Crunch day for TikTok; Spotify and video; Sonos and the animated Aussie Open.

Plus risk and innovative financing for TV producers; Meta vs Apple; advertising on streamers and the latest on the UK government's AI plans.

This week I’ve included quite a few of the goings on with various tech platforms - the latest on TikTok, the long running skirmish between Meta and Apple, plus Sonos and Spotify. While these could feel slightly tangential to the TV or digital content industry, each one may either be directly relevant to TV producers in the future, or alternatively in the case of Sonos, is a great example for any company on how to manage its customers and audiences.

The future of TikTok

Today is the big day for the future of TikTok - so perhaps by the time you read this the Supreme Court will have given the platform a stay of execution in the US, and if not, then President Biden’s order for the Chinese tech company ByteDance to sell or shut TikTok will come into effect on Sunday. As a reminder, TikTok has 800m users globally, 170m of which are in the US.

Many commentators are reporting panic from a whole range of people and organisations that will be affected by this ban such as creators and their agents, never mind the users themselves. Put into the mix advertisers and the range of technical partners who power the app, together there is a broad range of people and companies facing high levels of uncertainty and risk. Kaya Yurieff has done a great run down of the situation as well as potential options for the platform and the US government in her Creator Economy newsletter. She outlines the number of service providers that potentially may be impacted by whatever happens with TikTok:

There is also the possibility that Trump’s new attorney general would not enforce the law [forcing the sale of TikTok]. But TikTok’s service providers—including Apple, Google and Oracle—might want additional assurances from the Trump administration to continue hosting TikTok. These companies face hefty fines for doing so—and they’d still be breaking a law.

This week there has been all sorts of chatter about who a potential purchaser could be. Considering all the moving parts, at this stage guessing the outcome is a little pointless, however there have been several interesting nuggets in all the hubbub.

For example, American users, so irritated by the government potentially forcing their favourite app to be shut off to them, called themselves ‘TikTok refugees’ and signed up to another Chinese app called ‘Red Note’ or Xiaohongshu, which is said to translate as ‘little red book’ (as in Mao). This pushed the app to the top of the US App Store charts. The observation from many was this constituted a collective middle finger to the US government.

What followed this week was a lot of noise about:

American users reportedly being banned for behaviour that was considered normal on TikTok but unacceptable on Red Note

barriers being broken down and conversations happening between the influx of US users with Chinese users already on the platform which was swiftly followed by

observers noting that while the US was worried about Chinese influence via TikTok, the Chinese government might be more than a little nervous of US influence via Red Note.

As Rush Doshi (assistant professor at Georgetown and China specialist including Biden NSC China 2021-2024) wrote:

The whole thread and discussion is worth reading, especially as Rush predicted Chinese authorities and/or Xiaohongshu executives would bifurcate the app to split Chinese and outside of China users. While this discussion on X played out, it appeared that this splitting of the user base was underway. Although in a fast moving situation with a lot of social noise, it will take some time for the dust to settle to know the exact outcome.

Whether any of this has any lasting effects is as yet unknown, but it is a little indicator of the unpredictability of users, as well as the impact of governmental decisions in the internet enabled world.

Separately, this looming ban had already lead to TikTokers cross-posting to Instagram and YouTube Shorts to de-risk the impact if the platform disappears entirely. As TV Futurist Substack noted:

YouTube’s ability to cater to both short-form and long-form storytelling gives creators a platform for deeper engagement. Platforms like Instagram and Snapchat may also benefit as creators hedge their bets, but YouTube is poised to become the ultimate refuge.

The TV Futurist has also published this post, so if you have a brand active on TikTok, it is worth a read: The TikTok Ban: a Guide for your Brand.

Who shoulders risk and how should projects be financed?

Ed Sayer has written a great LinkedIn post as a call to arms to the production sector to focus on risk taking, thinking big and finding new sources of finance, as well as develop ideas with proper legs beyond the TV output.

He wrote:

This industry is changing. Channels aren’t the only source of funding anymore, and I believe more private equity groups will soon start investing in IP, especially if the government starts incentivising that to happen. So if that happens, producers need to be ready—and the scattergun approach won’t cut it.

Investors will look for scalable, adaptable ideas — content that doesn’t just live on one platform but can thrive across many:

TV shows that expand into podcasts, YouTube channels, books, or merchandise.

