Future of Warner Bros. Discovery; Apple TV spending rumours & latest on Netflix games for TV titles

Is a new plan for WBD due to emerge, as analysts and Wall Street are making noises that the current strategy is 'untenable'?

What next for Warner Bros Discovery?

Now that we have an answer (or the beginnings of an answer) to the question ‘What next for the future of Paramount?’, attention is turning to another big beast to ask the same question - ‘what next for Warner Bros. Discovery?’.

Since the merger between Discovery and Warner Bros. was completed in 2022, an acre has been written about the corporation’s future and how it will manage to jump to a digital world while preserving its existing revenue streams, all the while carrying an eye-watering debt mountain - somewhere around $44bn at the point of the merger. In the last two years, WBD’s share price has lost two thirds of its value, and it must be a stressful time for employees as well as their suppliers.

The company itself has been making all sorts of noises about its longer term plans, especially concerning its streaming service. Ideas have been floated such as a joint venture or a shared streaming product with other studios or networks. There have also been hints at selling or indeed not selling particular assets - CNN or HBO as examples. Despite the chatter, nothing yet has emerged as a concrete and committed plan for the future.

However it feels like this might be about to change. The FT has reported that WBD is exploring a break up plan, and leading media analyst for Bank of America, Jessica Reif Ehrlich, has said WBD is not working and staying its current course is ‘untenable’. And this was before the latest situation regarding NBA rights and Amazon.

Matt Belloni of Puck News has written a longer piece (£) about the future of WBD, summarising CEO David Zaslav’s problems as:

“Zaz has whittled its debt down to under $40 billion, but his linear television business is nose-diving faster than his streaming business is growing….His two summer movies (Furiosa and Horizon) both flopped in theaters, one so badly that its sequel had to be pulled from release. And even HBO, the prestige jewel of the company, was beaten in yesterday’s Emmy nominations not just by Netflix but FX, which only a few years ago was written off as a casualty of the streaming wars.”

Belloni goes on to summarise what analysts consider are the options for WBD:

“1) sell the company; 2) sell some assets; 3) merge, preferably with the home of a broadcast network; 4) do a streaming merger or joint venture; 5) stay the course; or 6) spin off the linear assets (and the debt) into a separate company.”

Business Insider’s Peter Kafka says (based on his reading of the FT piece which seems to float that the number 6 option above is being considered):

'“The theoretical plan, as best as I can understand from the FT report, is to turn WBD into one "Goodco" — its (formerly known as HBO) Max streaming business and its Warner Bros. movie studio — and one "shitco" — all of its declining linear TV networks, including CNN, plus most or all of the $40 billion in debt WBD has taken on.”

However, even between the various analysts and commentators, there isn’t a consensus on how possible or appealing any of these options are for WBD. Peter Kafka observes what perhaps is more important is this is an admission that the merger hasn’t done what it needed to do:

“… the biggest takeaway is the seeming admission behind the trial balloon: That the WarnerMedia-Discovery deal — pitched at the time as a way to scale up to fight Netflix and Big Tech companies — hasn't worked.”

One decision that was questioned at the time and has also resurfaced now, was the rebranding of HBO Max to just ‘Max’, creating a single streaming service with HBO premium content sitting alongside Discovery’s reality TV library.

It was criticised when it was announced, for example: “HBO took four decades of prestige and casually tossed it all into a dumpster, lit a match, and cheered as it burned.” Ouch. It is debatable whether maximising the HBO brand would have changed the direction of travel for the merged entity, however WBD have announced their premium series will be branded HBO Originals rather than Max, which perhaps is an indication there is shift in how the HBO brand is being treated.

WBD is due to report its earnings on August 7th, so all eyes will be looking for further evidence of the fundamental trends for the business.

Apple TV reins in originals spending

As the streaming bubble burst and platforms & networks pulled back their programming spend, a question mark has hung over Apple TV as thus far they have remained fairly quiet on their response to market conditions. Perhaps the three trillion-dollar corporation would be better placed to protect their commissioning levels from the troubles hitting the rest of the industry?

However Bloomberg this week has reported that Apple TV is seeking to rein in its spending. Despite being a popular creative partner for producers as well as receiving much critical acclaim for its titles, this has not yet delivered big audiences or revenues. As the Bloomberg piece highlighted:

“Apple TV+ generates less viewing in one month than Netflix does in one day.”

Apple TV reportedly has spent more than $20bn on original content, but so far this year only one Apple TV title has made the Nielsen most popular streaming report (Killers of the Flower Moon). Insiders note in the Bloomberg piece that Nielsen only track certain devices and only US data, however Apple itself hasn’t revealed any numbers unlike other streamers, therefore putting the corporation as an outlier in terms of data transparency.

Multiple commentators and industry observers made the same point regarding the relative lack of marketing muscle put behind these shows, suggesting their ‘if we build it they will come’ strategy hasn’t so far worked:

Also this week, Reuters reported that Apple TV is looking to spend more on film acquisitions from existing studios, therefore utilising the same model that has proven so successful for decades in Hollywood. Fair to say some commentators have been a little unvarnished in their response to this announcement, such as Puck News’ Scott Mendelson:

Much of the online chatter around Apple TV’s content spend has focussed on the high budgets for titles - for example, the rumoured $20m per episode for Severance.

