A seismic legal ruling for social networks? Plus compliance in the internet age; UK tax breaks; and AI production tools

This week, I’ve covered the following trends which I believe are of medium to longer term significance to the UK TV & film production market:

The end of the era of social networks being platforms rather than publishers?

The sticky issue of compliance in an online world

Mr Beast’s tips on how to succeed on YouTube

The rise of niche streaming audiences and how Amazon is dominating this market

AI video production tools and their biases

The value of streaming customers in different territories.

If this newsletter is useful to you, please do share with your colleagues and friends, and thank you for subscribing!

Social networks: publishers rather than platforms?

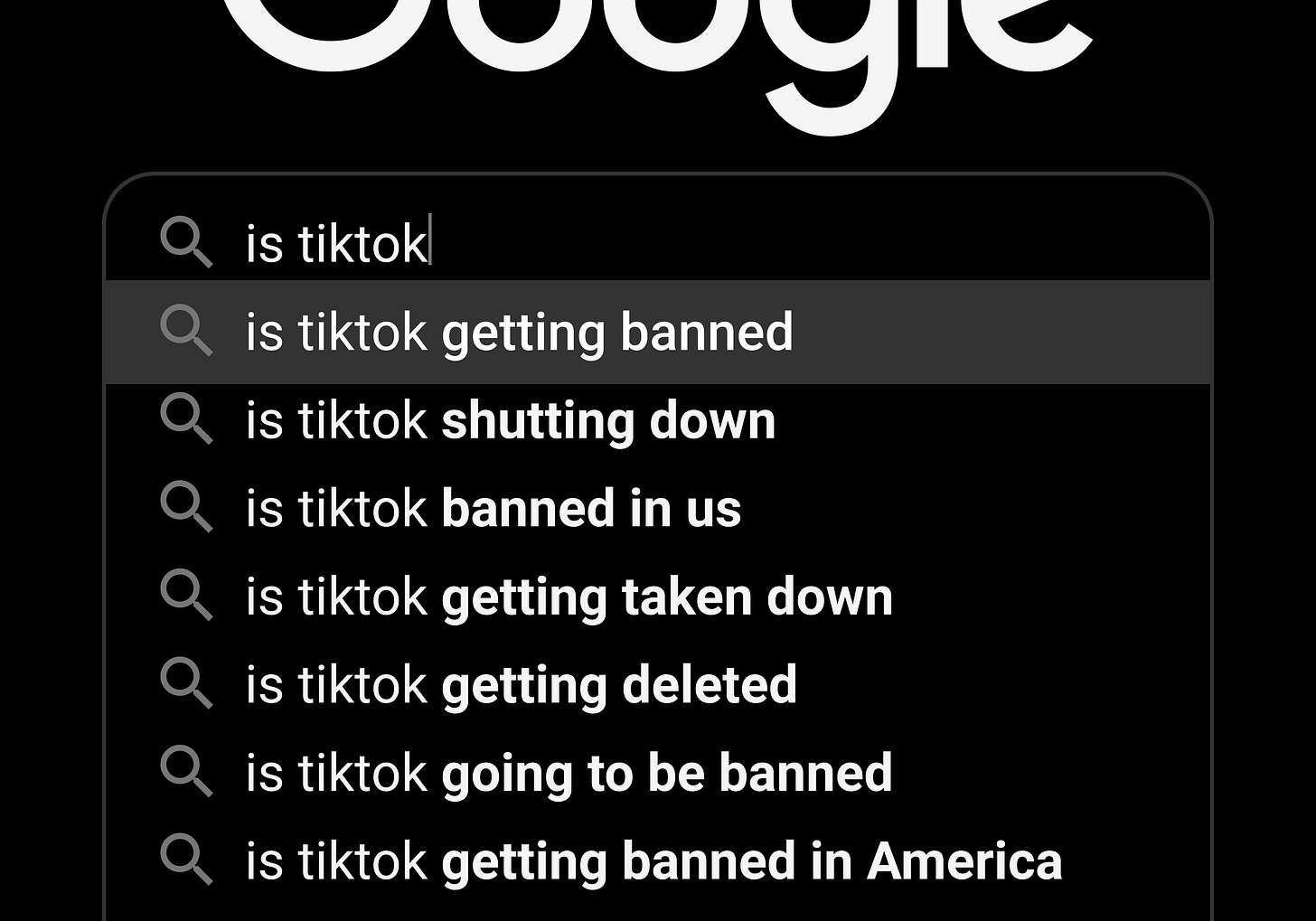

A few weeks ago there was a ‘woah, that’s really quite significant’ moment, and this may sound dramatic, but in the views of many, does have the potential to change the internet as we know it.