Returnable formats that deliver long-term value.

IP that resonates globally and generates multiple revenue streams.

Ask yourself this - If your idea doesn’t have this kind of potential, then why spend time developing it? Start thinking big, and start thinking global.

In many of the sessions I regularly have with TV producers over the years, the increasing importance of developing an entrepreneurial spirit and deal-making capability is a common theme. This is only going to get more pronounced as be-spoke deals become the norm: multiple sources of finance including self-funding, clever windowing, co-commissioning, brand activation, distribution to third parties plus owned channels, online spin-offs as well as merchandising and other IP.

The challenge is finding and keeping hold of the people who have the creativity and ingenuity to navigate this complex new world as well as the capability to stack up innovative deals and partnerships.

When CEOs sledge - Meta vs Apple

In the fine tradition of sledging (for those not familiar with cricket, it is akin to trash talking to unsettle an opposition player), Mark Zuckerberg went on Joe Rogan’s show last week and in a wide-ranging two and a half hour long conversation suggested that Apple was a company lacking in innovation and was coasting on past successes.

His criticism of Apple covered the following:

Lack of innovation: "It’s like Steve Jobs invented the iPhone, and now they’re just kind of sitting on it 20 years later."

When Apple has innovated it hasn’t been a huge success like the iPhone was: The Apple Vision Pro "did not hit it out of the park"

A walled garden approach for customers that also locks out third parties developing for these products and services unless approved by Apple: "They build stuff like AirPods, which are cool, but they’ve just thoroughly hamstrung the ability for anyone else to build something that can connect to the iPhone in the same way.”

Apple’s percentage share of revenues via the App Store: "So how are they making more money as a company? Well, they do it by basically squeezing people...having this 30 percent tax on developers by getting you to buy more peripherals and things that plug into it”.

This sparked a whole host of responses, some agreeing with his observations, while many others suggested a pot kettle black situation. For example, many noted that Meta also charges a fee of 30% for every sale made on its virtual reality system formerly known as Oculus, now Meta Quest, and also said that during his criticism of the Apple Vision Pro he failed to mentioned that Meta has their own competing headset.

Inc: Zuckerberg Comments on Apple Add to Criticism of Recent Meta Moves

Mashable: Mark Zuckerberg criticizes Apple for lack of innovation on Rogan podcast appearance.

The reason to mention this latest skirmish between Meta and Apple is because these two corporations have very different views of the Internet and the future. Simply put, Apple is focussed on privacy and data protection, while Meta’s priority is connectivity and data integration. So as a result, these very different positions translate to a whole host of conflicting strategies that may have knock-ons to all of us. A good summary of the differences is this LinkedIn post from November last year.

This latest salvo should be viewed as part of the larger war around ownership of our lives: the prize is being the go to operating system (as well as hardware, software, security and more) that runs the internet and its connected devices for users in as wide a range of activities as possible.

What next for Spotify and video

Spotify announced last November its latest push into video podcasts as well as more ways for creators and podcasters to monetise their content.

A few weeks ago, Spotify premiered its first high profile video original - Billions Club Live with The Weeknd: A Concert Film - produced by OBB Media.

Spotify and video isn’t a new relationship - as far back as 2015 they announced original programming (although Tech Crunch’s review at the content’s launch in 2016 was fairly lukewarm: Spotify’s first original videos are boring behind-the-music cartoons).

As a Digiday article from 2016 noted:

… the biggest problem facing Spotify in its push toward video is the simple fact that as a music-streaming service, most users don’t expect or even want to watch video on Spotify. But the company, which has yet to turn a profit even though it has 30 million subscribers and 100 million users, needs to show growth — and like other platforms, it believes video is a way to do that.

In the intervening eight years, the podcast revolution saw watching rather than listening to podcasts explode as a common user behaviour: to the extent that for a podcast like The Rest is History, it is reported that approximately 10% of their audience is watching the podcast on YouTube rather than listening to it via a podcast service. Indeed, according to Edison Podcast Metrics in October 2024, 31% of weekly podcast listeners age 13 and up choose YouTube as the service they use most to listen to podcasts, surpassing Spotify (27%) and Apple Podcasts (15%).

