'Netflix can't do everything' - the future of scripted and serious factual

Plus streamers turning to procedurals, A24's business model, and C4's new online drama

Hello! This week I’ve covered the future of the UK’s scripted sector plus journalistic documentaries; how streamers are turning to procedurals; an interesting read on A24’s business model; Channel 4’s foray into digital drama, plus the a little graphic on the state of TV in South Korea.

As always, send feedback - especially if there are particular things to want to know more about - at hello@businessoftv.com.

If this is your first time reading, please do subscribe, you’ll be joining over 1,300 other TV, film and online content professionals from across the world.

—

Before getting going, another little reminder to get your ticket to Create London on April 30th; a new one day event from C21 to bring together everyone across the full range of the creator economy - TV/film producers, creators, online platforms, brands, partners and AI tech.

Join the Evolution of the Creator Economy at C21’s Create London Festival

C21’s Create London Festival is a one-day event on April 30, celebrating the creator economy and bringing together creators, TV/film producers, digital platforms, commercial partners, commissioning brands, and AI technologies.

Be part of the creator economy’s next chapter - secure your place today HERE!

Exclusive Offer: Business of TV subscribers receive 20% off the current ticket price with code VIP20 at checkout.

—

‘Netflix Can't Do Everything’ - the future of scripted and factual

Jane Featherstone last week sounded major alarm bells for the future of the UK’s scripted TV production sector. She was speaking at a DCMS committee looking into the UK TV market, and said:

“Costs below the line have gone up around 40% and below the line is everybody. That is the production costs. So that doesn’t include cast, writers, producers; and those costs are called above the line. They’ve gone up even more, probably 50 to 60%. So we’re at a place now where budgets have become so high that that’s priced the public service broadcasters pretty much out of the market.”

Hearing such stark public words from a highly accomplished producer is important; however for anyone in scripted they’ve long been aware of tales of series ostensibly being greenlit by UK broadcasters and then struggling to find the rest of the finance needed to get into production. As Jane bluntly said: “Because a green light is not a green light. It’s ‘Here’s 30% of the budget.’”

