How hobbies, interests and tribes can help TV companies find success online

Identifying a group of like-minded souls and making content for them is a route to building your own audiences.

A regular theme that comes up in this newsletter is the importance of niche global audiences, and how targeting and reaching a specific bunch of people with a shared interest or world view is key to success in the online world.

So this week, much of what I’ve covered connects to this central theme:

What is the interest graph, and how does it help TV producers wanting to grab - and keep - people’s attention online

What does the response to the closure of Eurosport tell us about the fans of minority sports

How a fintech company has used content to market to a set of like-minded souls which in turn has become a new revenue stream

Plus a fascinating piece on how Spotify is creating and promoting its own music.

Before all of that, a quick update on AI and the ongoing copyright battle.

As previously summarised, there have been growing concerns that the UK government’s plans will allow tech companies to train their AI tools on existing IP without needing to seek permission from copyright owners.

This week things came to a head. Firstly, Macca staged an intervention via Sunday with Laura Kuenssberg to plea for the rights of artists and creators to be protected. And on Tuesday Baroness' Kidron’s amendment to the UK’s Data (Use and Access) Bill was approved by peers:

I’d urge you to watch Baroness Kidron’s speech in full below as it summarises the concerns felt by many, and not just those within the creative industries. She described the government’s planned copyright position as a “… forced marriage, on slave terms”. You can read her speech in Hansard here.

Pact has this morning expressed their serious concerns about the government’s approach to AI and copyright.

The Creative Rights in AI Coalition has a website where you can email your MP, and are asking everyone in the UK’s creative industries to publicise the campaign on social media, and share the campaign with your own networks.

Separately, in the US, the Copyright Office has issued guidance around the use of AI tools in the creative process and to what extent the outputs can be copyrightable. You can read more below, plus Ed Newton-Rex is worth following on this issue.

Variety: Copyright Office Offers Assurances on AI Filmmaking Tools

AP: AI-assisted works can get copyright with enough human creativity, says US copyright office.

The interest graph and the importance of tribes

Understanding and identifying niche interests can be crucial in successfully building an online audience. These can be hobbies, obsessions, a worldview, an identity or a subculture. It can gather around a band, a singer, an artist, a sport, an athlete, a writer, different types of media, genres within media (film noir or 80s classics), TV shows or specific producers. A particular look or fashion. A brand or a designer. Political parties or a set of beliefs.

In general, it is about identifying a vibe that creates a tribe of like-minded souls. Something that generates the sentiment: ‘these are my people’.

Last week I mentioned Alex Lieberman (co-founder of Morning Brew), and this post he wrote recently:

Of all his predictions, you can probably pick out the ones most relevant to TV production companies and producers, but instead I thought I’d focus on this one:

Everyone realises we’ve entered the era of the interest graph.

What is the interest graph I hear you say?

Well, to explain we need to go back to the early days of the social networks in the mid 2000s, where the concept of the social graph was foundational (especially in the creation of Facebook). Simply put, the social graph represents how entities are related. In other words, a social network with your friends, family, education and work colleagues all connected around you and connected to each other when they know each other. The idea of a social graph was usually represented visually with a graphic like this:

In practice this resulted in social algorithms showing you content depending on who you follow, and what topics and hashtags you are following. It is based on the broad assumption that “this user is likely to like what their friends like”. In other words, it assumes that your friends, colleagues and family members are your tribe of ‘like-minded souls’.

Conversely the interest graph is based on an individual’s interests, rather than on their social connections. In practice, this means social algorithms don’t care who you are following and only show you content that it understands you’ll like based on your behaviour on the platform. This means the algorithms in real time are tracking what you are responding to (as well as what you’ve responded to in the past), and then building feeds that is completely tailored to you.

You can see the concept of the interest graph in action quite easily if you go to the search page on either Instagram or TikTok, and type in something you have no interest in and click a video on that subject. Pretty quickly, you’ll start seeing similar videos or posts routinely popping up in your feed.

What is even more interesting is that the difference between social and interest graphs is - in part - what explains the explosive growth of TikTok. Facebook at its heart was about social connections - your school friends and family - while other platforms, TikTok in particular, have always been about your interests.