It came in the form of a US court judgement which has ruled (in a horrible case involving a child on TikTok) that a social network is responsible for the content users publish to their platform because they use customer data to populate user feeds via their algorithm.

By way of background, social networks have used what are referred to as ‘section 230 protections’: a US legal shield that says internet companies are not responsible for their users’ content. The wording of section 230 is as follows:

“No provider or user of an interactive computer service shall be treated as the publisher or speaker of any information provided by another information content provider.”

In other words, tech companies (and social networks) can’t be held responsible for what their users publish to their platforms.

There have long been arguments in favour and against these provisions. Supporters see them as offering freedom of speech protections, while critics argue that section 230 requires internet companies to be genuinely hands off when it comes to content on their platforms - and as these companies regularly remove or boost content based on their own policies, they aren’t hands off as section 230 requires.

All this is in stark contrast to the world of UK TV production for broadcasters and networks, where Ofcom compliance overlays on top of the laws of the land to inform what is and isn’t broadcastable. In the US, it is up to each network to decide their own rules, so for some they are standards and practices that are similar in nature to Ofcom requirements, whereas others are much more relaxed.

So this judgement a few weeks ago is hugely significant. It was in a court in Pennsylvania and if TikTok appeal it will end up in the Supreme Court. Therefore there will be many more arguments in favour and against these section 230 shields, and the associated views on freedom of speech versus publisher responsibilities for social networks and tech companies over the coming months.

If these limitations on section 230 hold, then this will have a direct impact on how social networks manage their algorithms and the content users publish to their platforms.

By way of further reading and commentator responses:

Matt Stoller has written a long piece explaining in his view how and why these section 230 protections emerged over the past 20 years, and why this judgement will have enormous implications on the regulation and responsibilities of social platforms in the future. He wrote:

Want to know why it’s so difficult to touch the business models of extraordinarily powerful big tech firms? Well, for years, a law known as Section 230 of the Communications Decency Act granted them a de facto Get Out of Jail free card, as long as they could say ‘the algorithm did it.’

In contrast, Eric Goldman (who teaches and publishes in the areas of Internet Law, Intellectual Property and Advertising & Marketing Law) calls the ruling ‘bonkers’, going on to say:

The [decision] implies that any effort to curate third-party content automatically converts the third-party content into first-party content so that it no longer qualifies for Section 230 immunity. Because every UGC [user generated content] service necessarily curates every content item (by promoting the content…), the [decision’s] legal standard would categorically negate Section 230 in the Third Circuit. As Mike Masnick says, “this ruling takes a wrecking ball to 230. It basically upends the entire law.” It’s a terrible example of judicial activism.

For as long as the internet (and then social networks) have existed, there has been huge tensions around freedom of speech, publisher responsibilities and regulation. This ProPublica interview with Jeff Kosseff from 2021 is an interesting summary of the complexity of these issues (he wrote the book on section 230 and has insightful thoughts about the future of the internet and regulation).

Compliance in the new world

Beyond the above sticky issue of social networks being platforms or publishers, there has long been differences between how traditional UK TV, YouTube creators, global streamers and online content publishers have managed the sticky issue of compliance, and is something I’ve been intending to write more on (and will do so in the future!).

But in the last week, the issue cropped up again with the news that various contributors and contestants on ‘Beast Games’ have filed a class action law suit against Mr Beast and Amazon. I’ve written before about Mr Beast crossing over from YouTube to streaming via a $100m deal with Amazon Studios, noting that the reason he gave for signing with Amazon was they were willing to give him a level of creative control others weren’t. As he said at the time:

"Amazon will give us the most creative control, and--by most--I mean all creative control, and they'll let me do whatever we want.”

And separately, obviously there is the ongoing case of ‘Baby Reindeer’ - at the RTS Convention this week Netflix CEO Ted Sarandos said it was “clearly dramatised” despite the wording ‘This is a true story’ appearing at the beginning of the show. According to Reuters, Ted Sarandos said:

"It is not a documentary, and there are elements of the story that are dramatised, we are watching it performed by actors on television, we think that it's abundantly clear that there is dramatisation involved".

Without wishing to get into the nuts and bolts of either of these particular claims (which will ultimately be decided either in court or between the various parties), both of these stories illustrate another way in which technology is upending the traditional way of doing things. In this case, the difference between how an Ofcom regulated UK broadcaster versus a non-Ofcom regulated streamer would treat compliance.