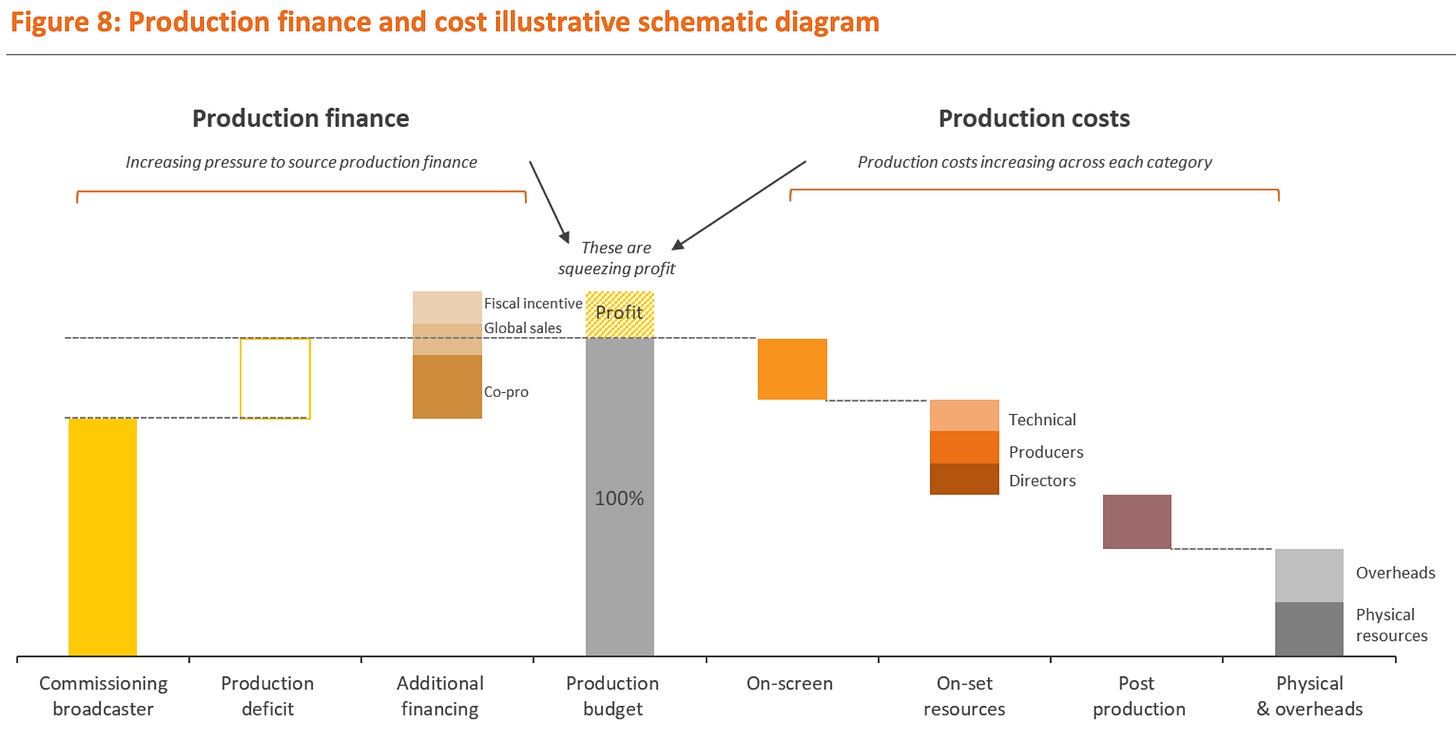

Looking at this helpful visual below from the Ofcom 2023 report ‘Understanding the UK’s TV Production Sector’; what Jane is describing is increasing downward pressure on these production budgets which were already requiring deficit financing when this diagram was draw up several years ago. So all of the costs on the right are going up, and the sources of production finance on the left are either at best static or at worst going down. That production deficit delta has become even larger, to the point that in some cases the different can’t be made up by global sales or other alternative sources of finance.

Jane said to the committee “Netflix can’t do everything” - and while she was talking about scripted in particular, I thought it worth pointing out the other large elephant in the room - and that is about the future of factual TV that is journalistic in nature.

There is a long and distinctive tradition of factual TV in the UK. On a spectrum between news at one end and factual entertainment formats at the other, there is a huge bunch of factual output in between that widely ranges in tone, format and subject matter, but all share common threads of holding power to account, informing and educating the audience, or unearthing stories that should be widely known. To give a sense of the type of programmes I’m referring to, here are a handful of titles:

The Dying Rooms about the neglect of abandoned babies in Chinese state-run orphanages

The Death of Yugoslavia documenting the decline of the Soviet Union and at the time recent war (the interviews were subsequently used in war crime prosecutions)

The Boy Whose Skin Fell Off - the moving observational documentary about Jonny Kennedy who was born with the genetic condition EB

The Big Fish Fight - Hugh Fearnley Whittingstall campaign to get law changed on rules around fish catchments in EU waters

For Sama was nominated for an Oscar and told the story of doctors and a hospital in the siege of Aleppo.

All of the above are public service broadcaster commissioned or financed titles, and the BBC, Channel 4 and ITV have a long track record of commissioning and funding feature documentaries and factual TV that has changed the world, altered public perceptions and shone a light on something that was previously hidden.

And for all the appeal of the streamers, in general they are not in the market for commissioning these types of films or programmes (although they might acquire them at some point).