For those unfamiliar with the nuts and bolts of podcasting, it is a fascinating and highly valuable market where there currently remains a low level of transparency over listener, download and subscriber numbers. To the extent that only the individual podcast owners really know how well their podcast performs. As evidence, Rephonic is one of the most prominent paid subscriber tools to track listener numbers of the 2.5m podcasts in their database - and even they say:

We collect hundreds of publicly available data points for each podcast to come up with our metrics. Of course, it is a "best guess," so if you're determined to know the actual listener numbers, you'll have to contact the podcast publisher or host directly.”

Last week, I read this great post by

on Spotify’s push into video: Spotify is Coming for Your Living Room. It covers a lot about Spotify’s revenue model, specifically how streaming music includes a 70% of every dollar going to music rights holders which isn’t the case for podcasts as well as original video formats. As Scott noted:The time you spend listening to audiobooks, listening to podcasts, and watching video podcasts is time you’re not spending listening to music that costs Spotify more money on a per-minute basis.

How does all this matter to the TV and digital content market?

Firstly, the convergence of old media verticals into one amorphous mass means that where previously listening to music or speech radio was distinct from watching TV or going to the cinema, now these old distinctions have broken down and are competing for audiences attention at the same time and on the same shared services and devices. So a podcast is being viewed in the living room on a connected TV via YouTube where TV shows and films are also watched on the same service and so on.

Secondly, podcasting has been a natural space for TV producers to branch into, and this will see increasing competition with creators and other podcast brands seeking to monetise their audiences.

And thirdly, while there isn’t a (current) expectation that Spotify will commission high volumes of professionally produced TV-like content, they have a history of doing some content, so if you are a specialist in producing content that matches Spotify’s strategy, then it might be advantageous to keep tabs on their evolving ambitions.

