This week: Paramount and Skydance finally agree a deal, and Hallmark to launch a new streaming service

After much courting and will they/won't they, a deal has been agreed between the Ellisons, Redbird and Paramount Global, owners of Channel 5.

Paramount & Skydance agree to get hitched

What does the deal between Paramount Global and Skydance mean for Paramount’s operation in the UK - including Channel 5, but also Comedy Central, MTV and Nickelodeon? In short - we (or ahem, I) don’t yet know. But while we wait for details, it is worth considering the landscape and why this deal matters (caveat being it won’t get approval until 2025 and a lot can happen between now and then).

To recap, the initial phase of the streaming wars involved studios, TV networks and content creators trying to beat Netflix at their own game of building their own streaming platforms, exclusively releasing content to these walled gardens, ramping up content volumes and chasing subscribers. This phase has firmly come to an end.

The current phase is where all players focus on profitability in an era when advertising money rather than subscriptions will become increasingly important.

This is seeing three new themes: 1) scale 2) tech and data and 3) content everywhere.

The first two of these themes is about capturing a share of the advertising dollars flooding the market. To succeed in this struggle, the winners need to have first rate tech plus a sufficiently large enough audience (and a lot of data on this audience) to be able to attract advertisers. Subscale platforms without a clear niche are likely to wither in this environment. The third theme is simply about the ending of the policy where content more often than not sat exclusively within walled gardens - instead content owners will revert to their old (and highly successful) strategy of doing content deals wherever they can to generate income.

Another key observation is that the US streaming market has capacity for say 4 to 5 large mass market players (or is that 5 to 6, or 6 to 7? Whatever it is, there is a limit). Which platforms will make the cut? Amazon, Netflix, YouTube, Disney+, and then perhaps one or two others - would that be Tubi and Max? Paramount+ and Peacock?

You can see below how small the streaming share is for Paramount+ and their free ad streamer Pluto TV via The Gauge from Nielsen.

However, when viewed by media company across all their output, the landscape does look different (read the full report here). This is a reflection of how significant linear TV continues to be, for example making up around 55% of Paramount’s revenues.

It is in this context that means the Skydance and Paramount deal has strategic significance. Can they aggressively improve their tech offering to remain in competition? What then happens to their content strategy and their global (and UK) operation?

Finally, what do the other players jostling for position, market share and profitability do in response to the Paramount deal - specifically, what will Warner Bros Discovery do? Remembering just last week there was more chatter about a WBD/Paramount+ streaming merger or joint venture.

So that is the scene set, here are some big trends to look for in this deal.

A committed buyer

This from Matt Belloni at Puck News is excellent (£ subscription required). He says it is something to celebrate that the company is being being sold “…to someone who actually wants to be in this business for a while… this is probably the best-case scenario for these assets—and for Hollywood, a business in secular decline that just got a major boost from the billionaire class.”

He outlines why in his opinion the deal is the best chance Paramount has of surviving into the future. So while other buyers such as private equity or tech might also have deep pockets, they aren’t passionate about the TV and film in the same way as David Ellison is.

Alternatively, Sean McNulty in the Ankler has outlined the nuts and bolts of the deal, where he says both Larry Ellison - who paid $6bn - and RedBird Capital Partners who paid $2bn (and have also bought other media companies like All3Media) were very motivated to do this deal because it enables them to “… trade in their SKYDANCE ‘studio’ for a real Hollywood studio with all of the global resources that come with it, by also throwing in a few extra billion 💰 alongside SKYDANCE.” So perhaps David’s dad was less motivated by the love of movies…

Technological advantage

This is something often not visible to those on the TV production and creation part of the business, but the tech advantage of Netflix, Amazon and YouTube is simply enormous. YouTube has been going since 2005. Netflix first started streaming video content two years later. And Amazon is Amazon. These companies have been building, inventing, iterating and improving their tech for 20 years. I wrote recently about Netflix’s technical advantage, which is a multi-billion pound engineering feat.

In summary, all the other streaming platforms in the US (by that, I mean Max, Disney+, Paramount+, Peacock plus the free ones including Tubi and Pluto) are playing serious catchup, and their owners need both exceptionally deep pockets plus technological chops to have a chance of building a successful future. Larry Ellison certainly has both in spades, and David Ellison framed the merger announcement as creating value by blending traditional media and tech as reported in the Wrap: “The tech companies have obviously been pushing very significantly into the media space … we believe what is required to meet this moment is to obviously have a traditional media company like Paramount expand into both a media and technology company.”

Will this be enough for Paramount to leap frog to the front of the rest behind Netflix, Amazon and YouTube?

Valuation

Many commentators have noted that the deal gives Paramount and the new company a very high valuation. In Matt Belloni’s Puck piece he referenced Guggenheim analyst Michael Morris’ observation: “When combined with the length of time to close and relatively high valuation compared to media peers (6.8x the company’s 2026 outlook vs. 5.7x at Fox and 5.6x at Warner Bros. Discovery), we expect investor enthusiasm to remain tempered.”