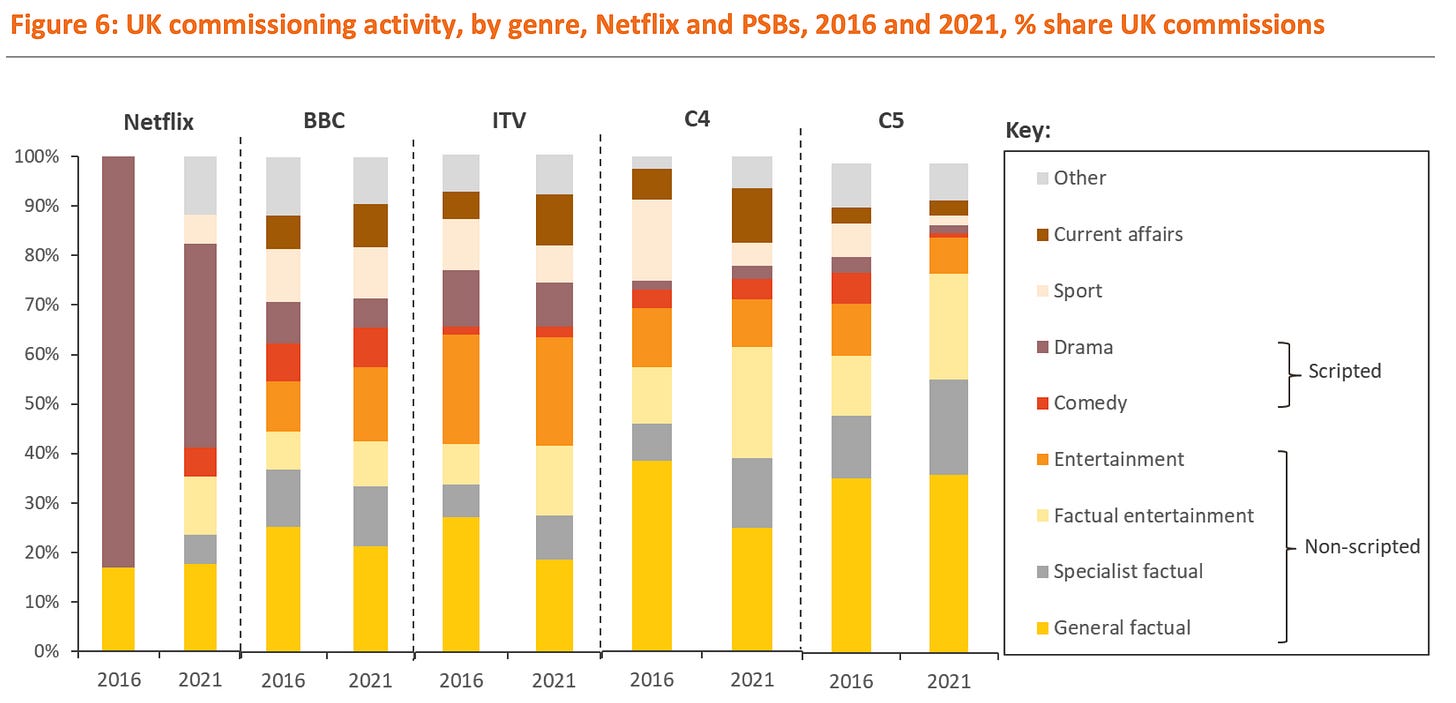

The 2023 Ofcom report above included this diagram which shows that in 2021, around 18% of Netflix’s UK commissions were general factual, while all the PSB channels had the same or significantly higher percentages off factual, plus specialist factual as well as current affairs.

And it is important to recognise that for streamers, ‘general factual’ is much more likely to mean shows that tell entertaining or thrilling real stories, rather than programmes that are journalistic or are about holding power to account. This Hollywood Reporter article from 2024 explains how Netflix isn’t interested in breaking news, and it has the following quote:

“The entertainment platforms are not interested in news,” an anonymous agent told CNN. “Their audiences don’t want it and it can be polarizing. It’s just not worth it for them.”

And while these journalistic or current affairs factual programmes aren’t in the news genre, they are more likely to be viewed in a similar vein by the various streamers. As the quote above suggests, they are entertainment platforms without the same history or legal remit as the UK’s public service broadcasters.

That doesn’t mean they couldn’t commission these types of shows, but it isn’t hard to understand for a pure play entertainment company why they have limited appeal: not only there are legal and compliance risks with the type of journalistic factual programming, they are also far less likely to have global appeal, as is well known amongst programme makers with current affairs titles hoping for international distribution. This is reflected in Jane Featherstone’s point about the scripted series Mr Bates vs the Post Office, which smashed it in the UK but struggled to travel further afield.