And last night,

published a piece (£) on the responses of UK producers to Sarandos’ view that concerns abut compliance are a uniquely British obsession. She quoted a producer saying “The idea that the debate about Baby Reindeer is a uniquely British thing is not right… due care and editorial standards shouldn’t be uniquely British. If you operate here, you should be striving to meet those standards.” The full piece is below.Mr Beast: How to succeed on YouTube

Speaking of Mr Beast, last week a document called ‘How to succeed in Mr Beast Production’ - a 36 page guide believed to be for new joiners to his company - was published online.

Considering Mr Beast is 26 years old and his operation turns over $500m a year (of which YouTube is rumoured to be anywhere from $40m - 80m), it naturally caused quite a flurry of excitement online amongst people interested in replicating his formula.

Some of it is highly specific to his own organisation and working methods. And for those of us in the consultancy business found ourselves in (self-serving, deeply opportunistic, have we connected on LinkedIn?) agreement about this opinion:

Consultants are literally cheat codes. Need to make the world's largest slice of cake? Start off by calling the person who made the previous world’s largest slice of cake lol. He’s already done countless tests and can save you weeks worth of work. […] In every single freakin task assigned to you, always always always ask yourself first if you can find a consultant to help you.

If you are in TV production and are curious where to start with YouTube, then reading this document might give you a good insight into it as as platform, and how one successful content business operates within that environment.

How tax incentives have reshaped global production

Back in 2021, there were numerous articles about the success of the UK scripted and feature film production sector, with words like ‘boom’ and ‘juggernaut’ thrown around. Despite covid and the production slowdown, that trend has continued and has been the subject of much commentary in the last few weeks, often being compared favourably with the decline in production in California.

The trend for feature films to be shot in locations other than Hollywood is hardly new, however the rise of the streamers has meant that this approach has started to hit TV dramas as well. A recent piece (£) notes:

TV productions leaving [Hollywood] (not just films) is a more recent phenomenon and seems to be the source of new angst. A few people I talked to say it’s another symptom of the Netflix effect. (They call out other streamers too, including Amazon and Max.) Streamers are making shows the way films have been made, prepping scripts in advance and shooting all the episodes in a block, which makes it easier to move the production to another state or country where it’s cheaper to film.

To give some examples of the commentary. A few weeks ago a Puck article explored Warner Bros. Discovery’s options to sell various assets included this paragraph about the company’s UK’s production facilities (my bolding):

[WBD’s] ... big asset is Leavesden in the U.K., the converted airplane hangar facility where Warners and other studios now shoot many of their big movies. Warners owns Leavesden, and it’s become a huge business since Britain became so dominant as a production hub thanks to its generous tax incentives … who knows how long this U.K. production boom will last, and one banker I talked to thought Warner Discovery could get a couple billion for Leavesden today.

The success of the film and high end TV tax relief regime in luring productions is welcome, however maintaining tax break advantages must involve constant vigilance for governments, as other territories make similar adjustments. Just recently, Italy has refreshed its tax regime in an attempt to attract productions.

Similarly, there is a growing campaign in Hollywood for California to up its game on tax incentives, as many other US states are preferable for productions, let alone other countries like the UK, Canada, Australia, New Zealand, Bulgaria, Ireland and Hungary. The piece above includes an illustration of the benefits economically for California:

Not only does each incentive dollar translate into $24.40 in economic value to the state, but that same LAEDC study shows that it also equates to $1.07 in tax revenue. In other words, it pays for itself, with a 7 percent profit to boot.

Conversations online show that there is a real sobering fear about the future of Hollywood as a production centre, for example, this post below:

As of June 2024, the # of people employed in the entertainment industry in LOS ANGELES hit its lowest point in 30+ YEARS, according to the U.S. Bureau of Labor Statistics. Californians make up LESS THAN 30% of the US entertainment industry, down 40% in 10 years.

Some people react to Hollywood losing its appeal as a production centre with a shrug of the shoulders (one comment under the Ankler piece said “Honestly who cares if no one shoots in Los Angeles?”). And it isn’t like California isn’t using tax breaks to woo TV productions - just recently ‘Suits:LA’ shifting to be filmed in California rather than Vancouver after being offered around $12m by the state’s film commission.

However, that a place synonymous with show business can decline in this manner is a warning to other territories such as the UK of the need for vigilance on the tax credits front, as well as facilities and local production talent.