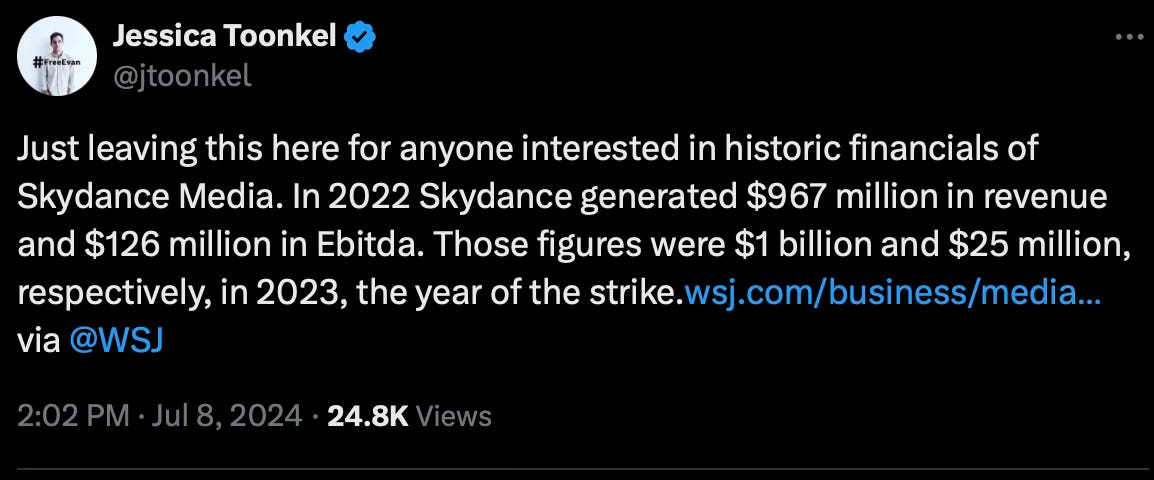

In addition, the Wall Street Journal’s deputy media editor made the following point about the size of SkyDance Media:

A perhaps more vivid response came from Richard Rushfield in the Ankler:

Every time I read about this deal and try to make sense of it, I start to feel like someone dropped a tab of acid in my Vernors, and I’ve been micro-dosed, or macro-dosed with numbers spinning in the air around me.

It is possible unhappy non-Redstone Paramount shareholders might make their opinions heard in the coming months.

Games

If you take a spin through the full Paramount/Skydance deck, games are listed as a planned route for IP exploitation and revenues, building on the existing SkyDance Games operation. Other TV/film companies are pushing into games - Netflix an obvious example plus of course Warner Bros Games Interactive that makes the Hogwarts Legacy juggernaut.

Having said that, the games industry is experiencing a rough time, with a significant number of layoffs so far this year.

Finally, although the deal won’t be made official until 2025, the new entity has said that $2bn in savings have been identified, and an email from the joint CEOs of Paramount to the staff as the deal was announced included the following depressing paragraph:

“Until the transaction closes, it's business as usual - we will continue to operate as an independent company and move forward with the strategic plan we outlined at our town hall. This includes actions to modernize our organization by streamlining teams, eliminating duplicative functions and reducing the size of our workforce. We will also continue to explore opportunities to transform global streaming and optimize our asset mix by divesting some of our assets.”

This episode of The Town is worth a listen with Matthew Belloni and Bloomberg’s Lucas Shaw on the future of Paramount.

Richard Rushfield in the Ankler on the deal - includes a new song to the tune of Davy Crockett (‘Davy, Davy Ellison, the New King of Paramount’)

Listen to The Town where Matt Belloni interviews David Ellison and his plans for Paramount

Hallmark to launch a new streaming service

It may seem like a crackers time to launch a new streaming service, but that is just what Hallmark has announced.

Called Hallmark+, it will launch in the US in September and will include a mix of archive titles, shows from their linear channels plus originals.

The subscription to Hallmark+ will include monthly coupons and rewards for shopping.

A streaming subscription offering as part of a membership and retail strategy could be a clever move. As Rick Ellis of Too Much TV said:

“This might seem like a crazy time to launch a new streaming service, but I think this approach is very astute. Bundling the streaming service into the overall Hallmark universe is not that different an approach than the one used by Apple TV+ with the overall Apple One service or Prime Video with Amazon Prime.”

YouTube creators and the TV leap

It was announced earlier in the year that YouTube mega creator Mr Beast signed a deal with Amazon MGM Studios worth $100m to do reality TV shows for the platform. This Inc opinion article outlines that the significant creative control given to Mr Beast is the reason he signed with Amazon over other platforms like Netflix.

He isn’t the first or last social creator making this journey to TV, however Night, the talent agency who up until recently represented Mr Beast, last week shut down the studio they had set up to produce a slate of TV and streamer shows with other creator talent.

In a LinkedIn post, the CEO of Night Reed Duchscher and the (now former) head of Night Studios Alex Piper (who previously looked after unscripted originals at YouTube) outlined why they were closing down the studio, and why in their view it hadn’t worked. Among the reasons, they said:

“Besides the MrBeast x Amazon project (which we are very excited about), streamers are still getting their heads around the power of creators to tell stories and move audiences. We hope to see more progress in this area soon.”

Down the years, numerous UK based TV producers and commissioners have observed that excelling in short form social content doesn’t necessarily translate to TV. However, as Kaya Yurieff said in TheInformation’s Creator Economy newsletter (£ subscription required), while the Mr Beast deal is an outlier there are a handful of other shows with creators being commissioned - for example, kids yoga queen Jaime Amor is is doing a series with Sky Kids. Nor is this the first time social platforms have tried to do telly. Kaya wrote:

“We’ll see if that show, or the MrBeast series, become hits with viewers. But I suspect some service will figure out a formula that works. Too many viewers are glued to YouTube and TikTok to drop the idea of featuring creators altogether.”

Another watch this space to see whether giving Mr Beast creative control results in a ratings smash for Amazon, as well as how more content creators successfully make a transition to TV.