Knowing that the streamers are not really in the market for commissioning these types of important documentaries and factual programmes, Jane’s comments about Netflix not being able to do everything is being echoed by many factual producers and documentary makers. There are genuine concerns out there amongst producers about the pressure the PSBs are under and what knock on effects this could have for these types of shows now and into the future.

The state of the UK’s production sector

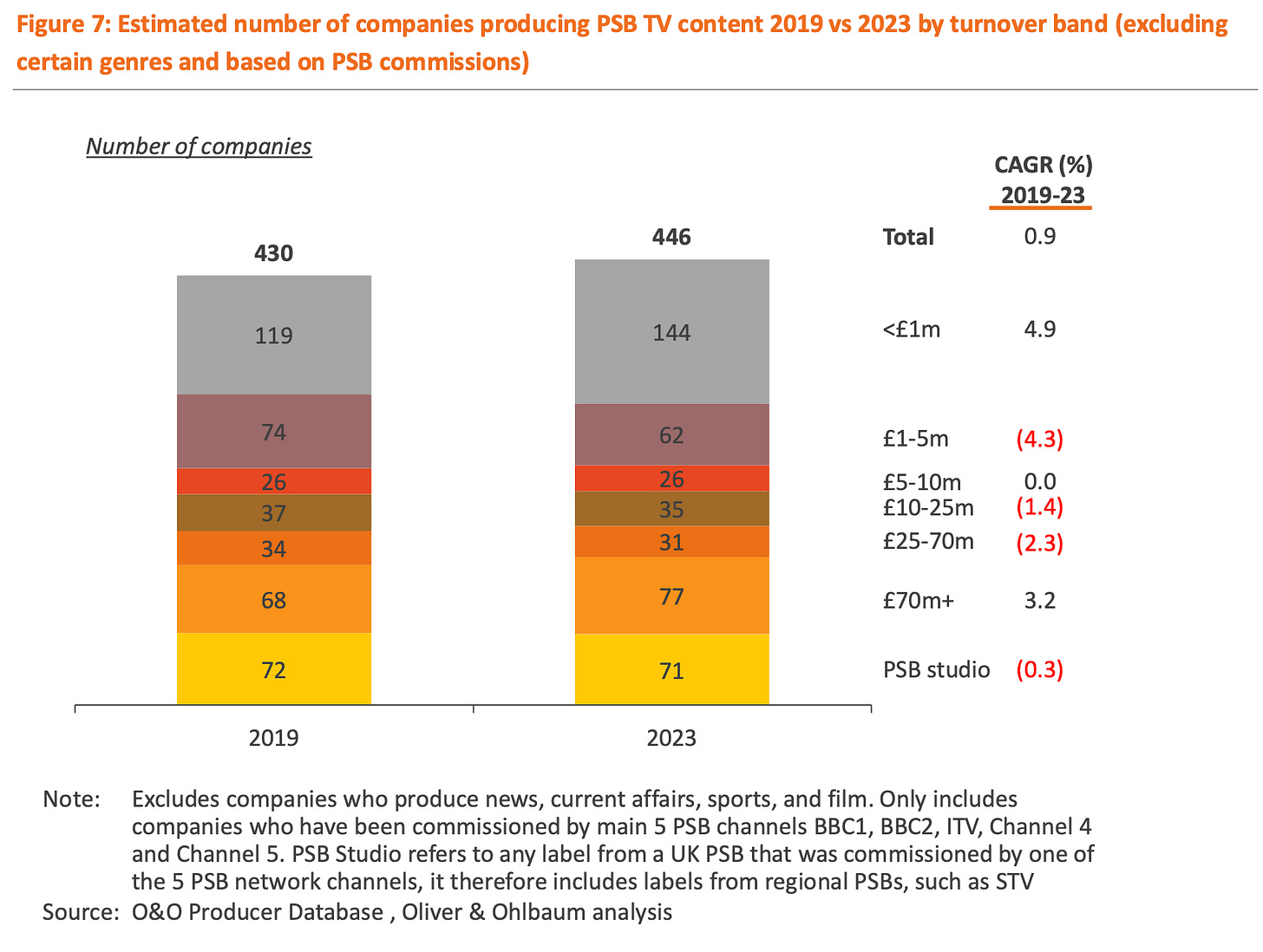

The Pact report into the state of independent TV production last week (Changing UK content investment: what could this mean for the health of the production sector?) is worth your time, although it tells a now familiar story: the overall spend in commissioning in the UK is up since 2016, and has increased 4.5% from 2022 to 2023, however overwhelmingly that growth has come via the SVODs, and indeed multichannel and PSB spent is either down or flatlined over that time.

