Court cases shaping the future of the internet and what that could mean for TV; AI and copyright; What next for WBD

This week, I’ve covered the following trends which (in my opinion!) are of medium to longer term significance to the UK TV & film production market:

Various court cases in the US against tech companies such as Google and TikTok are shaping the future of the internet

AI and copyright - will the UK government side with content creators or AI companies?

Continuing to read the tea leaves on what’s next for Warner Bros Discovery.

If this newsletter is useful to you, please do share with your colleagues and friends, and thank you for subscribing!

Multiple court cases are shaping the future of the internet

The future shape of the internet is being determined by various cases in the US, and these judgements could have a significant impact on multiple industries, including TV.

The first two cases involve TikTok. The company is currently trying to stop the US government banning the app in the US unless its parent company ByteDance sell it to a third party (the government is concerned about US citizens’ data being accessed by the Chinese authorities). This case is fairly self-contained and specific to TikTok, so unlike the others isn’t expected have implications for other industries (however, some believe that the EU might try a similar ban for Facebook owner Meta).

TikTok has one billion active users worldwide, and 150m in the US. A ban would have an impact on these users (who probably would be scooped up by Instagram), and also on creators, brands and businesses who use the platform to connect with younger audiences. However two academics at the Oxford Internet Institute (part of University of Oxford) have made the following point about the challenges TikTok faces as a business:

TikTok’s number of active users globally declined in the final three months of last year and its downloads only increased by 4% – while its competitor Instagram saw an increase in active users of 13 million and a 20% increase in downloads. TikTok also holds a meager share of the advertising market: TikTok’s share of US video ad spending was about 6 percent last year, which is considerably less than YouTube’s 8 percent or Meta’s 30 percent. Furthermore, although TikTok’s owner ByteDance recorded $28 billion in net profit in 2023, none of it came from TikTok: the app itself is not yet profitable, so ByteDance’s profit mostly comes from its products in China.

The second case I’ve covered previously, and involves a parent suing the company after her child died doing the ‘Blackout Challenge’ that she had seen on her For You Page (FYP). This judgement stated that TikTok was responsible for the content algorithmically pushed to the child, whereas previously social companies argued they were platforms and not publishers and therefore were not responsible for the content on their service. If this judgement holds, then it sets a significant precedent for all companies that allow users to publish content to their platforms. It will have far-reaching implications for how all these companies build, moderate and monetise their platforms. Law.com has this legal explainer of the case, and here is a longer piece I wrote a few weeks ago:

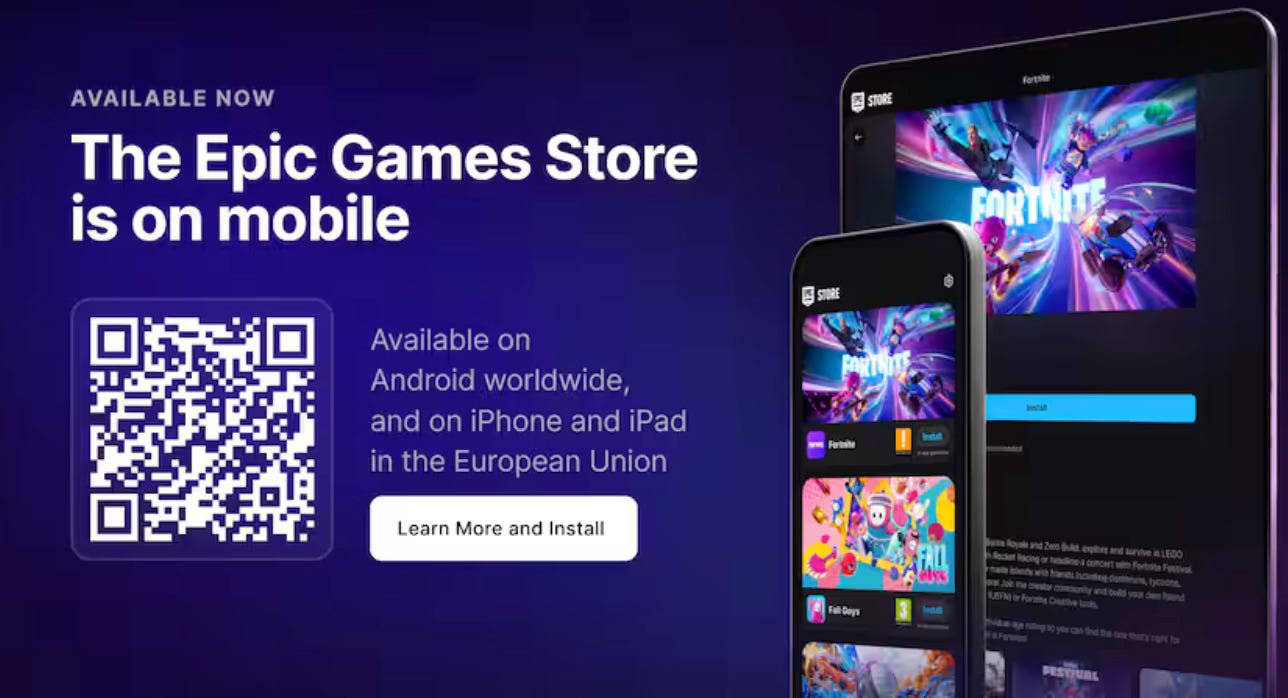

Separately, Google is currently facing its third anti-trust trial, having lost the first two. The first was about its App Store on Google’s Android devices. The company was sued by Epic Games, makers of Fortnite (telly-related sidebar - the EVP of games development at Epic Games left in the summer to join Netflix run their games division). Epic Games successfully argued that Google was operating a monopoly by forcing developers to publish and monetise their games via Google’s Play Store on Android (where Google takes transaction fees of up to 30%). Epic has their own App Store on PC and now Android and iOS in the European Union.

