and networks, it is tricky to imagine that any of this AI content could be broadcast or published, unless there are clear guarantees from the owners of the AI tools that no unlicensed copyrighted material has been used as the source material. Otherwise, the headache is that material that is produced via an AI video generation tool is used within a programme, which then could see legal action from a rights holder who claims the content was produced by an AI model being trained on their original material.

This is a watch this space situation, and also perhaps one where discussions between broadcasters, producers and industry bodies across the creative industries are crucially important.

Graham Lovelace has written much more about this issue in this week’s

and it is well worth a read:Subscription membership clubs

Offering meaningful, worthwhile memberships to audiences is a great way for content creators, production companies, talent and IP owners to build further connections with people, plus also obviously can provide an additional revenue stream.

Previously I’ve mentioned A24 and Mubi’s membership offerings in this piece below:

As part of an ambition to continue providing you with inspiration, here are a few more examples.

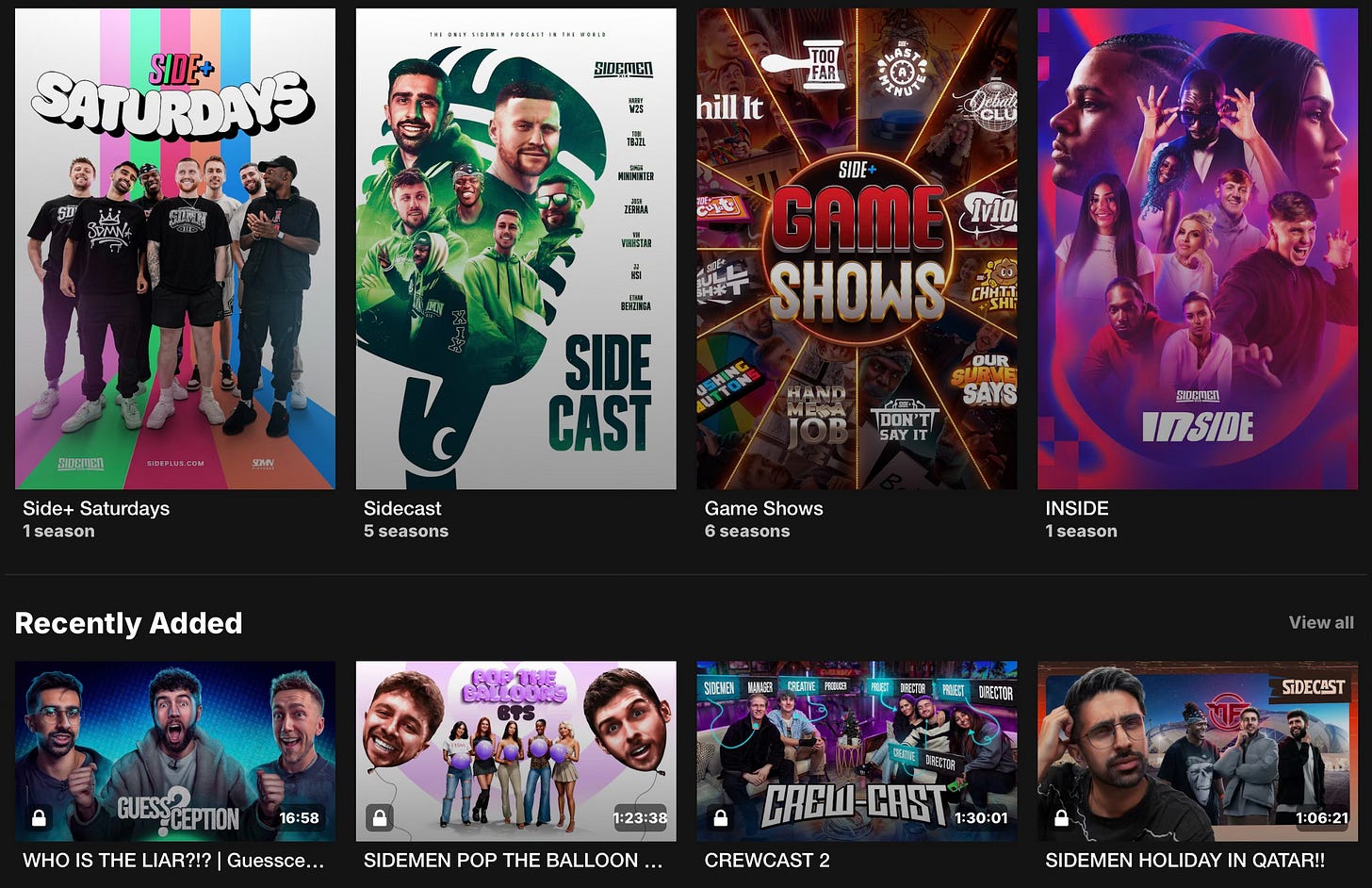

SidePlus - a membership club from The Sidemen

Side+ is a monthly (£6.99) or yearly (£69.99) membership offering, which includes exclusive shows; Sidecast - a weekly podcast; behind the scenes; prize giveaways such as win a Nintendo Switch or an iPad; fan dinners; monthly zoom calls; and the opportunity to take part in their shows. It also includes access to their Discord channel.

From browsing various places where Sidemen fans discuss the pros and cons of Side+, it is clear that they see ongoing value in paying a membership, especially because of the exclusive podcast and behind the scenes.

Amplify Pictures

Fleabag producer Joe Lewis’ company Amplify Pictures has what in the future might be considered a business-as-usual offering on its website, but currently is fairly unusual.

They have AP++, where (free) subscribers get the latest behinds the scenes news, secret merch drops and more* (and the asterisk after more explains that is a free sticker). This is a great example for how even newer or smaller producers can start gathering audience registrations to build something in the future.

The website also has a bunch of Amplify Pictures merch for sale, plus a rather lovely link to a Google doc of recommended books about the film and TV industry.