The deeper picture is that off-peak especially has taken a clobbering, and there is also a squeeze on mid-sized companies getting commissions from the PSBs. There are concerns about the effect this will have on nations and regions companies, as well as diverse-run indies.

At a zoomed out level, what we are seeing is commissioning activity increasing for the streamers, and while their strategies can and do evolve over time, their priorities have been certain fairly tight factual genres, big entertainment formats and prestige scripted; sports, sports-adjacent and live. Putting this Pact report together with the evidence to the DCMS committee above, and many are saying there are red lights flashing on the dashboard for programming that sits outside of these categories.

Channel 4’s first digital original drama

Last week the cast was announced for Channel 4’s first digital original drama, Beth, a sci-fi series that will launch on YouTube and All4 as 3 x 15 minute episodes (and broadcast on the linear channel as 1 x 45). In addition to Channel 4, the project has been backed by Group M’s Motion Content Group Diverse Indies Fund, which was set up in 2022.

The drama is being produced by Yaw Besoah’s Dark Pictures, and exec produced by Anna Higgs, who back in 2012 was responsible for Film4.0, the first film strand to fund innovative digital activities across production, distribution and marketing. It resulted in Ben Wheatley’s film ‘A Field in England’.

Futurology is a dangerous game, but when you look at this latest announcement against the 20+ year history of scripted web series (see below), it does feel that in the next year or two we will see more of this type of activity, especially perhaps bigger budgets and longer episodes. Maybe even established TV showrunners originating for YouTube?

The question remains about when and where the business models will emerge to support production budgets that start to get closer to TV, cinematic or streamer levels. Kasey Moore (who runs What’s On Netflix) recently flagged this great 2022 quote from James Dolan, AMC Networks’ chairman:

We are primarily a content company and the mechanisms for the monetisation of content are in disarray.

What was true in 2022 is still true now in 2025, and we are all in the same hunt to find these new mechanisms.

Streamers getting into procedurals

As any long time reader of

knows, he has a thorough data-driven understanding of which streaming shows have actually been genuine hits with audiences and what in reality have been misses, rather than relying on buzzy noise, chatter and awards.For more than five years, he’s been banging the drum for streamers to make the type of shows that people actually want to watch across the range of formats and genres on TV, rather than focussing on prestige TV which isn’t necessarily particularly popular with mainstream audiences. So procedurals primarily but also, sitcoms, cheaper reality shows and the like. This week, the Hollywood Reporter had the following article outlining how streamers are now doing just that:

THR: Welcome to “Broadcast-ification”! Streamers Switch From Prestige to Procedural Amid Cost Crunch

To paraphrase ESG’s arguments from around 3 - 5 years ago which he made over various posts:

There was a huge uplift in the number of scripted shows over the 2010s, for example in 2021, there were 600 scripted shows made in the US, up from 350 in 2013

Despite a lot of press activity and buzzy noise, there was quite a high flop or miss to hit ratio

Shows that were being made weren’t necessarily what mainstream audiences want to watch

The hits were often coming from established formats that have been the bread and butter of linear TV for years

This disconnect between what was being made and what was popular was caused by the lack of public streaming ratings data, so noise was instead used as a success measure

The demographic of streaming early adopters was different to the general population, which caused a distortion of the type of shows that were getting commissioned.

As ESG said back in 2022, the next battle will involve streamers trying to recreate the full TV bundle, and not just a few sections of it. The reason being:

A lot of people want to watch easy, kickback TV shows where someone gets murdered, then the murder gets solved 42 minutes later. Or they want to watch sexy doctors save someone’s life.