So what relevance does this have to TV production companies and TV producers?

I’ve written previously how important it is for TV producers to start building direct relationships with audiences rather than leaving it all up to the broadcasters, streamers and distributors. This can be via a number of routes depending on what each company has in its armoury: company name recognition, talent, a particular hit show. There is more in this post about each of these:

As an aside, this TellyCast video below includes lots of examples of creator and brand formats and is definitely worth a watch.

However, for those businesses without talent, a big show or name recognition for their production company, then the question can be where and how do we even start to think about building an audience? After all, you may have lots of content ideas similar to those in the YouTube video above, but if you struggle to get attention then they are likely to sink like a stone.

And this is where the concept of the interest graph is useful, as it encourages producers to focus on building an audience around a specific demographic or set of interests. And fortunately, for many TV producers - all genres, but perhaps especially those in factual - they are already expert in producing content that reflects this concept, as they innately understand how important shared interests, hobbies and world views are in forming social groups and tribes.

TV after all is very adept at spotting trends and making shows out of them. However, this is often the end of the journey for TV; occasionally broadcasters or production companies go on to establish long-running online products or communities around these hobbies, interests or tribes, however it isn’t very common for these to be sustaining. TV by its very nature is often hungry for the new which means programmes are made, broadcast and then everything moves on to the next new show. This is a key point of difference compared to the culture of working online, where iteration and enhancement of the same product or service over a long period of time is the dominant approach.

So the interest graph is helpful for two reasons for those looking at YouTube and the internet in general and thinking ‘goodness, where on earth do we start?’.

Firstly, it emphasises the importance of identifying a target audience, understanding their interests and what motivates them. And secondly, it is an approach that in theory makes it easier for smaller niche accounts to find audiences as long as the content being created targets people’s interests. In other words, you don’t have to have a huge broad following to break through.

And why should TV producers think this way? Well, not to be a lemming but as everyone else is trying to build online audiences, why wouldn’t individual producers and production companies do likewise, especially considering how many already have a deep understanding of a specific tribe?

As a postscript, I’ve talked previously about the Channel 4 Tribes initiative and how useful it has been in the past. This week, C4 released a report called ‘Gen Z: Trends, Truth and Trust’ which is worth a read, especially the six different worldviews they identified from page 19 onwards.

Niche sports and the shuttering of Eurosport in the UK

An example of the potential oil and water relationship between niche hobbies and TV broadcasting (clue’s in the name broadcast) has been this week’s announcement by Warner Bros. Discovery that Eurosport is shutting in the UK and instead will be folded under the TNT Sports brand.

The news - along with the announcement that the price for TNT Sports will be around £370 per year - has gone down badly with many minority sports fans online. While change is often met with grumbles, the response demonstrates the conflict between niche fandoms and the broader nature of broadcasting and bundling.

WBD’s sell of the new TNT proposition is that you get a huge range of sports under one brand - the Australian and French Opens, Grand Tour cycling, every major winter sports championships, UEFA club football, premiership rugby, boxing, cricket and so on (plus some particular sports will be broadcast free to air on WBD’s Quest channel). Positioned this way, it is a snip at £30 a month.

However, this comes crashing into the reality that many of these fans are obsessed with a specific minority sport - so they love mountain biking or cycling, skiing or clay court tennis, MotoGP or snooker. They are passionate about an individual sport, not *all* these sports together. So paying £3.99 a month for Eurosport to get access to their particular sporting obsession is value for money to them.

As Simon Warren, author of the Greatest Cycling Climbs books, summarised on X:

It isn’t just cycling fans who are hopping mad - dip into the online community for each niche sport, and similar complaints are heard: snooker, MotoGP, cross country skiing and so on.

A regular theme in the disruption of TV by the internet is what happens to the bundle - the hugely profitable concept where users pay for a bunch of stuff that includes things they want along with things they don’t want, and they aren’t given a choice. So where previously, (especially in the US) audiences paid for a bundle including internet access plus a whole range of TV channels, now through cord cutting users pay for their internet access separately plus perhaps a bunch of streaming services to give them the content they want to watch, and then chop and change as they so desire. Interestingly, while this might create a sense of more flexibility and greater customer choice, it isn’t necessarily cheaper than the bundle of old. Meanwhile, broadcasters and corporations are exploring new bundling options of which sports is one area (remembering the Fox/WBD/Disney sports joint venture Venu as an example).