Building on the success of the film and HETV tax regime, there is a campaign to get these tax breaks extended to unscripted TV. If successful, this would benefit UK production companies as well as potentially see big reality juggernauts move from other territories to be produced here. A petition can be viewed and signed here.

However, tax breaks can have their downsides, as noted by Jason Mitchell of the Connected Set during a recent trip to Canada:

Generally I think incentives are a good thing and something that would benefit UK unscripted, and it’s definitely led to many shows being made in Canada that wouldn’t have otherwise. But Canada has experienced some downsides: a shift to more of a model to servicing productions from US companies rather than creating original IP leading to a creativity deficit, and some people felt local shows in Canada were increasingly being compromised creatively by the need to do things editorially that ‘qualify’ for additional tax breaks which weren’t good for audiences or the export potential of the shows. Also it felt like there were so many hurdles to getting public funding that producers were spending more time on this piece of the puzzle than production itself.

There is a potential race to the bottom here, where all TV (and film, and scripted, and unscripted, and kids, and animation) has so many global tax breaks the advantage is cancelled out. Even so, that the UK has done so well as a production centre is notable and keeping our tax regime advantage much be high on the list of the DCMS’ priorities.

Global niches

Amazon accounts for 58% of sign ups for speciality or niche streaming services, according to a new report by Antenna recently. This is because Amazon Prime Video has been most successful in enabling users to find and subscribe to niche and speciality streaming channels - the screen grab above of Amazon Prime Video shows many niche channels including Shudder for horror, Crunchyroll for anime, Curzon for arthouse cinema, Marquee TV for arts and more.

At some point I’ll write something more fulsome on the increasing importance of identifying and serving global niche audiences, and a few potential market opportunities that (in my opinion) are there to be grabbed. After all it is how numerous traditional news brands have evolved, as well as innovative film companies like Mubi and in a slightly different way A24.

In the meantime, as Antenna says, while streamers focus on breadth and mass appeal, it leaves space for targeted niche offerings:

“As the largest premium streamers focus on profitability, they are deploying ‘fewer, bigger’ programming strategies which focus on shows that appeal to the masses,” wrote Antenna’s co-founder, Jonathan Carson. “This leaves an opening for specialty players who have a tight focus on a specific genre or audience.

In a similar vein of serving niche audiences rather than just mass market, this is a lovely read about the fall and rise of vinyl record buying. While the buying of physical music product hasn’t and probably won’t reach the dizzying heights of previous generations, the trend back to vinyl (as well as the growth in physical music shops) does remind us that humans are a social species, and changing consumer behaviour doesn’t always follow a linear pattern which inexorably goes in one direction.

StatSignificant: Unpacking Vinyl's Remarkable Revival: A Statistical Analysis

- : Netflix owned the arthouse movie niche now it's Mubi

Comparing emerging AI tools

posted the results and analysis of a test he recently ran with all the different video AI tools which are competing to become a (or the?) winner in the current race for market dominance.It is worth reading his full post where he details the results to his deliberately open-ended request which was “‘great leader at public gathering, golden hour, arc shot”. Below is a screen grab of what each tool produced, but in his full post you can watch all the results to see the difference.

He also outlines the differences in the biases in each tool (notably only one selected a woman to be a ‘great leader’, and only one selected a real person - in the form of Donald Trump) and what that may mean for the future when using this type of AI in production.

Customer value in different markets

A little datapoint appeared in an email newsletter this week which I thought was worth drawing your attention to.

Obviously different audiences generate different revenues depending on what territory they are in. For streaming, a US eyeball is worth more than an eyeball in any other territory. This poses challenges for the people running global streaming platforms, when they may be maxing out the audiences in higher value markets, while larger markets where they can get more subscribers might not generate as much revenue.

This was reflected in the Wake Up with Sean McNulty newsletter this week, where he included this summary:

In other words, it is great WBD has added 6m subs, however ‘most’ of them are international, who are worth approximately a third to a quarter of a US subscriber. Worth keeping in mind whenever global subscriber numbers are bandied about.

Other bits and pieces

Hollywood Reporter: UK produced shows top Netflix’s data dump

C21: Roku’s commissioning strategy evolves - focussing on food, home, comedy and sports-adjacent

Bypass Hollywood: How Branded Entertainment is Revolutionizing Film Funding and Audience Reach

Evan Shapiro’s published his UK TV landscape update graphic.

Follow @businessoftv on Twitter/X, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.

I wonder what is the training data behind the AI that selected Donald Trump as the example of a great leader 👀. I bookmarked the link to read more about the biases. Seems super interesting