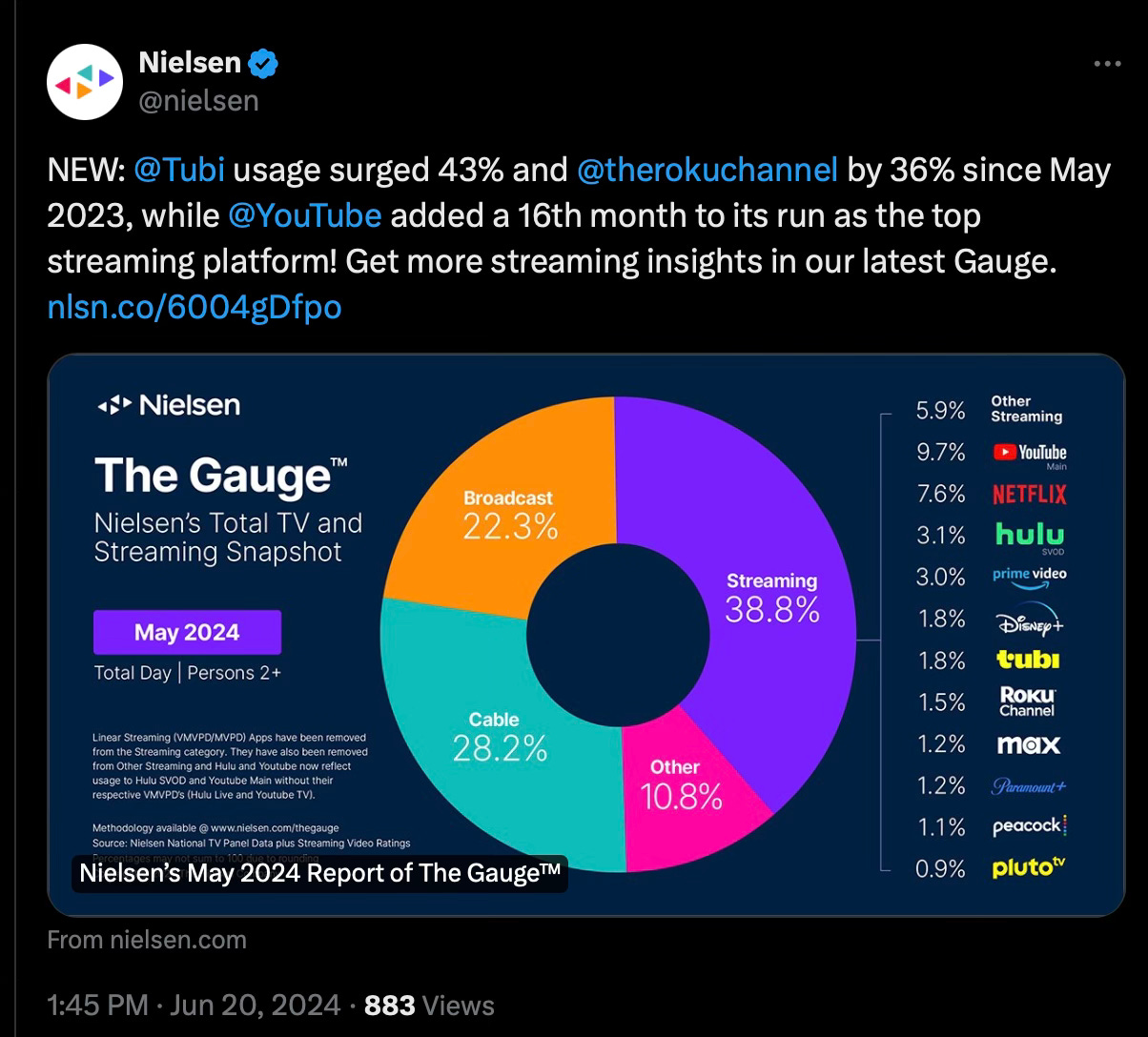

Tubi now equal to Disney+, Cinematic (continuing) to trump streaming releases

Tubi now equal to Disney+

To add to the pile of ‘things the media doesn’t talk about that much but should’, Nielsen’s The Gauge’ monthly US TV & streaming report shows Tubi with the same share as Disney+ for the month of May. Free to access ad-funded platforms obviously have a lower barrier to entry than subscription services, so this isn’t comparing lik…

Keep reading with a 7-day free trial

Subscribe to Business of TV to keep reading this post and get 7 days of free access to the full post archives.