Minority sports have often been an area where online services have tried to reach a large enough global niche audience to make the whole thing viable. In the mid 2000s, there were several IPTV channels showing live sailing and cycling races (although I can’t find any record of them - if anyone can recall these websites let me know!). And now, there are a whole host of niche sports destinations offering free or paid streaming of events. Triathalonlive.tv is one example - which is £9.99 a month or £31.99 a year.

As always is the case, how representative noisy online complaints are of the broader audience remains to be seen. Plus each sports’ governing body will have its own position and strategy, all fully aware of the need for revenues against the risk of paywalls acting as a barrier to creating the fans or participants needed for the future viability of the sport.

Even so, this is a great example that shows that even when TV is catering for an interest group (‘sports’) it is still often much broader than the interests of the fans (‘touring cycling’ or ‘alpine skiing’). And this is where the online channels and propositions can find an edge.

How Stripe has turned its content marketing strategy into revenue

While the fintech sector is quite removed from TV, film and digital content, the strategy of the company Stripe is a great example for producers and production companies looking to extending their businesses into other areas.

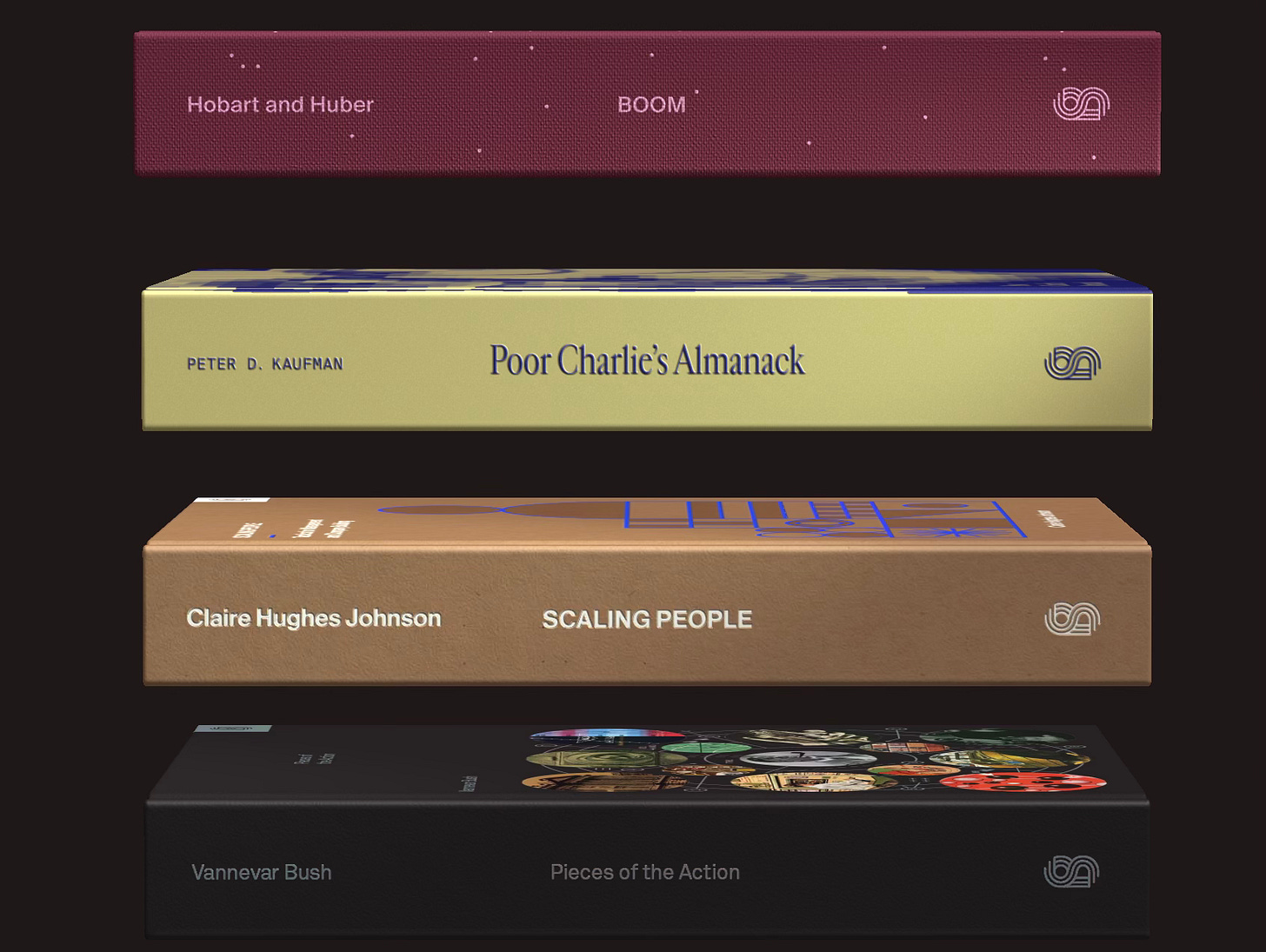

Stripe is one of the top five payment platforms in the world - used by millions of companies to accept payments and automate financial processes. In 2018, they launched Stripe Press, a book publisher, which has the strapline ‘Ideas for Progress’. Since then, they’ve published 16 books all with a common theme of sharing knowledge and expertise about starting and running companies. They also were behind the feature documentary ‘We Are As Gods’ in 2020 which also had a podcast series on Audible.

In addition, they have another audio series called Beneath the Surface: An Infrastructure Podcast.

In the late 2010s, Stripe wasn’t alone in doing this type of content-as-marketing activity. At the same time, there was a flurry of brands-as-magazines from companies such as Airbnb and Dollar Shave Club - many of which didn’t survive the long term. Here is a 2016 article from the Ringer wondering about the future of this trend: Can tech startups do journalism?