The second case was about its search business, and Google’s practice of paying other companies to ensure their search engine is given prime placement on their devices and web browsers. This TechCrunch article outlines the practice that was deemed to fall foul of antitrust rules:

Google pays companies, including Apple, Samsung and Mozilla, billions of dollars for prime placement in web browsers and on smartphones. In 2021 alone, Google spent $26 billion to be the default search engine across Apple and Android platforms. According to The New York Times, about $18 billion of that spend went to Apple alone. Google shares 36% of search ad revenue from Safari with Apple. The government has argued that paying for the dominant position effectively kneecapped competitors from being able to build up their own search engines to a scale that would give them the data and reach to stay competitive.

And the third case is regarding Google’s ad tech business, which generates $200bn a year, and makes up 75% of the company’s revenues. Digiday has a summary of the case, stating:

The Justice Department alleges Google has a “trifecta of monopolies” across the publisher ad server market, the ad exchange market and the advertiser ad network market. According to the DOJ, these monopolies have allowed the giant to control not just the competition, but also to control customers and the rules while harming publishers, advertisers and rival ad tech companies.

All of these cases have significance, however this third antitrust case could have serious ramifications for the TV industry as some are speculating that this could lead to the break up of Google, including splitting out YouTube into a separate company. As Entertainment Strategy Guy wrote a few weeks ago:

Indeed, one of the stories from this trial is that Google can tie ad-sales to YouTube, something other ad-markets can’t match. Thus, one simple, pro-competition decision could be to split YouTube from Google and create another competitor in the market. As a person who thinks markets need competition—and lots of neoliberals, libertarians and free marketers disagree with me on this!—that seems like a big win for the market and consumers.

However, others believe it is the other declining parts of Google that could be split out, and Google will keep YouTube, which is the growing part of their business. This Digiday piece covers a whole range of opinions on breaking up Google, and includes this observation:

As Eric Seufert, a consultant, analyst and editor of Mobile Dev Memo, put it: “Google’s Network business is in a state of systemic decline and isn’t structurally important to the company. YouTube revenue eclipsed Network revenue by the largest margin ever in Q2 2024 at $1.2BN — this is astonishing in part because YouTube revenue only surpassed Network revenue for the first time in Q2 2023.”

And it isn’t just Google that is facing antitrust cases. As this New York Times article points out, “… the latest case could have ramifications that go well beyond Google, with Apple, Amazon and Meta all facing their own antitrust clashes with the Biden administration.”

In this third trial, the testimony has now ended, so we all wait for the decision which is expected in November.

AI and copyright - another one to watch

This week’s Charting AI newsletter by Graham Lovelace highlights the ongoing issue of training AI models on copyrighted content.

Justine Roberts of Mumsnet has launched the first British legal action against OpenAI, after she discovered the tech company had been scraping Mumsnet for content without permission. Watch Alan Rusbridger’s interview with Justine Roberts:

Graham Lovelace explains the current disagreement between UK content owners and AI companies, where the latter are asking the government to change UK copyright law:

…a Google lobbying document calling for an overhaul of UK laws so it can freely train its AI models on copyrighted content. Unauthorised text and data mining (TDM) is currently restricted in the UK to non-commercial uses such as academic research, but… Google wants that to be extended to allow commercial use.

The government says it believes it can resolve the dispute by Christmas, however as Graham says:

It’s unclear where this leaves the UK’s £126 billion creative industries, and just how committed Labour is to supporting them or appearing to be ‘innovation first’. [UK AI minister] Clark’s hope that she can resolve matters by Christmas or soon after feels a tad optimistic.

What next for Warner Bros. Discovery

Yet more coverage about the future of WBD, and its CEO David Zaslav. This time via an interview with WBD investor and chairman of Liberty Media, John Malone. He did an interview with analyst Craig Moffett, which was reported in Deadline Hollywood:

Malone said WBD’s balance sheet is “bulletproof” due to deep-pocketed backers like himself through Liberty Media. “It’s investment grade,” Moffett quoted the billionaire as saying of WBD. “They’re not going to run out of cash anytime soon. So they don’t have to do anything while they sit and watch this consolidation in the industry move forward.”

No one should “rush to judgment regarding WBD’s trajectory,” Moffett wrote, summing up Malone’s overall sentiment. “They probably have the best studio and the best library in the industry, in [Malone’s] view.” The mogul added they’ve got “the most energetic CEO, certainly more energetic than anybody I’ve ever met.”

Richard Rushfield has written a great piece for the Ankler (including Britney references and a King Lear quote) where he ponders why an investor such as Malone is focussed on the balance sheet rather than market share or other indicators of a business’ health. Rich guesses it is for this reason:

…he sounds like a man looking to position himself for the coming consolidation so he can get the best price out of Big Tech when they come a-knockin’….

If your focus is an eventual sale, the best thing you can do is get your balance sheet in order, no matter what you’ve got to do to get there.

Other bits and pieces

Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.