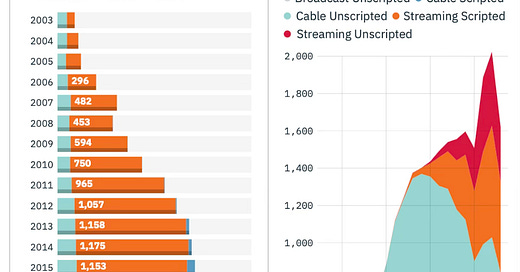

Variety VIP+’s ‘Death of Peak TV’ report

This week, a report into the death of peak TV was published by Variety - with the subtitle ‘A 2024 post-mortem on Hollywood’s production downturn’. It was only four years ago we were all talking about TV’s golden age, how quickly that period has now been dubbed ‘bloated’ and the priority now for all studios, stre…

Keep reading with a 7-day free trial

Subscribe to Business of TV to keep reading this post and get 7 days of free access to the full post archives.