Irrespective of how much of this money ends up on screen, these budgets can help illuminate the difference between the old model and the streaming approach.

In simple terms, in the old model the production budget reflected there were potential rewards in the form of residuals from reruns and secondary sales for everyone involved if the show was a hit. The new streaming model (using a cost plus approach) instead looks to pay more at the point of green light to buy out all rights globally so a title can sit on a subscription streaming platform, with no opportunity for producers or talent to benefit from any residuals income. The clash between these two models is well documented in this Vulture piece from June 2023 - ‘TV’s streaming model is broken. It’s also not going away. For Hollywood, figuring that out will be a horror show.’ To give a flavour (it is worth reading in full), here is one quote:

“These companies took what was an extraordinarily successful economic model and they destroyed it in favor of a model that may or may not work — but almost certainly won’t work as well as the old model.”

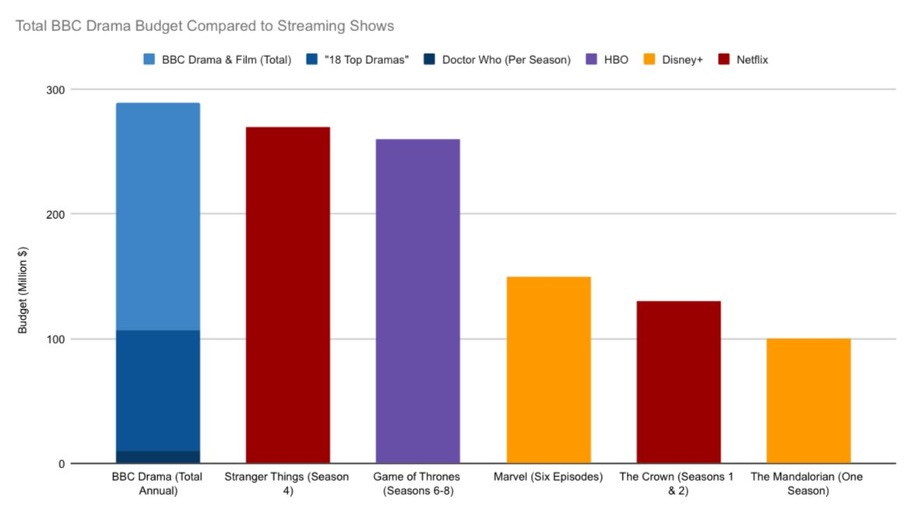

This graph below did the rounds in 2022 in response to fans’ unhappiness with the BBC Studios & Disney deal for Doctor Who. It shows the relatively tiny budget for Doctor Who, and that the entire BBC drama and film budget was not much more than Netflix’s Stranger Things season 4’s budget (widely reported to be $30m an episode).

Again, you could view this graph as highlighting this difference between the traditional versus streaming financing models, although obviously there also was a difference in production budgets too.

Doctor Who was broadly operating on the old long established model where more than likely the (lower) production costs paid for an initial broadcast window on the BBC plus streaming catch up. Then it can be assumed additional revenues were generated via secondary distribution and licensing over subsequent years that benefited everyone involved including the talent, producers, writers, production company, financiers and so on.

Stranger Things instead was probably operating on the new streaming model where the (higher quality and more expensive) finished product was bought out completely at the point of green light. This was on the assumption the title would live on the global Netflix platform and therefore be unlikely to have any future secondary sales income (and even if it did, the money would not be shared). So the $30m per episode cost was a reflection that key talent et al were compensated upfront rather than earning via residuals over the years to come.

Netflix furthers its IP game investment

Netflix continues its investment in games and digital spinoffs for TV and film brands, announcing a further 80 games in development and from July 2024 planning to publish a new game a month in their Netflix Stories app. In addition, Epic’s EVP of games development (of Fortnite fame) has recently been hired to lead their games division.

Netflix co-CEO Ted Sarandos talked about how games enabled the company to serve its super fandom, saying the Netflix Stories offering:

“…gives the superfans a place to be in between seasons. And even beyond that, to be able to use the game platform to introduce new characters and new storylines or new plot twists, events. Now you could do those kinds of things, and then they could then materialize in the next season, or in the sequel to the film.”

For those who have been working in multiplatform or interactive TV over the last decades, it was a familiar ambition, albeit from a company with much deeper pockets and significantly larger global audiences:

(I was going to do a quick potted history of multiplatform TV within broadcasters, but will save that for a later date).

As the Deadline Hollywood piece notes, “Netflix doesn’t provide financial or engagement details for its games division”, although they said they are happy with their “pretty aggressive engagement and growth targets”. It would be interesting to see how the standalone Netflix Stories app performs compared to the games that are published via the main Netflix app.

Separately, it is worth noting that games franchises don’t necessarily translate into TV gold, even when Stephen Spielberg is involved. Recently Xbox, Amblin TV and 343 Industries’ production of Halo for Paramount+ was cancelled after two series.