Volumes of advertising versus shows on streaming platforms

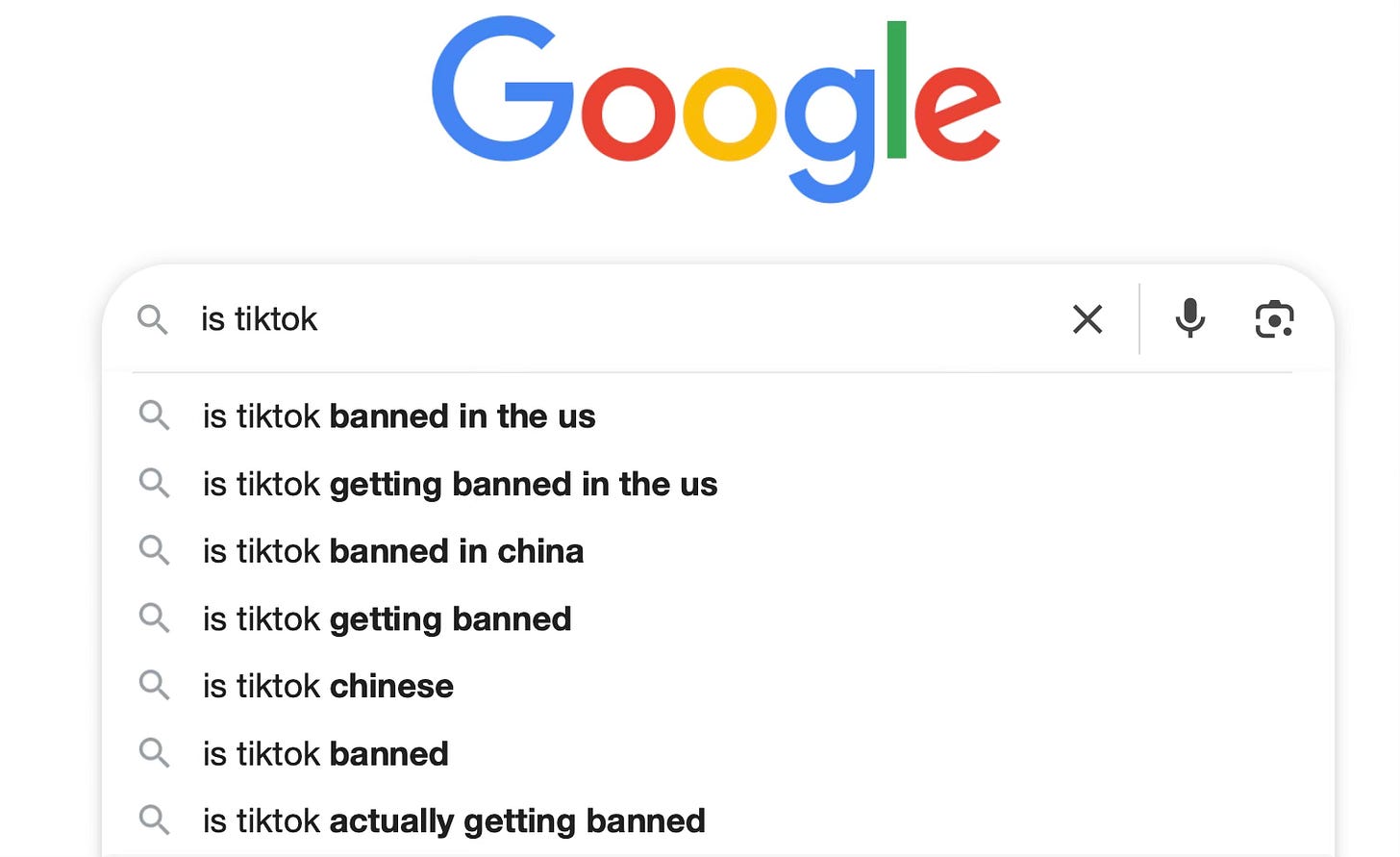

There was a Sherwood piece recently about the volume of adverts per show on streaming platform with the following graphic ranging from 16% on Disney+ to 3% on Netflix.

What made this piece even more interesting was the volume of house ads versus actual advertising from brands on each platform. As the writer said about watching two shows on Paramount+:

One thing that struck me about the ads shown for both “Lioness” and “Landman” (another Sheridan show) was the sheer number of Paramount-owned brands in the mix. “Landman” had only two ads out of its 14 that were not Paramount house ads. “Lioness” had only two non-Paramount advertisers out of its 18 ads. I kept seeing lots of ads for “Yellowstone” merch. It made me wonder why I wasn’t seeing real brands in these ads.

Here is a visualisation from the piece which shows in orange the house ads versus the proper paid adverts in red:

In contrast, it is interesting that Netflix has the lowest advertising percentage of all the streamers, carrying four ads in the show the author watched, and no house ads.

A simplistic explanation of the tricky game each platform is playing is they are trying to find that sweet spot of as many (paid) advertising slots the audience will stand without switching off, and selling those slots for the highest price possible.

Lucas Shaw offered a more nuanced explanation about the Paramount+ strategy:

So Paramount+ is putting out lots of house adverts for other shows to try to get people to watch those shows and stick with the service, which in the long run is more valuable than a few additional ads.

Of course all this should be against the backdrop of linear TV’s ad load, which is often 30% of adverts in a 60 minute slot (of course made up a mix of house trailers and adverts as well as brands and sponsorships). The difference with streaming is the linear TV audience is completely used to the rhythm of the TV schedule. The streaming audience conversely, especially in the US, has been used to subscription services with no advertising at all. As the Sherwood article observes:

It’s getting harder to avoid ads on streaming video. For cord-cutters, after years of living in ad-free bliss, the trend is heading toward ads — a lot of ads.

Conversely, the audiences of YouTube and ad supported streamers like Tubi (and UK VOD services like All4 and ITVX) have long been acclimatised to advertising.

The reason this piece is important is because the advertising market is hugely complex and there isn’t an infinite supply of brand money wanting to pay high prices on all platforms. With the growth in ad funded streamers, FAST channels, YouTube as well as many other platforms, media and connected TV manufacturers seeking to carve out a share of the advertising market (let alone broadcasters, publishers and so on), in one way advertising is a growth market but in the longer term, some are predicting that there simply won’t be enough ad money to go round.

Australian Open live streams animated matches

The rights to live matches for the Australian Open often are with different broadcasters depending on the territory - for example, Eurosport in the UK, which requires a subscription - so Tennis Australia has been live streaming on YouTube matches with animated characters that mirror the real life actions of the players.

Tennis Australia told BBC Sport the aim is to "captivate a new generation of tennis fans, making the sport more accessible and engaging, particularly for kids and families". This is quite an interesting move, especially considering the long-running debate whether putting sports on subscription services rather than free to air reduces how many kids develop a lifelong love for a particular sport: cricket being the most obvious example, but also rugby. In other words, while the upside is short(er) term revenues, the downside is the potential reduction in cultural relevance as a national pastime of certain sports.