The Rest is History Club

Much has been written about the juggernaut that is the Rest is History. And from a creative perspective, it is worth listening to the first episode to see how far the hosts and format have come in the four years it has been in existence.

The Rest is History Club has two tiers: the basic membership for £6 a month or £60 a year which includes ad-free listening, weekly bonus episodes, and access to a Discord channel. The second tier (Athelstan level) is £25 per month or £200 per year, which gets you invitations to Rest is History parties plus a quarterly zoom quiz with the hosts.

The Rest is History’s revenue split is quite well known: the two hosts and Goalhanger Podcasts divide the income three ways. This simple approach is very clever for this particular podcast, as its success depends so heavily on the hosts’ skill and diligence in doing thorough research on subjects which aren’t always their history specialisms. By doing a three way split, it ensures that all parties are incentivised to work as hard as possible to make the output as good as it can be, as they all equally benefit.

An alternative model (some sort of host fee and a lower share of net perhaps?) could have curtailed the success of this podcast from the start, as the hosts wouldn’t have been as invested in it, plus potentially could have encouraged clock-watching on how much research was needed for each episode.

Ten Club

There are tonnes of great examples of musicians and bands offering memberships to their fans. To pick just one, Ten Club by Pearl Jam was started in 1990, and for $35 a year gives priority access to tickets, exclusive video and lower merchandising prices.

This Reddit thread is worth a read to see how fans view Ten Club in terms of value for money - there are people there who have been members for 26 years which is extraordinary. However there is a sense from these fans that the offering was better in the past. It may be nostalgia talking, but the way in which these fans felt that they genuinely were part of an exclusive club does offer inspiration for those wondering how to create a membership offering now.

The appeal of memberships

Paid memberships act as a marketing mechanism to promote the breadth of activities to those most passionate about a brand - tours, new shows, merch, books, meet and greets and the like. For podcasts and YouTube channels, as well as diversifying and increasing revenue, they also help to reduce how much money has to be shared with third parties such as Apple, YouTube and the like.