However, Stripe Press seems to have had success in achieving the ultimate ambition where marketing activity actually generates revenue and becomes a profit centre in its own right. Recently Stripe Press’ commissioning editor Tamara Winter revealed they sold 1,000 books a day in 2024 - at a guess this could equate to around US$9m in sales of the 16 books in their library (although there might be discounts or freebies in there).

Stripe Press is one of several examples of tech companies using content to build their brands and the sensibility they want to evoke in potential customers.

Others include ‘WePresent’ which is the arts platform by WeTransfer - the file sharing website. It features art, music, photography and films such as this one by Juan Isaac-George, which was promoted on the WeTransfer landing page to all users.

And as previously mentioned, Mubi’s magazine Notebook ships twice a year and is intended to be the publication of choice for global cinephiles.

Why might this be of interest to TV? Well, firstly, it is another example of businesses successfully targeting a particular tribe of people, and secondly it demonstrates how a coherent portfolio of products can potentially increase income while also reducing the dependence on one route to market or a small number of buyers.

Spotify, rights and music creation

I wrote about Spotify and video a few weeks ago, and in the piece noted that for every pound earned from listening to music on the platform, 70% goes to artists and rights holders.

Since then, an

piece by outlined his attempts to find out why certain tracks have been created and the manner in which they are seeded throughout the Spotify network. He references Liz Pelly’s new book coming out in March Mood Machine: The Rise of Spotify and the Costs of the Perfect Playlist. He quotes her saying:What I uncovered was an elaborate internal program. Spotify, I discovered, not only has partnerships with a web of production companies, which, as one former employee put it, provide Spotify with “music we benefited from financially,” but also a team of employees working to seed these tracks on playlists across the platform. In doing so, they are effectively working to grow the percentage of total streams of music that is cheaper for the platform.

This article is really worth your time (and I’ve pre-ordered the book), as it is hugely illuminating about music, rights, profit, the future of copyright and artistic income especially with the growth in AI.

Other things

Applications now open for IndieLab’s 2025 ‘Future of Content’ TV accelerator programme

FOCUS Film City Futures has its inaugural company business achievement awards next Friday February 7th in Glasgow, to celebrate Scotland’s independent production sector. Buy tickets now (and see you there!).

Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.