The above clip is worth watching - both for the lively chat - some commenting on the match, others the graphics themselves. Despite the glitches - sometimes the players have no racket and are hitting the ball with their hands - it is quite impressive that this is happening in real time, plus also is clearly engaging a global audience.

Sonos CEO steps down after disastrous app launch

Sonos as an audio hard and software company may not directly be related to TV and digital content, however for the past 10 months there has been an ongoing reputational disaster that finally has come to a head this week.

A quick explainer: back in May, Sonos updated the app that is needed to run the audio speaker system, and the new version was deeply unpopular with users. As The Verge reported:

The company’s decision to prematurely release a buggy, completely overhauled new app back in May — with crucial features missing at launch — outraged customers and kicked off a monthslong domino effect that included layoffs, a sharp decline in employee morale, and a public apology tour. The Sonos Ace headphones, rumored to be the whole reason behind the hurried app, were immediately overshadowed by the controversy, and my sources tell me that sales numbers remain dismal. Sonos’ community forums and subreddit have been dominated by complaints and an overwhelmingly negative sentiment since the spring.

The reason this tale is even more surprising is this is the second time Sonos has been through a customer backlash through an unpopular change to their products. The previous situation was in 2020, when it was announced that products bought between 2006 - 2015 would no long receive new software and without these updates the devices would eventually stop working.

This week, the company announced CEO Patrick Spence has stepped down, and although this situation was specific to Sonos, it has wider lessons and implications:

Sonos has been (yet another) company in the war to be the operating system of choice to power our lives, a battle including companies from Apple to Samsung

In general software is increasingly complicated, to the extent that it is reported that Sonos can’t simply roll back to a previous version - they are stuck with this new version

In a world of increasing choice combined with transparent customer feedback, it is important to keep tabs on audience sentiment and consider the potential response of users in advance of key decisions.

What happens next will be interesting to watch. There are many players in the home entertainment and smart home market to control a range of our everyday activities.

Some companies are trying to be the single provider for a range of activities - Samsung, LG, Apple, Amazon Alexa, Google - while other companies focus on a couple of areas - Eufy with its iRobot vacuum cleaners, Vivint for security or Rachio for plant watering.

Nevermind the obvious competition for the TV and media landscape where everyone from Walmart to Samsung are doing battle. And of course, many (but not all) of these players are in the content game, either through acquisitions or original commissioning, as part of the competition for users’ attention and wallets.

Unsurprisingly, there are now predictions of consolidation in the TV operating system/devices territory. As

said this week in her post called The Ugly Truth about the TV OS Wars: “My prediction for this year: consolidation is a must, otherwise it’s gonna get messy in 2025 and beyond.”So within this context, perhaps Sonos with its affluent user base might be an interesting acquisition?

The week AI went mainstream

The government this week announced their AI plans to much coverage, and

has outlined industry concerns around copyright (in a nutshell, that despite being in consultation period, the government may have already decided to give the AI tech companies what they are seeking when it comes to training their models on copyrighted material).Thanks to those that got in touch about a free month’s subscription to Charting Gen AI. I have another set to give away, so get in touch via hello@businessoftv.com if you’d like one.

And while the government’s AI announcement was much wider than the media industry,

did a helpful post about what AI means for the UK: 5 questions about the "AI opportunities action plan - for example, do we have enough energy, what is the national data library and do we have the high skilled workers to deliver all of this?In other AI news,