And so, the Hollywood Reporter article reflects this journey to ‘broadcastify’ (oh dear) the streaming package to make it a more fulsome offering inline with what mainstream audiences are looking for. We can see that with the focus on sports as well as live, as well as this shift to procedurals, and perhaps cheaper reality TV will also move up the priority list.

You could argue that this was always going to happen, as streamers began to hit the ceiling on subscriber growth in key territories, and therefore started looking to commission shows across a range of price points and volumes, which would naturally lead to the known and loved genres of linear TV. The piece above quotes Guy Bisson of TV market research group Ampere Analysis:

We are not going back to the peaks of peak TV. And there’s been a strategic shift from the streamers, which are spending more of their budget on sports rights, more on unscripted TV and more on traditional genres like crime shows, leaving less for high-end premium series.

If you’d like to read more on this subject, then back in 2022 ESG wrote a five part series for The Ankler. on Hit TV, and his advice for streamers. As he said:

Sometimes, it feels like the streamers — or the people running the streamers — are making the types of shows they want to watch and are just sort of hoping that America changes its viewing habits, rather than making shows that conform to the tastes of most Americans.

It is worth reading if you missed it the first time around, especially as much of his advice back then is becoming reality now - here is part 4, but there are links at the top to part 1 - 5:

Decoding A24’s business model

Film industry analyst

this week has done a great deep dive into A24’s business model - basically trying to get behind the mystique of their success.He’s covered 10 things A24 does well, and my favourite is the last one, because it chimes with the argument that success can lie in building a sense of belonging and community for audiences, and not being constrained by what it is you think you do and what you believe is off limits for you:

Build something that people want to be part of. Don’t just make films. Create a world around them that fans can enjoy, whether through podcasts, merchandise or a sense of community.

Many of the most interesting companies - and A24 is one of them - all have in common this unconstrained mindset, and therefore are open to working across any and all opportunities. This can involve starting with one thing (films or TV or podcasts) and then add on new products and services that they think their audience might value and be interested in - events, or subscriptions, or books, or merch. If it doesn’t work, they can be dropped, and if it does, well all the better.

More on creator journalism

Earlier this week I shared a list of examples of news and journalist creators and their channels:

If you’d like some further insights into this market, Project C is a newsletter about “supporting, amplifying and normalizing independent content creator-model journalism”.

An example is this post on the evolving journalism landscape which includes this map of the different types of news outlets online - from traditional media operations to influencers offering up their takes (missing is the UK’s public service dimension of the BBC and Channel 4 News which don’t quite fit into any of these categories).

The latest The Gauge numbers

February’s The Gauge numbers by Nielsen are out, which reflect the TV viewing habits of Americans. It shows the same trends that have been progessing for a long time now - the slow decline of cable and broadcast and the rise of streamers and YouTube. Below is the distributor chart, where a company’s full portfolio is aggregated - so for example, Fox or Warner Bros. Discovery will include all their TV channels as well as streaming services.

However, looking at it from a company distribution perspective, and you can see a more pronounced version of that story, especially when you look at the change since November 2023 (which is as far back as this version goes). These are the percentage share of total of time spent watching TV across the month, and then on the right the percentage change from November 2023 to February 2025 by company:

South Korea suffers from similar challenges to other markets

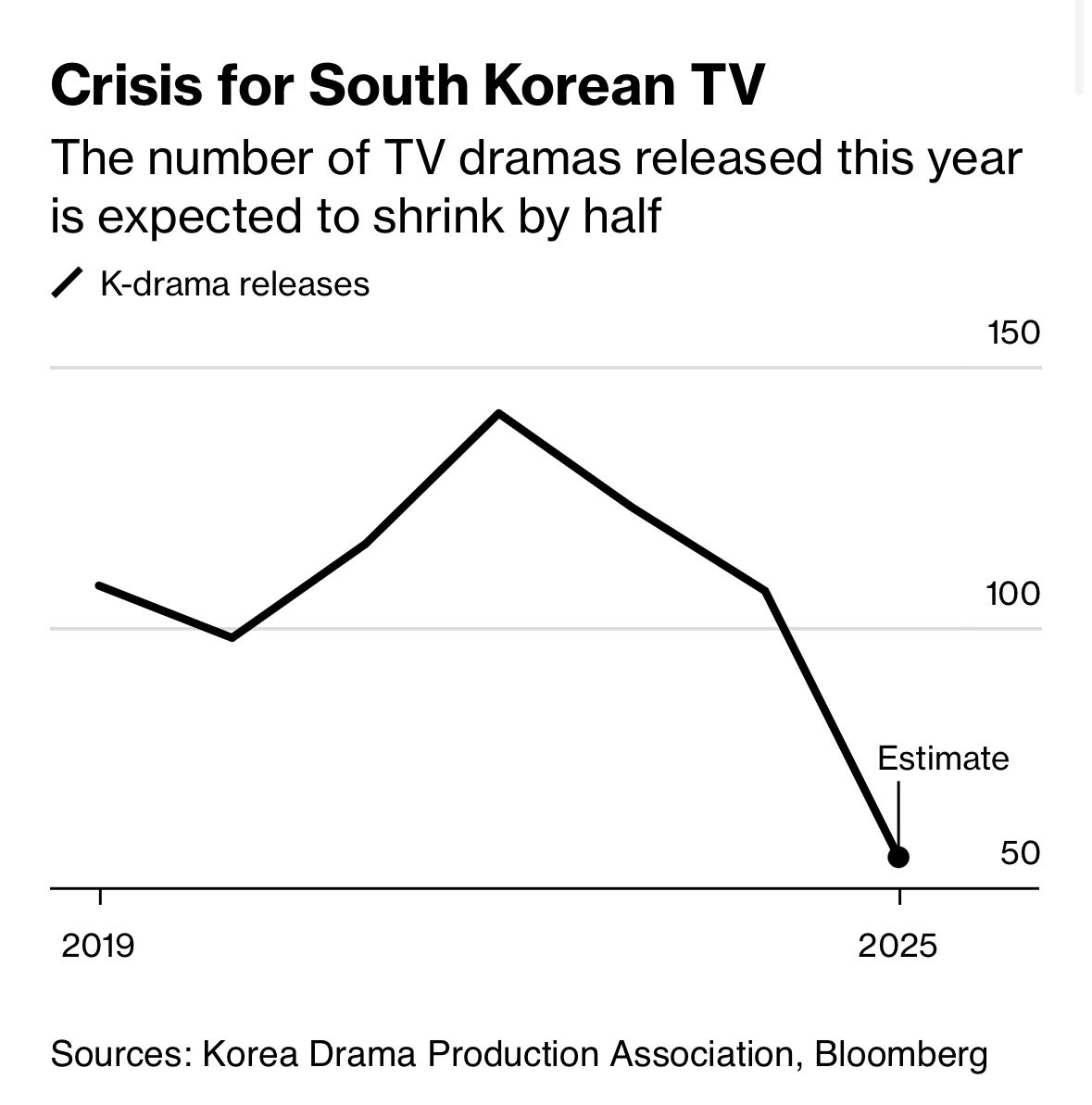

This from Lucas Shaw at Bloomberg was quite an arresting graphic, showing that the South Korean TV production market is in a crisis larger than the US or UK, with TV production expected to fall by 50% this year. While the situation there is slightly different regarding South Korea’s relationship with China, there also is the common concern of struggling to compete against streamers and YouTube.

Quote of the week

I saw this anecdote shared online by Jonathon E Stewart (writer for Pixar amongst many others):

Had lunch with a producer friend the other day who said an EVP-level studio exec told him with a straight face that they were only buying "guaranteed hits." So, you know, change of policy I guess from the salad days when execs were like "sounds decidedly mediocre... we'll take it!"

—

If this is useful, please do share it with your colleagues or anyone you think might be interested:

Find out more about me and the purpose of this newsletter, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

This is an important post, really great work, a must read for anyone in the industry.

Thanks for the shout out ;) Great post!