A bit of background about how advertising works for podcasts and YouTube channels: There are various advertising networks for podcasts with enough listens to run adverts, and usually they work on a revenue sharing model. As an example, Spotify Partner Programme takes 50% of advertising income. And as previously outlined, YouTube takes 45% of video advertising revenue. In contrast, Apple Podcast Subscriptions takes 30% in year one, dropping to 15% (plus taxes) when a user has been subscribing for more than a year. Supportingcast.fm (who host the Rest is History Club, although you can subscribe via Apple as well) take 10% of subscription income.

The CPMs (cost per mille, or the price paid by an advertiser per 1,000 views) varies depending on the type of content and size of audience you have. So for big beasts, then there will be a premium on advertising on these channels. In addition to pre/mid/post roll audio or video adverts, there are also host sponsor reads for individual podcasts - which can be booked via various networks such as Acast. Again, how much these cost an advertiser depends on the number of listens, demographics of the target audience and the like. To give a sense of what these generate, for a big high profile podcast with 300,000 listens a week, then a sponsor host read would cost say £17,000 per week, based on CPMs of roughly £40 - £50.

For any service reliant on advertising income, sell through rates are another important factor. When the most recent incarnation of the podcast revolution took off in 2019(ish), there were lots of listeners, not that many podcasts, and so the volume of advertising inventory was relatively low compared to the demand. As a result many ad slots were filled, which is called having a high sell through rate. As the market has been saturated with podcasts, there are now many more ad slots than necessarily advertisers wanting to buy the slots. As a result, ad slots can go unfilled - sometimes as low as only 25% of a podcast’s available slots have ads, although this does fluctuate. So you can see that while you might have a successful podcast, this doesn’t necessarily automatically translate to a high sell through rate and therefore income.

This context demonstrates the appeal of paid membership programmes for marketing as well as revenue streams unaffected by the vagaries of the ad market.

Insights into the kids TV and streaming market

(ex of Disney) has launched a brand new report to help increase the transparency and understanding of the kids content market. Called the Netflix Kids Content Performance Report, it is a deep dive into what works in the kids market based on Netflix’s six monthly data drop. Over time, this will build into an important resource for anyone seeking to understand the kids content market including brands, producers, broadcasters and streamers, toy manufacturers and IP owners.If you’d like to purchase a copy of her Netflix Kids Content Report, you can do so here.

To get a flavour, the LA Times has this article: ‘How YouTube and Netflix are changing the business of kids’ shows’.

Emily also has a Substack called

which is very much worth subscribing to if you are seeking to understand the kids market, plus the Kids Media Club podcast along with Jo Redfern and Andy Williams (recent guests include ).Podcast of the week: In celebration of know-it-alls

This week’s Martini Shot from

is a fun (and quick - only 11 minutes) celebration of the benefits of optimism and being a know it all in our current state of television turbulence. And how hard it is to admit none of us know where we are going and where a new business model (or models) for TV will emerge from.As Rob says at the end:

William Goldman’s old saying about Hollywood is “Nobody Knows Anything,” but maybe we should add “And they’ll never admit it.” And that is, probably, a good thing. Know-it-alls are optimists and show business needs optimists, so let’s set them all loose. Only a fool would greenlight a project — any project — but what purpose does it serve to remind them that the business is in trouble and the failure rate is high and the customer is doing other things?

Other odds and ends

Variety: Warner Bros. Discovery Restructures in Seeming Bid to Fuel Future Deals

Semafor: Murdoch and Fox in the market to buy podcast networks

Forbes: BuzzFeed Sells ‘Hot Ones’ Studio For $82.5 Million To Investors Including Soros Fund, Host Sean Evans and Pod Save America parent company Crooked Media

The Industry: The Sundance 2025 lineup

Om Malik’s Crazy Stupid Tech Newsletter: Will AI eat the browser?

Nielsen’s The Gauge for November: Streaming nabbed its largest share of TV with 41.6% of viewing time

Follow @businessoftv on Twitter/X or on BlueSky, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

Great post Jen. Thanks for the post link!