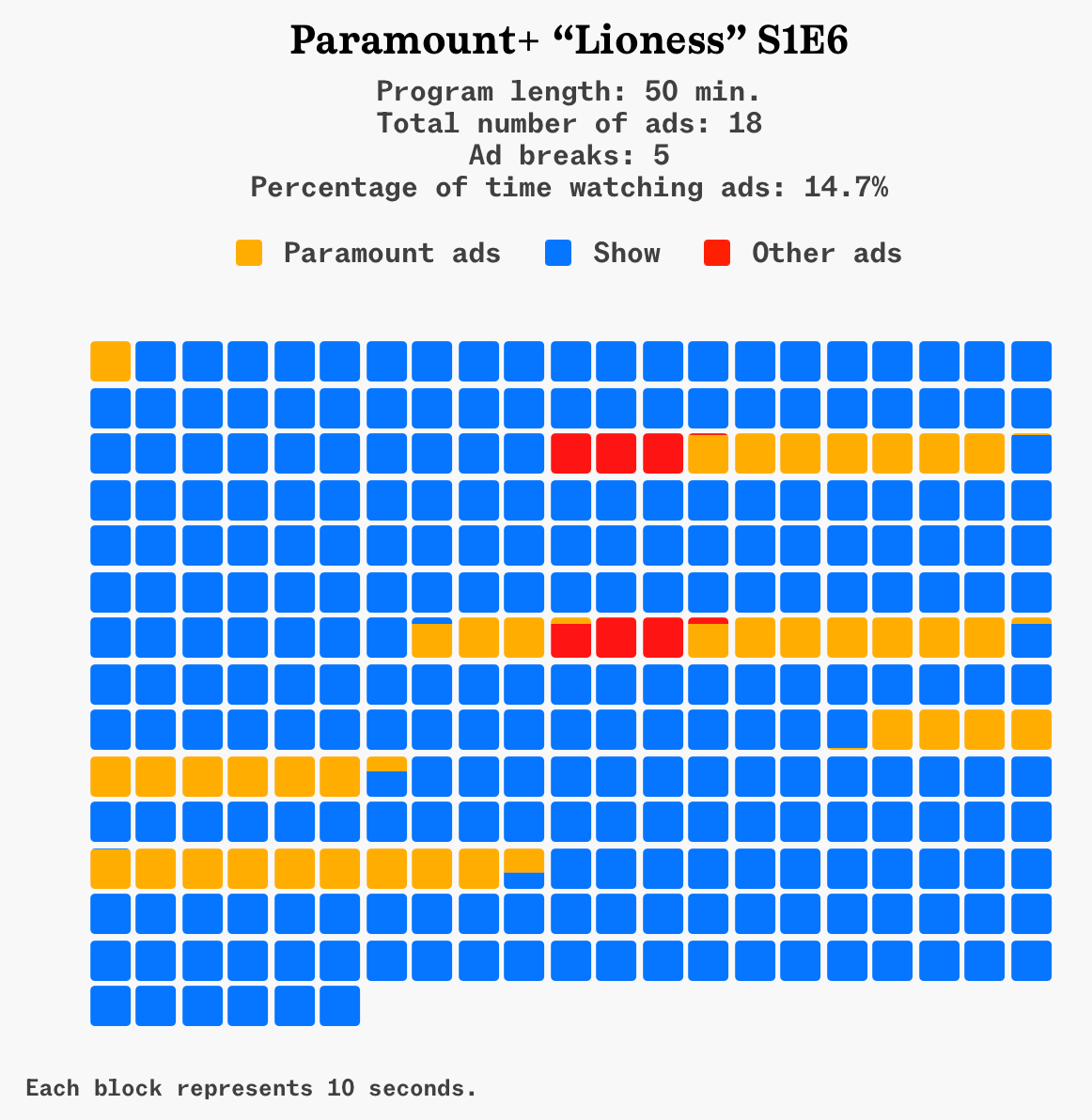

’s Too Much TV newsletter highlighted a Hub Research survey of TV viewers’ attitudes towards AI. In general, audiences are open to the benefits of AI for better recommendations based on their previous viewing across platforms, summarising reviews of shows, or recommending shows for particular situations (74%+ of those surveyed said they were somewhat or very interested in each).Only 6% said that companies didn’t need to tell viewers if AI was used in the making of a show or movie. And below showed a general appreciation in the value of human creativity the more it involves origination.

Meanwhile there have been other moves this week in the world of AI and TV:

And finally, a little nugget from other industries where certain tasks are also getting commodified by AI. The CEO of Goldman Sachs was quoted in the FT saying:

The work of drafting an S1 - the initial registration prospectus for an IPO - might have taken a six-person team two weeks to complete, but it can now be 95% done by AI in minutes. “The last 5 percent now matters because the rest is now a commodity”.

Other interesting things:

C21: View from 2030: How will the business look in five years?

Arcadia Fund Report: Preservation of Knowledge in the digital age

Variety: YouTuber Ms. Rachel Sets Netflix Debut: Four Episodes to Stream in January

Let me know what you think in the comments below, follow @businessoftv on X or on BlueSky, say hi via email hello@businessoftv.com, or connect with me on LinkedIn.